Question: View Policies Current Attempt in Progress Amy Strand's regular hourly wage rate is ( $ 1 6 ) , and she receives

View Policies

Current Attempt in Progress

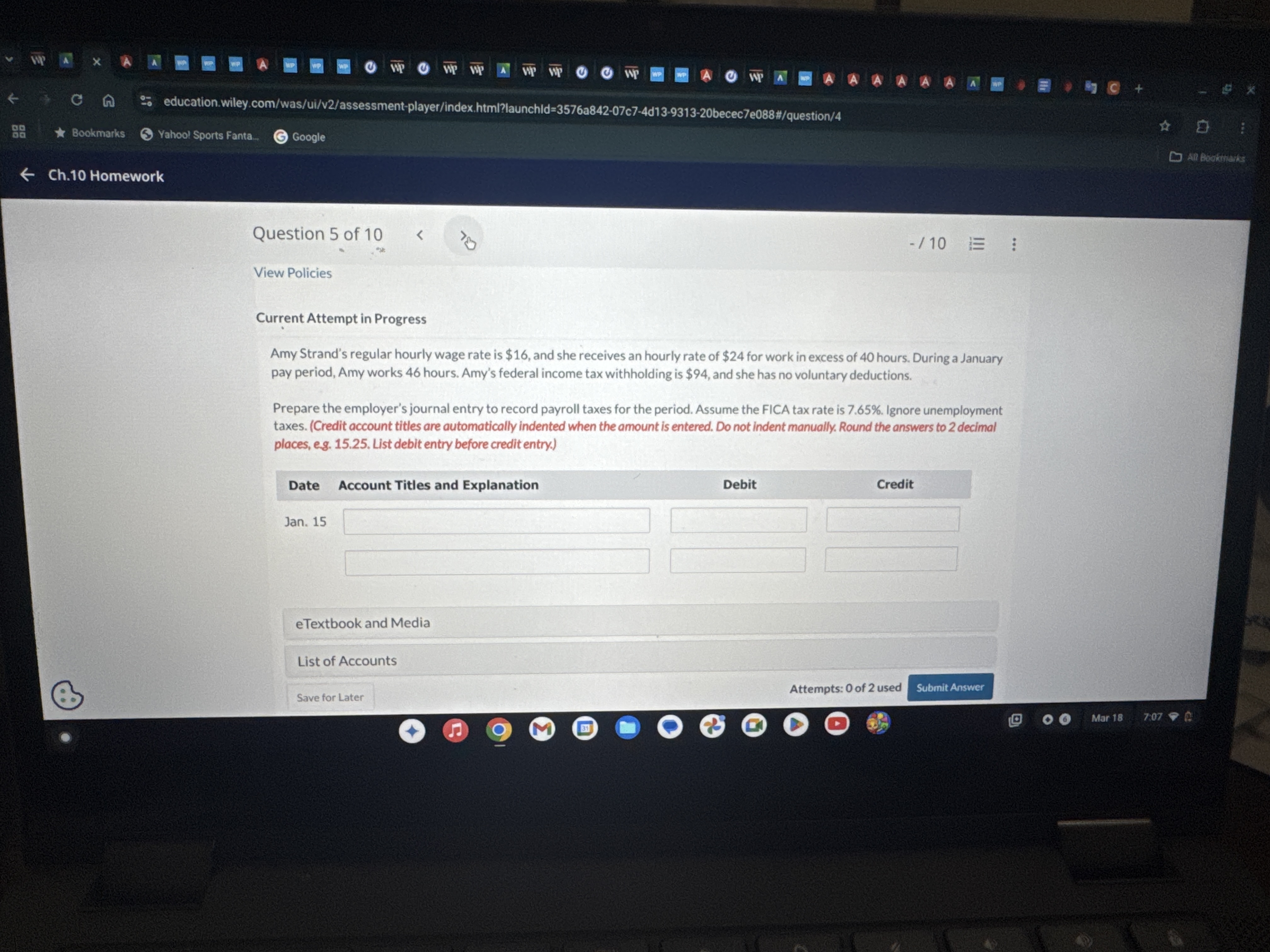

Amy Strand's regular hourly wage rate is $ and she receives an hourly rate of $ for work in excess of hours. During a January pay period, Amy works hours. Amy's federal income tax withholding is $ and she has no voluntary deductions.

Prepare the employer's journal entry to record payroll taxes for the period. Assume the FICA tax rate is Ignore unemployment taxes. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round the answers to decimal places, e List debit entry before credit entry.

Date

Jan.

eTextbook and Media

List of Accounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock