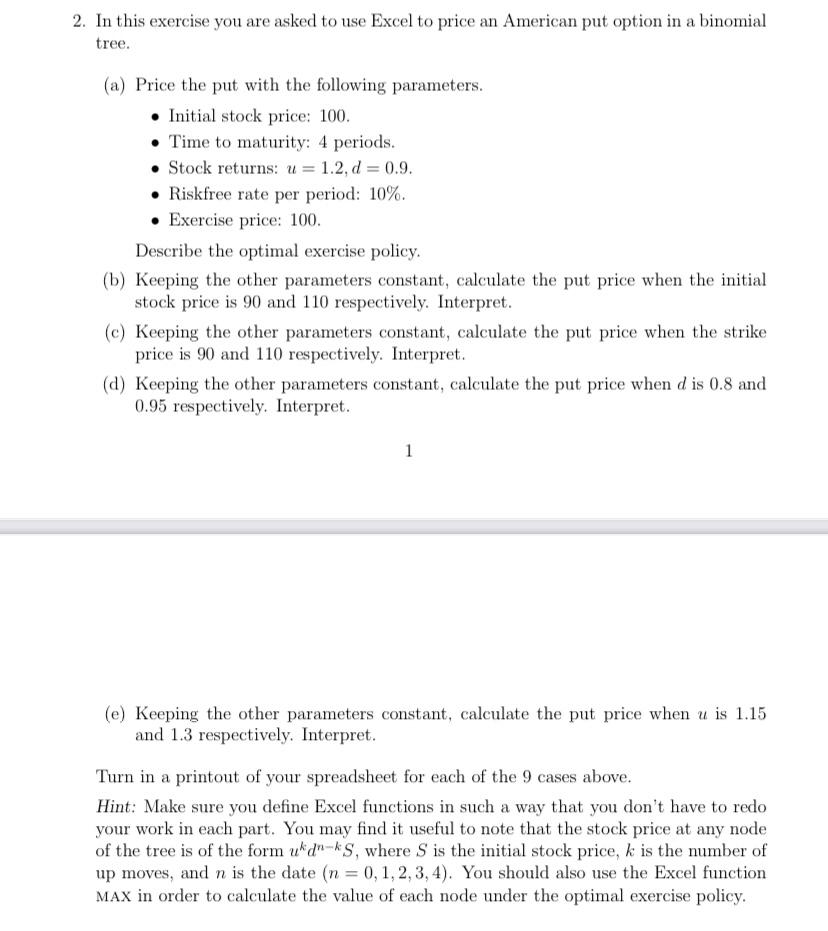

Question: 2. In this exercise you are asked to use Excel to price an American put option in a binomial tree. U= (a) Price the put

2. In this exercise you are asked to use Excel to price an American put option in a binomial tree. U= (a) Price the put with the following parameters. Initial stock price: 100. Time to maturity: 4 periods. Stock returns: u = 1.2, d = 0.9. Riskfree rate per period: 10%. Exercise price: 100 Describe the optimal exercise policy. (b) Keeping the other parameters constant, calculate the put price when the initial stock price is 90 and 110 respectively. Interpret. (c) Keeping the other parameters constant, calculate the put price when the strike price is 90 and 110 respectively. Interpret. (a) Keeping the other parameters constant, calculate the put price when d is 0.8 and 0.95 respectively. Interpret. 1 (e) Keeping the other parameters constant, calculate the put price when u is 1.15 and 1.3 respectively. Interpret. Turn in a printout of your spreadsheet for each of the 9 cases above. Hint: Make sure you define Excel functions in such a way that you don't have to redo your work in each part. You may find it useful to note that the stock price at any node of the tree is of the form udn-kS, where S is the initial stock price, k is the number of up moves, and n is the date (n = 0,1,2,3,4). You should also use the Excel function MAX in order to calculate the value of each node under the optimal exercise policy. 2. In this exercise you are asked to use Excel to price an American put option in a binomial tree. U= (a) Price the put with the following parameters. Initial stock price: 100. Time to maturity: 4 periods. Stock returns: u = 1.2, d = 0.9. Riskfree rate per period: 10%. Exercise price: 100 Describe the optimal exercise policy. (b) Keeping the other parameters constant, calculate the put price when the initial stock price is 90 and 110 respectively. Interpret. (c) Keeping the other parameters constant, calculate the put price when the strike price is 90 and 110 respectively. Interpret. (a) Keeping the other parameters constant, calculate the put price when d is 0.8 and 0.95 respectively. Interpret. 1 (e) Keeping the other parameters constant, calculate the put price when u is 1.15 and 1.3 respectively. Interpret. Turn in a printout of your spreadsheet for each of the 9 cases above. Hint: Make sure you define Excel functions in such a way that you don't have to redo your work in each part. You may find it useful to note that the stock price at any node of the tree is of the form udn-kS, where S is the initial stock price, k is the number of up moves, and n is the date (n = 0,1,2,3,4). You should also use the Excel function MAX in order to calculate the value of each node under the optimal exercise policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts