Question: We are doing an airline simulation where we make decisions quaterly. What numbers should i used that will put my company in the right direction

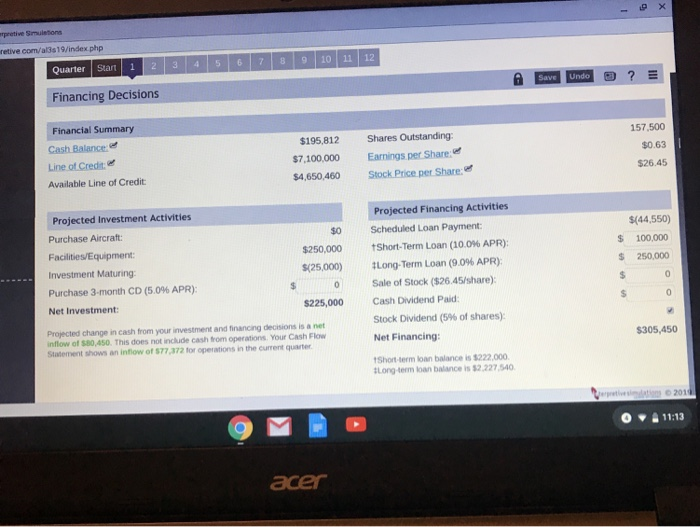

retive com/al3s19/index php Quarter Stat 1 2 3 45 6789 Financing Decisions Financial Summary 10 1112 $195.812 Shares Outstanding $7.100,000 Earnings per Share: $4,650,460 Stock Price per Share 157,500 $0.63 $26.45 Cash Balance. Line otCredt Available Line of Credit Projected Investment Activities Purchase Aircraft Facilities/Equipment: Investment Maturing: Purchase 3-month CD (5.0% APR): Net Investment: Projected Financing Activities Scheduled Loan Payment tShort-Term Loan (10.0% APR): Long-Term Loan (9.096 APR): 0 Sale of Stock ($26.45/share) $(44.550) $ 100,000 s250,000 $0 $250,000 $(25,000) $225,000 Cash Dividend Paid Projected change in cash from your investment and financing decisions is a net inflow of $80,450. This does not include cash from operations. Your Cash Flow Statement shows an inflow of $77,372 for operations in the current quarter Stock Dividend (5% of shares) Net Financing: 305,450 Short-term loan balance is $222,000 Long-term loan balance is $2,227,540 O11:13 acer retive com/al3s19/index php Quarter Stat 1 2 3 45 6789 Financing Decisions Financial Summary 10 1112 $195.812 Shares Outstanding $7.100,000 Earnings per Share: $4,650,460 Stock Price per Share 157,500 $0.63 $26.45 Cash Balance. Line otCredt Available Line of Credit Projected Investment Activities Purchase Aircraft Facilities/Equipment: Investment Maturing: Purchase 3-month CD (5.0% APR): Net Investment: Projected Financing Activities Scheduled Loan Payment tShort-Term Loan (10.0% APR): Long-Term Loan (9.096 APR): 0 Sale of Stock ($26.45/share) $(44.550) $ 100,000 s250,000 $0 $250,000 $(25,000) $225,000 Cash Dividend Paid Projected change in cash from your investment and financing decisions is a net inflow of $80,450. This does not include cash from operations. Your Cash Flow Statement shows an inflow of $77,372 for operations in the current quarter Stock Dividend (5% of shares) Net Financing: 305,450 Short-term loan balance is $222,000 Long-term loan balance is $2,227,540 O11:13 acer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts