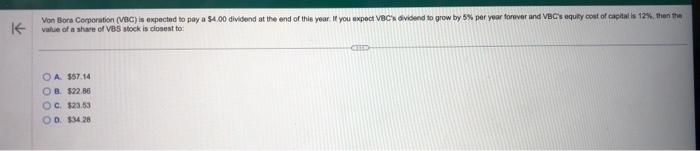

Question: Von Bore Comeration (VeC) is expected to pay a $4, 00 divibend at the end of this year. If you expect vecis divisend to grow

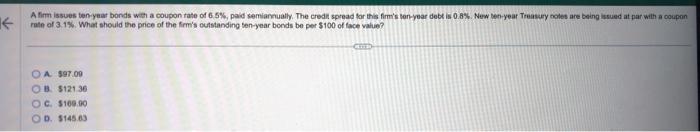

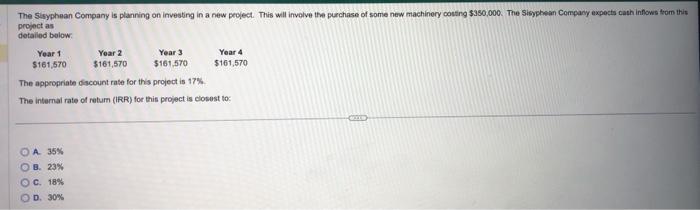

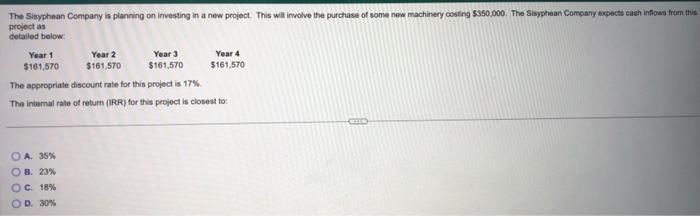

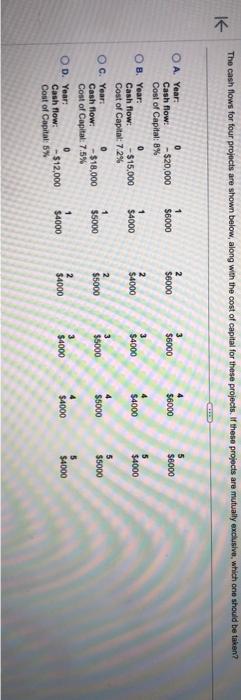

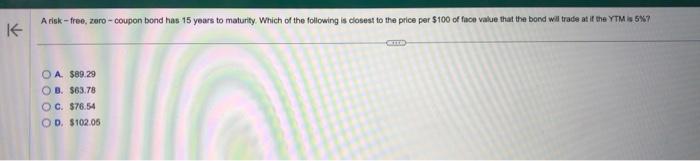

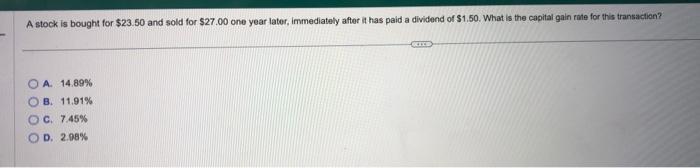

Von Bore Comeration (VeC) is expected to pay a $4, 00 divibend at the end of this year. If you expect vecis divisend to grow by 5% per year farever and VBC's equify cost of aptal is 12%, then the value of a share of VBS tock is closest to:- A. $57.14 B. $22.86 c. $23.53 . 334.28 rate of 3.1\%. What should the price of the frmis outstanding ten-year bonds be per 5100 of face vatue? A. 397.00 B. $12136 C. 110900 D. 5145.63 The sisyphean Company is planning on investing in a new pecject. This will involve the purchase of some new machinery cotting 3380,000 . The sibyphean Company expects cath infows form this project as detalied below: The appropriate discount rate for this project is 17%. The internal rate of retum (IRR) for this project is closest to: A. 35% B. 23% C. 18% D. 30% The Sisyphean Company is planning on investing in a new pecject. This will involve the purchase of some new machinery cosing 5350,000 . The Sisyphean Compary expects eash inflows from this peoject as detalled below: The appropriate discount rate for this project is 17%. The intemal rate of return (IRR) for this project is closest to: A. 35% B. 23% c. 18% D. 30% A risk-free, zero-coupon bond has 15 years to maturity. Which of the following is closest to the price per $100 of face value that the bond will trade at if the YTM is 5 . A. $89.29 B. $63.78 C. $76.54 D. $102.06 A stock is bought for $23.50 and sold for $27.00 one year later, immediately after it has paid a dividend of $1.50. What is the capital gain rate for this transactice? A. 14.89% B. 11,91\% C. 7.45% D. 2.08%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts