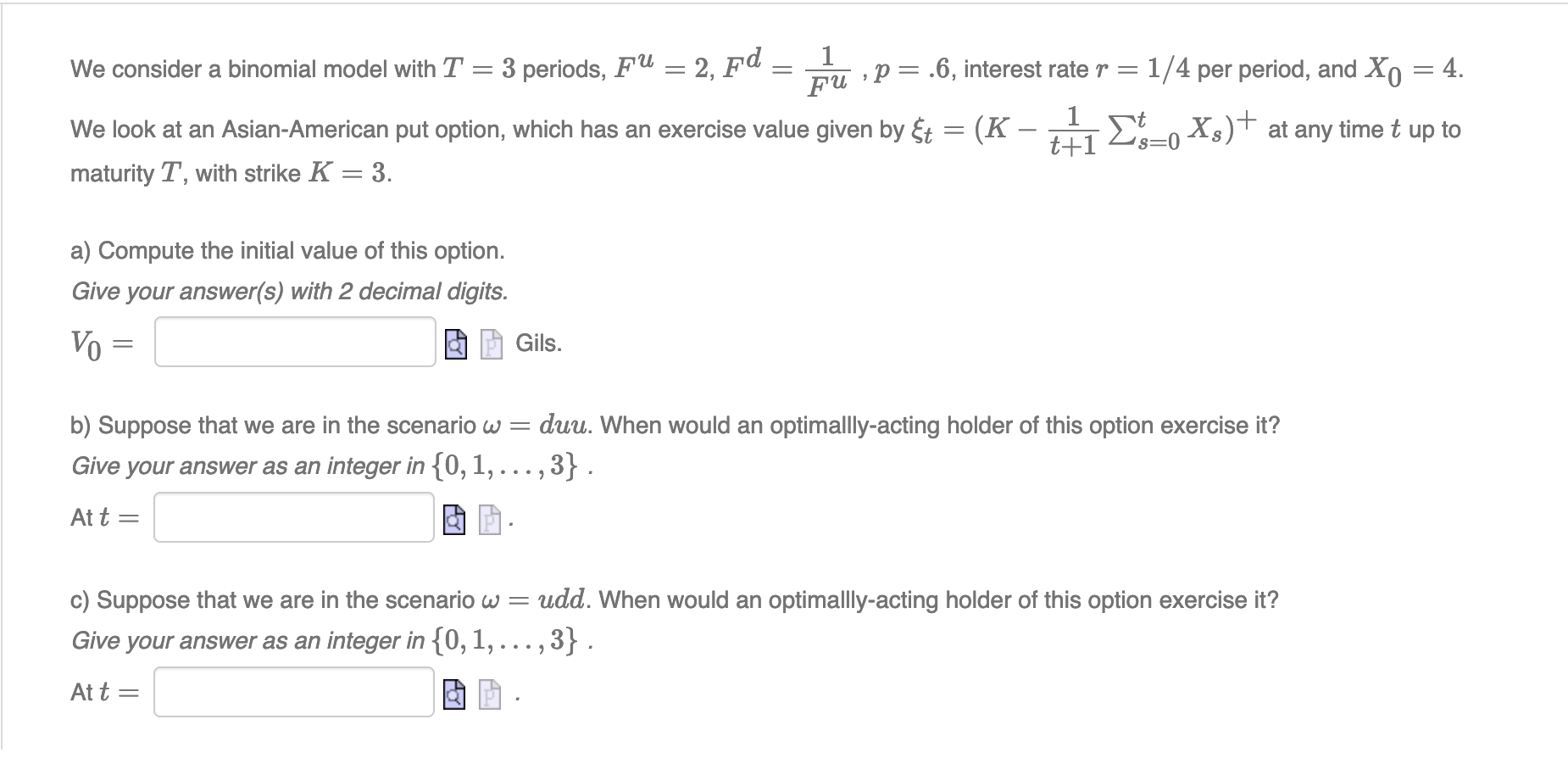

Question: We consider a binomial model with T = 3 periods, Fu = 2, fd 1 Fu p= .6, interest rate r = 1/4 per period,

We consider a binomial model with T = 3 periods, Fu = 2, fd 1 Fu p= .6, interest rate r = 1/4 per period, and Xo = 4. We look at an Asian-American put option, which has an exercise value given by $t (K Ets=0 X:)+ at any time t up to t+1 maturity T, with strike K = 3. a) Compute the initial value of this option. Give your answer(s) with 2 decimal digits. VO = Gils. b) Suppose that we are in the scenario w duu. When would an optimallly-acting holder of this option exercise it? Give your answer as an integer in {0, 1,...,3} . At t= c) Suppose that we are in the scenario w= - udd. When would an optimallly-acting holder of this option exercise it? Give your answer as an integer in {0, 1,...,3} . At t=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts