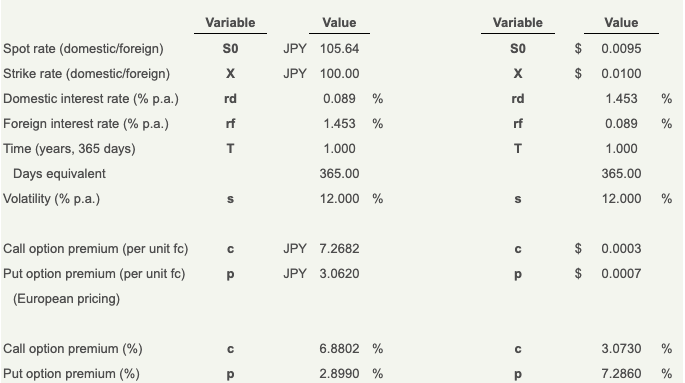

Question: Variable Variable Value SO SO $ 0.0095 $ 0.0100 x Value JPY 105.64 JPY 100.00 0.089 % 1.453 % 1.000 rd rd 1.453 Spot rate

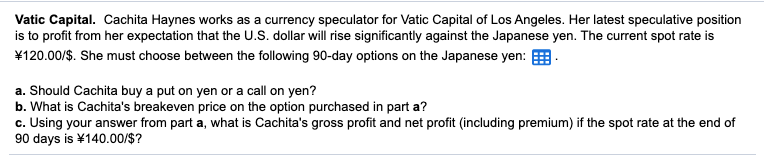

Variable Variable Value SO SO $ 0.0095 $ 0.0100 x Value JPY 105.64 JPY 100.00 0.089 % 1.453 % 1.000 rd rd 1.453 Spot rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) % rf % rf T 0.089 1.000 365.00 12.000 365.00 12.000 % S % 0.0003 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) JPY 7.2682 JPY 3.0620 p $ 0.0007 6.8802 % 3.0730 % Call option premium (%) Put option premium (%) 2.8990 % 7.2860 % Vatic Capital. Cachita Haynes works as a currency speculator for Vatic Capital of Los Angeles. Her latest speculative position is to profit from her expectation that the U.S. dollar will rise significantly against the Japanese yen. The current spot rate is 120.00/$. She must choose between the following 90-day options on the Japanese yen: B a. Should Cachita buy a put on yen or a call on yen? b. What is Cachita's breakeven price on the option purchased in part a? c. Using your answer from part a, what is Cachita's gross profit and net profit (including premium) if the spot rate at the end of 90 days is $140.00/$? Variable Variable Value SO SO $ 0.0095 $ 0.0100 x Value JPY 105.64 JPY 100.00 0.089 % 1.453 % 1.000 rd rd 1.453 Spot rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, 365 days) Days equivalent Volatility (% p.a.) % rf % rf T 0.089 1.000 365.00 12.000 365.00 12.000 % S % 0.0003 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) JPY 7.2682 JPY 3.0620 p $ 0.0007 6.8802 % 3.0730 % Call option premium (%) Put option premium (%) 2.8990 % 7.2860 % Vatic Capital. Cachita Haynes works as a currency speculator for Vatic Capital of Los Angeles. Her latest speculative position is to profit from her expectation that the U.S. dollar will rise significantly against the Japanese yen. The current spot rate is 120.00/$. She must choose between the following 90-day options on the Japanese yen: B a. Should Cachita buy a put on yen or a call on yen? b. What is Cachita's breakeven price on the option purchased in part a? c. Using your answer from part a, what is Cachita's gross profit and net profit (including premium) if the spot rate at the end of 90 days is $140.00/$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts