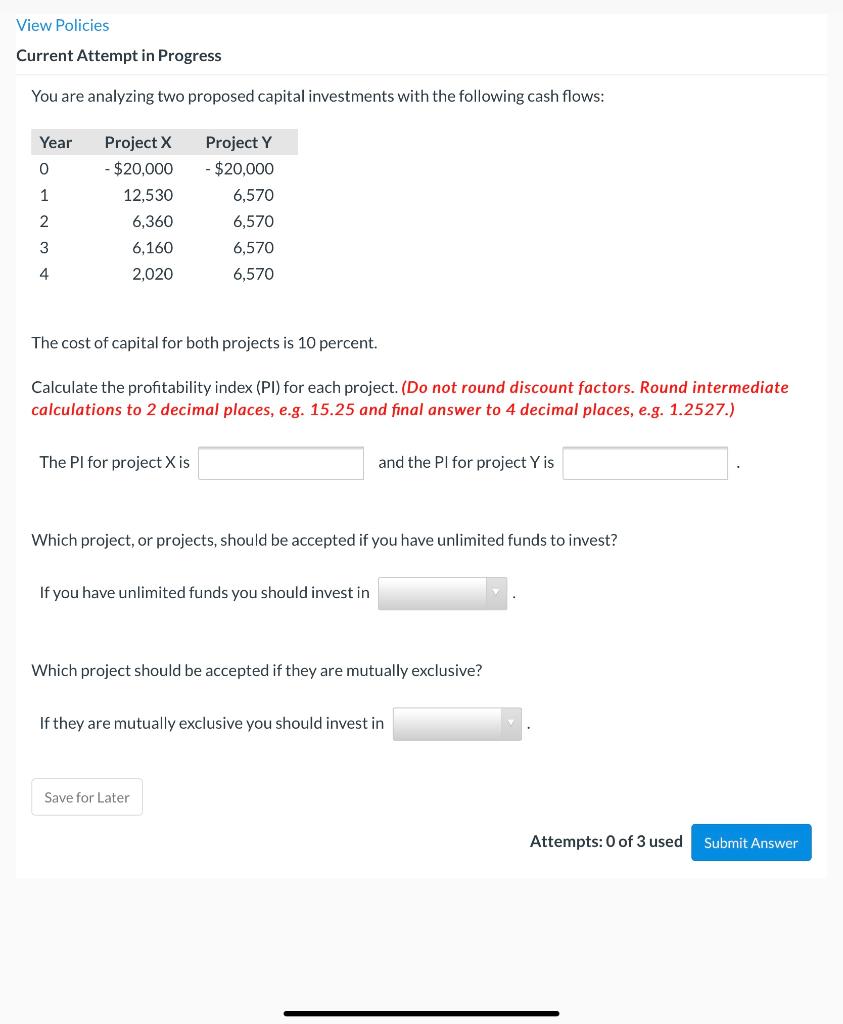

Question: View Policies Current Attempt in Progress You are analyzing two proposed capital investments with the following cash flows: Year 0 Project X -$20,000 12,530 6,360

View Policies Current Attempt in Progress You are analyzing two proposed capital investments with the following cash flows: Year 0 Project X -$20,000 12,530 6,360 1 Project Y -$20,000 6,570 6,570 6,570 6,570 2 3 6,160 2,020 4 The cost of capital for both projects is 10 percent. Calculate the profitability index (PI) for each project. (Do not round discount factors. Round intermediate calculations to 2 decimal places, e.g. 15.25 and final answer to 4 decimal places, e.g. 1.2527.) The Pl for project X is the Pl for project is Which project, or projects, should be accepted if you have unlimited funds to invest? If you have unlimited funds you should invest in Which project should be accepted if they are mutually exclusive? If they are mutually exclusive you should invest in Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts