Question: WACC? ACO Wh DECAL PLACE from 6.50 ABC Code ABC Comp MACED Cybe 89 Car Componenten Acomparar you were you Erwr your box 69 Acrylic

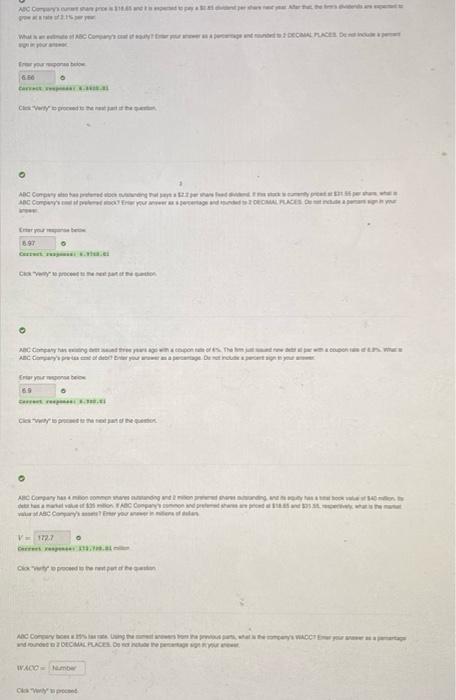

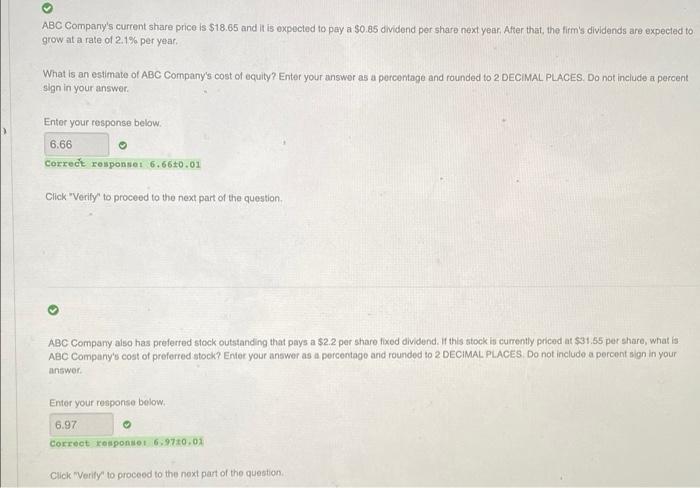

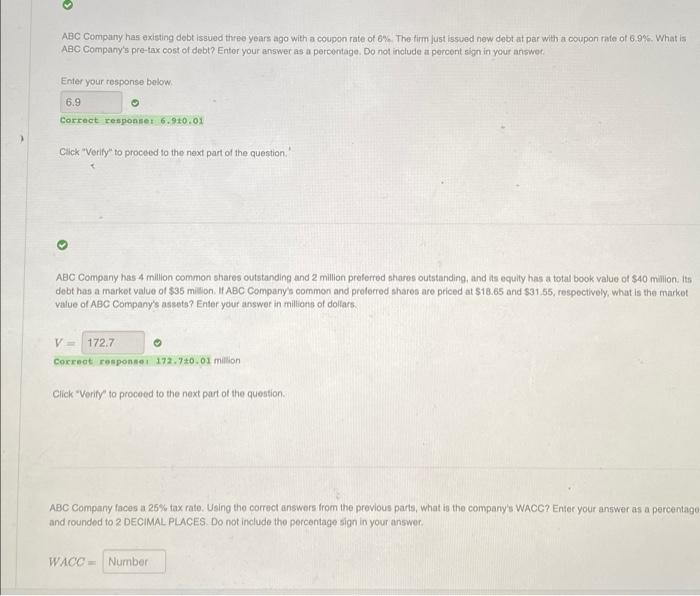

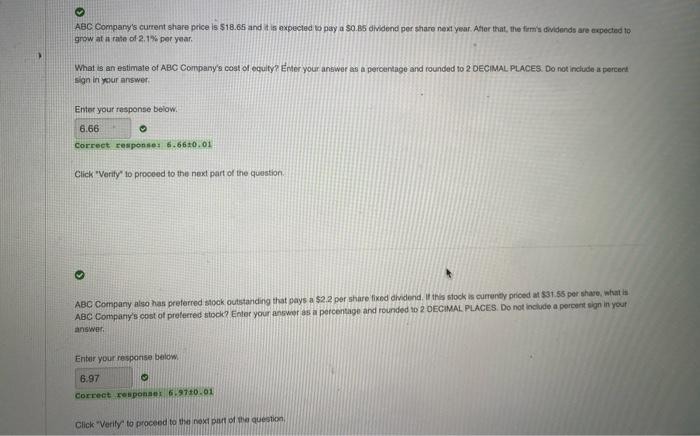

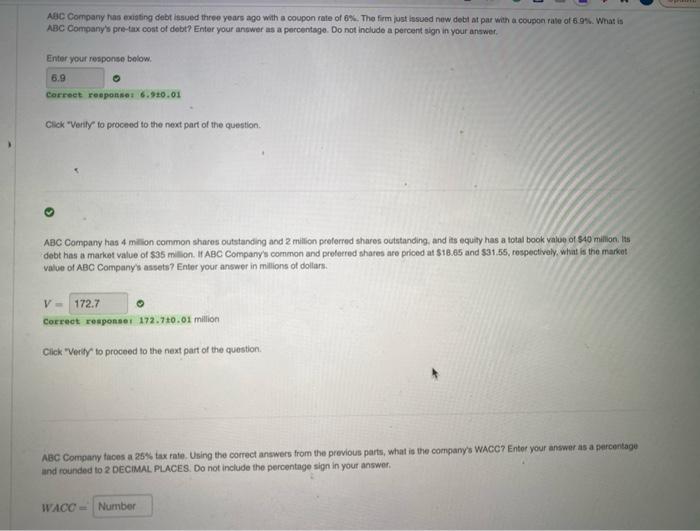

ACO Wh DECAL PLACE from 6.50 ABC Code ABC Comp MACED Cybe 89 Car Componenten Acomparar you were you Erwr your box 69 Acrylic ABC Code c.Com your V 1727 0 Ciproses ACCUWACCTE DECAL PLACE MORE WACO ABC Company's current share price is $18.65 and it is expected to pay a 50.85 dividend per sharp next year After that the firm's dividends are expected to grow at a rate of 2.1% per year, What is an estimate of ABC Company's cost of equity? Enter your answer as a porcentage and rounded to 2 DECIMAL PLACES. Do not include a percent sign in your answer Enter your response below. 6.66 Correct response 6.660.01 Click "Verily' to proceed to the next part of the question > ABC Company also has preferred stock outstanding that pays a $2.2 per share fixed dividend. If this stock is currently priced at $31.55 per share, what is ABC Company's cost of preferred stock? Enter your answer as a porcentago and rounded to 2 DECIMAL PLACES Do not include a percent sign in your answer Enter your response below 6.97 Correct response 6.970.02 Click "Vority to proceed to the next part of the question ABC Company has existing debt issued three years ago with a coupon rate of 6%. The firm just issued new debt at par with a coupon rate of 6.995. What is ABC Company's pre-tax cost of debt? Enter your answer as a percentage. Do not include a percont sign in your answer Enter your response below 6.9 Correct responder 6.910.0% Click "Verity" to proceed to the next part of the question >> ABC Company has 4 million common shares outstanding and 2 million preferred shares outstanding, and its equity has a total book value of $40 million. Its dobt has a market value of $35 million IABC Company's common and proferred sharos are priced at $18.65 and $31.55, respectively, what is the market value of ABC Company's assuts? Enter your answer in millions of dollars V = 172.7 Correct response 192.720.01 million Click "Vority to proceed to the next part of the question ABC Company faces a 25% tax rato. Using the correct answers from the previous parts, what is the company's WACC? Enter your answer as a percentago and rounded to 2 DECIMAL PLACES Do not include the percentage sign in your answer. WACC Number ABC Company's current share price is $18.65 and it is expected to pay a $0.85 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 2.1% per year. What is an estimate of ABC Company's cost of equity? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES Do not include a percent 2 sign in your answer Enter your response below 6.66 Correct response: 6.6610.01 Click "Verity to proceed to the next part of the question ABC Company also has preferred stock outstanding that pays a $2.2 por share fixed dividend. If this stock is currently priced at $31.55 per share, what is ABC Company's cost of proferred stock Enter your answer is a percentage and rounded to 2 DECIMAL PLACES. Do not include a porcent sign in your answer Enter your response below 6.97 Correct responses 6.9710.01 Click "Verity to proceed to the next part of the question ABC Company has existing debt issued three years ago with a coupon rate of 6%. The firm just issued now debt at par with a coupon rate of 6.9. Wat is ABC Company's pre-tax cost of debt? Enter your answer as a percentage. Do not include a percent sign in your answer. Enter your response below 6.9 Correct responder 6.10.01 Click "verly to proceed to the next part of the question. ABC Company has 4 million common shares outstanding and 2 million preferred shares outstanding, and its equity has a total book value of $40 millon, its debt has a market value of $35 millon. If ABC Company's common and preferred shares are priced at $18.65 and $31.55, respectively, what is the market value of ABC Company's assets? Enter your answer in milions of dollars. V = 172.7 Correct responser 172.720.01 million Click "Verity to proceed to the next part of the question. ABC Company faces a 25% tax rate. Using the correct answers from the previous parts, what is the company's WACC7 Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not include the percentage sign in your answer. WACC= Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts