Question: We learned about stock valuation using methods such as dividend discount model P = D/(R-G). Analyse the company's historic common share price using five

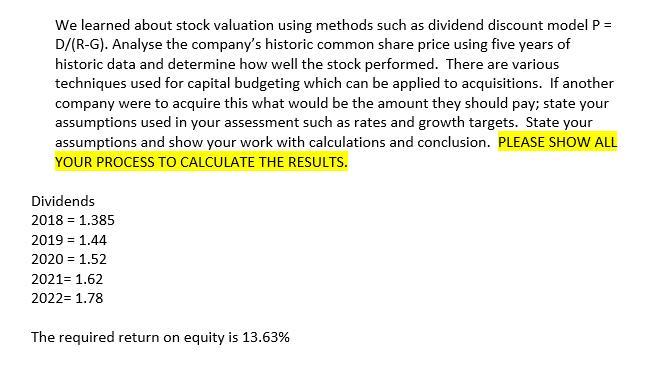

We learned about stock valuation using methods such as dividend discount model P = D/(R-G). Analyse the company's historic common share price using five years of historic data and determine how well the stock performed. There are various techniques used for capital budgeting which can be applied to acquisitions. If another company were to acquire this what would be the amount they should pay; state your assumptions used in your assessment such as rates and growth targets. State your assumptions and show your work with calculations and conclusion. PLEASE SHOW ALL YOUR PROCESS TO CALCULATE THE RESULTS. Dividends 2018 = 1.385 2019 = 1.44 2020 = 1.52 2021= 1.62 2022= 1.78 The required return on equity is 13.63%

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

To analyze the companys historic common share price performance using the dividend discount model DD... View full answer

Get step-by-step solutions from verified subject matter experts