Question: Warehouse Systems Enterprises (WSE) has designed a new inventory management system. Management must choose from three alternative courses of action. The firm can: (1) sell

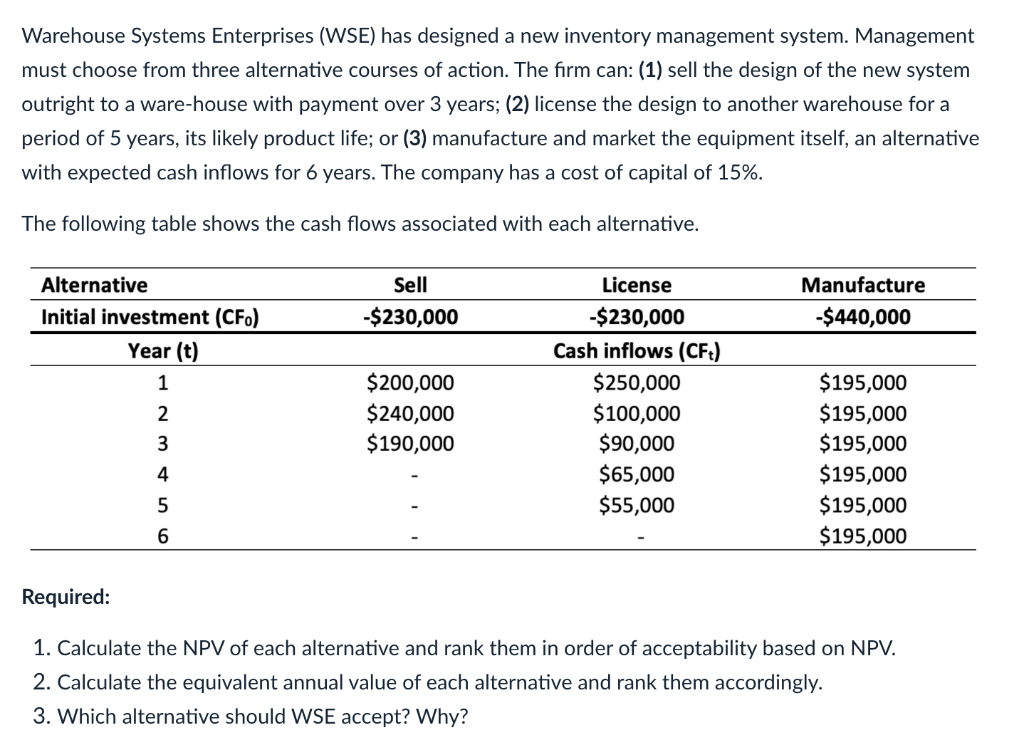

Warehouse Systems Enterprises (WSE) has designed a new inventory management system. Management must choose from three alternative courses of action. The firm can: (1) sell the design of the new system outright to a ware-house with payment over 3 years; (2) license the design to another warehouse for a period of 5 years, its likely product life; or (3) manufacture and market the equipment itself, an alternative with expected cash inflows for 6 years. The company has a cost of capital of 15%. The following table shows the cash flows associated with each alternative. Sell Manufacture -$440,000 -$230,000 Alternative Initial investment (CF) Year (t) 1 License -$230,000 Cash inflows (CF) $250,000 $100,000 $90,000 $65,000 $55,000 $200,000 $240,000 $190,000 2 3 $195,000 $195,000 $195,000 $195,000 $195,000 $195,000 4 5 6 Required: 1. Calculate the NPV of each alternative and rank them in order of acceptability based on NPV. 2. Calculate the equivalent annual value of each alternative and rank them accordingly. 3. Which alternative should WSE accept? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts