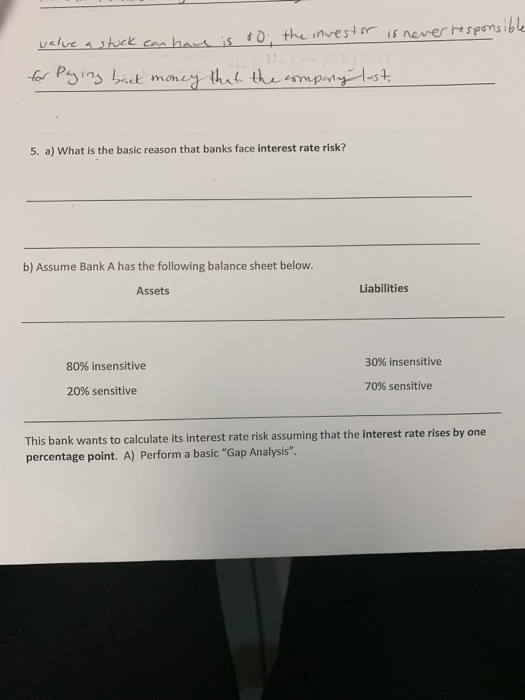

Question: vslue 5 mome 5. a) What is the basic reason that banks face interest rate risk? b) Assume Bank A has the following balance sheet

vslue 5 mome 5. a) What is the basic reason that banks face interest rate risk? b) Assume Bank A has the following balance sheet below. Assets Liabilities 80% insensitive 30% insensitive 70% sensitive 20% sensitive This bank wants to calculate its interest rate risk assuming that the interest rate rises by one percentage point. A) Perform a basic "Gap Analysis" b) Explain precisely what this number means in terms of bank profitability side of its 6. What are the basic ways that a bank adjusts to liquidity risk using the asset balance sheet

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock