Question: Consider that the marginal benefit of tax evasion follows MB = 0.25x, where x denotes for every $1000 tax evasion. The probability of getting

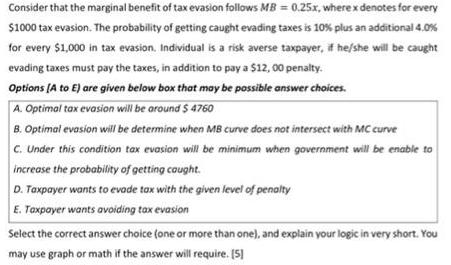

Consider that the marginal benefit of tax evasion follows MB = 0.25x, where x denotes for every $1000 tax evasion. The probability of getting caught evading taxes is 10% plus an additional 4.0% for every $1,000 in tax evasion. Individual is a risk averse taxpayer, if he/she will be caught evading taxes must pay the taxes, in addition to pay a $12,00 penalty. Options [A to E) are given below box that may be possible answer choices. A. Optimal tax evasion will be around $ 4760 B. Optimal evasion will be determine when MB curve does not intersect with MC curve C. Under this condition tax evasion will be minimum when government will be enable to increase the probability of getting caught. D. Taxpayer wants to evade tax with the given level of penalty E. Taxpayer wants avoiding tax evasion Select the correct answer choice (one or more than one), and explain your logic in very short. You may use graph or math if the answer will require. [5]

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Answer Option B Optimal evasion will be ... View full answer

Get step-by-step solutions from verified subject matter experts