Question: VII PUT OPTION VALUE USING DECISION TREE In this exercise, you will value an American put option that gives you the option of selling 100

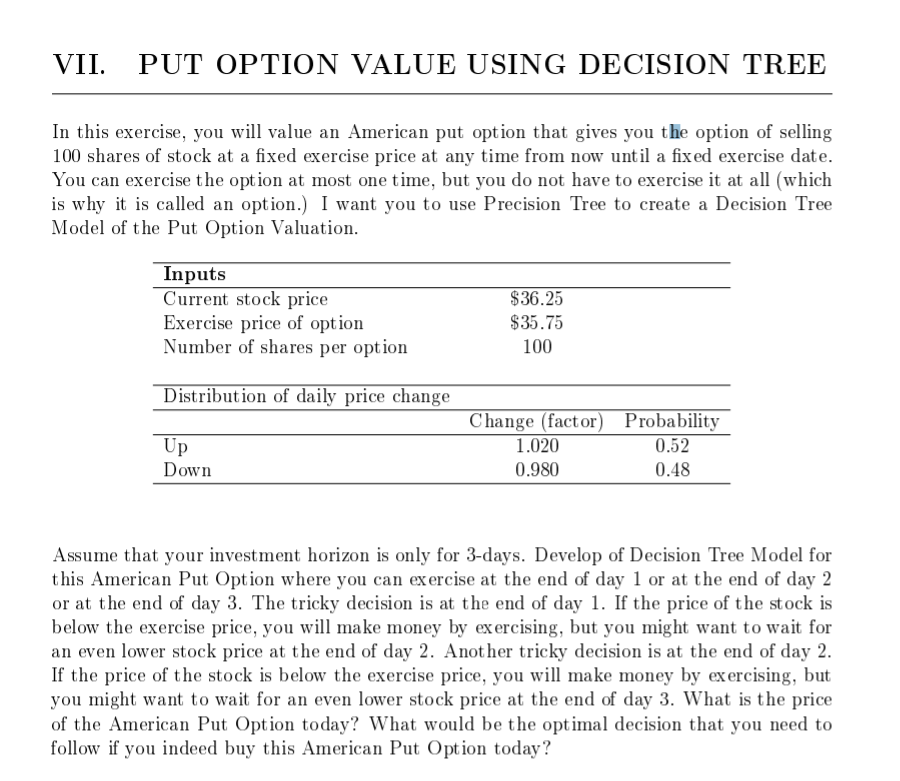

VII PUT OPTION VALUE USING DECISION TREE In this exercise, you will value an American put option that gives you the option of selling 100 shares of stock at a fixed exercise price at any time from now until a fixed exercise date. You can exercise the option at most one time, but you do not have to exercise it at all (which is why it is called an option.) I want you to use Precision Tree to create a Decision Tree Model of the Put Option Valuation Inputs Current stock price Exercise price of option Number of shares per option $36.25 $35.75 100 Distribution of daily price change Change (fact or) Probability 0.52 Up Down 1.020 0.980 0.48 Assume that your investment horizon is only for 3-days. Develop of Decision Tree Model for this American Put Option where you can exercise at the end of day 1 or at the end of day 2 or at the end of day 3. The tricky decision is at the end of day 1. If the price of the st ock is below the exercise price, you will make money by exercising, but you might want to wait for an even lower stock price at the end of day 2. Anot her tricky decision is at the end of day 2 If the price of the stock is below the exercise price, you will make money by exercising, but you might want to wait for an even lower stock price at the end of day 3. What is the price of the American Put Option today? What would be the optimal decision that you need to follow if you indeed buy this American Put Option today? VII PUT OPTION VALUE USING DECISION TREE In this exercise, you will value an American put option that gives you the option of selling 100 shares of stock at a fixed exercise price at any time from now until a fixed exercise date. You can exercise the option at most one time, but you do not have to exercise it at all (which is why it is called an option.) I want you to use Precision Tree to create a Decision Tree Model of the Put Option Valuation Inputs Current stock price Exercise price of option Number of shares per option $36.25 $35.75 100 Distribution of daily price change Change (fact or) Probability 0.52 Up Down 1.020 0.980 0.48 Assume that your investment horizon is only for 3-days. Develop of Decision Tree Model for this American Put Option where you can exercise at the end of day 1 or at the end of day 2 or at the end of day 3. The tricky decision is at the end of day 1. If the price of the st ock is below the exercise price, you will make money by exercising, but you might want to wait for an even lower stock price at the end of day 2. Anot her tricky decision is at the end of day 2 If the price of the stock is below the exercise price, you will make money by exercising, but you might want to wait for an even lower stock price at the end of day 3. What is the price of the American Put Option today? What would be the optimal decision that you need to follow if you indeed buy this American Put Option today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts