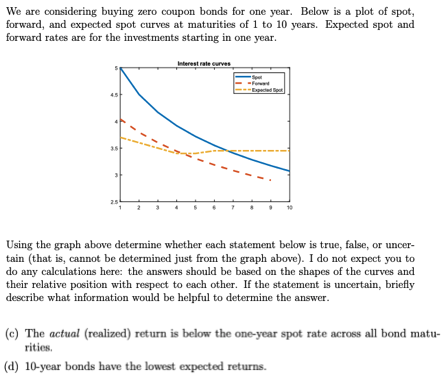

Question: We are considering buying zero coupon bonds for one year. Below is a plot of spot, forward, and expected spot curves at maturities of 1

We are considering buying zero coupon bonds for one year. Below is a plot of spot, forward, and expected spot curves at maturities of 1 to 10 years. Expected spot and forward rates are for the investments starting in one year. Using the graph above determine whether each statement below is true, false, or uncer tain (that is, cannot be determined just from the graph above). I do not expect you to do any calculations here: the answers should be based on the shapes of the curves and their relative position with respect to each other. If the statement is uncertain, briefly describe what information would be helpful to determine the answer (e) The actual (realized) return is below the one-year spot rate across all bond matu- rities, (d) 10-year bonds have the lowest expected returns. We are considering buying zero coupon bonds for one year. Below is a plot of spot, forward, and expected spot curves at maturities of 1 to 10 years. Expected spot and forward rates are for the investments starting in one year. Using the graph above determine whether each statement below is true, false, or uncer tain (that is, cannot be determined just from the graph above). I do not expect you to do any calculations here: the answers should be based on the shapes of the curves and their relative position with respect to each other. If the statement is uncertain, briefly describe what information would be helpful to determine the answer (e) The actual (realized) return is below the one-year spot rate across all bond matu- rities, (d) 10-year bonds have the lowest expected returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts