Question: View Insert Format Tools Table Window Help f (1) Facebook PowerPoint Presentation Q Search in Doc Assignment 3 Mo References Mailings Layout Design Review View

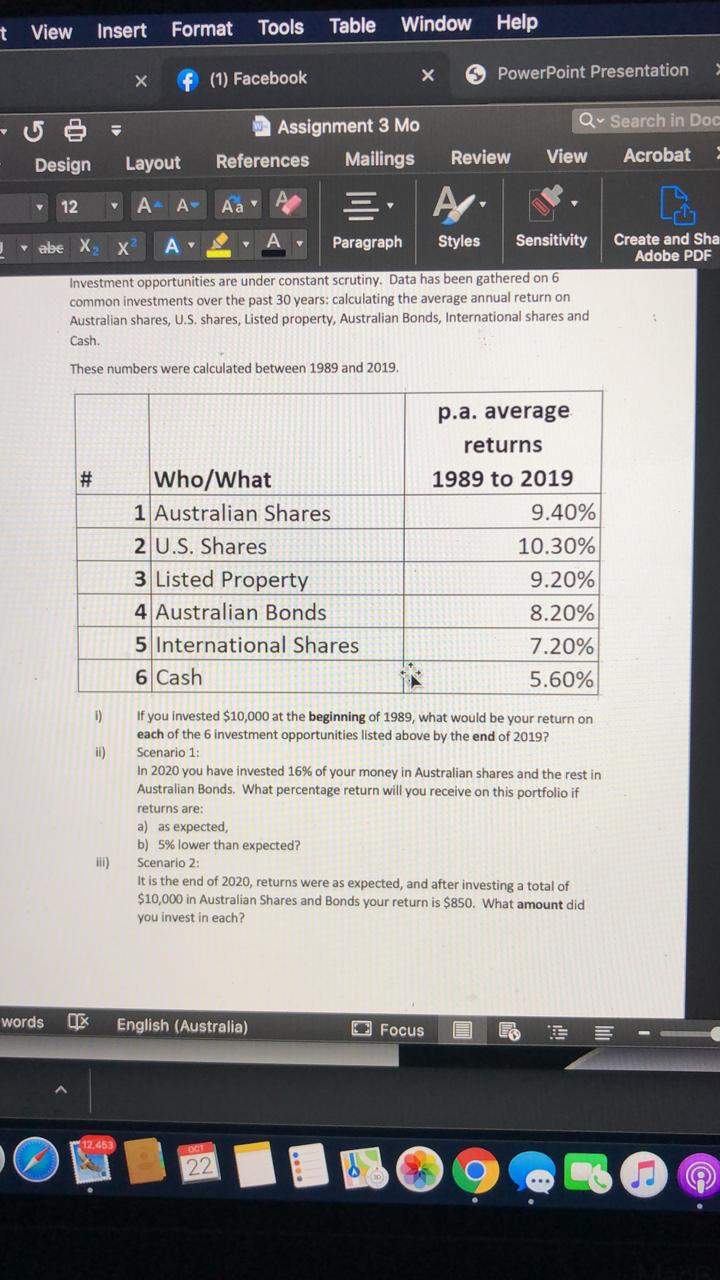

View Insert Format Tools Table Window Help f (1) Facebook PowerPoint Presentation Q Search in Doc Assignment 3 Mo References Mailings Layout Design Review View Acrobat 12 A A Y V J abe X A Paragraph Styles Sensitivity Create and Sha Adobe PDF Investment opportunities are under constant scrutiny. Data has been gathered on 6 common investments over the past 30 years: calculating the average annual return on Australian shares, U.S. shares, Listed property, Australian Bonds, International shares and Cash These numbers were calculated between 1989 and 2019. # Who/What 1 Australian Shares 2 U.S. Shares 3 Listed Property 4 Australian Bonds 5 International Shares 6 Cash p.a. average returns 1989 to 2019 9.40% 10.30% 9.20% 8.20% 7.20% 5.60% 0) ii) If you invested $10,000 at the beginning of 1989, what would be your return on each of the 6 investment opportunities listed above by the end of 2019? Scenario 1: In 2020 you have invested 16% of your money in Australian shares and the rest in Australian Bonds. What percentage return will you receive on this portfolio if returns are: a) as expected, b) 5% lower than expected? Scenario 2: It is the end of 2020, returns were as expected, and after investing a total of $10,000 in Australian Shares and Bonds your return is $850. What amount did you invest in each? words UX English (Australia) Focus A 2,453 22 View Insert Format Tools Table Window Help f (1) Facebook PowerPoint Presentation Q Search in Doc Assignment 3 Mo References Mailings Layout Design Review View Acrobat 12 A A Y V J abe X A Paragraph Styles Sensitivity Create and Sha Adobe PDF Investment opportunities are under constant scrutiny. Data has been gathered on 6 common investments over the past 30 years: calculating the average annual return on Australian shares, U.S. shares, Listed property, Australian Bonds, International shares and Cash These numbers were calculated between 1989 and 2019. # Who/What 1 Australian Shares 2 U.S. Shares 3 Listed Property 4 Australian Bonds 5 International Shares 6 Cash p.a. average returns 1989 to 2019 9.40% 10.30% 9.20% 8.20% 7.20% 5.60% 0) ii) If you invested $10,000 at the beginning of 1989, what would be your return on each of the 6 investment opportunities listed above by the end of 2019? Scenario 1: In 2020 you have invested 16% of your money in Australian shares and the rest in Australian Bonds. What percentage return will you receive on this portfolio if returns are: a) as expected, b) 5% lower than expected? Scenario 2: It is the end of 2020, returns were as expected, and after investing a total of $10,000 in Australian Shares and Bonds your return is $850. What amount did you invest in each? words UX English (Australia) Focus A 2,453 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts