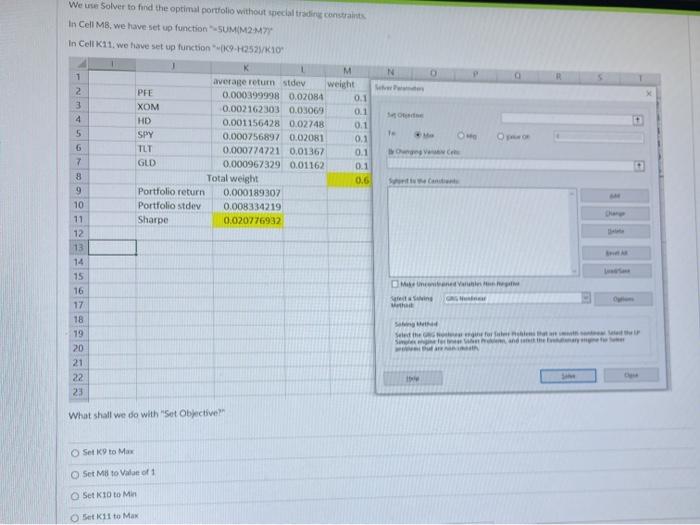

Question: We use Solver to find the optimal portfolio without special trading constraints In Cell M, we have set up functionSUMM2-T N O In Cell 11.

We use Solver to find the optimal portfolio without special trading constraints In Cell M, we have set up functionSUMM2-T N O In Cell 11. we have set up function K9-H2529/10 K M 1 average returnstev weight 2 PFE 0.000399998 0.02084 0.1 3 XOM 0.002162303 0.03069 0.1 4 HD 0.001156428 0.02748 0.1 5 SPY 0.000756897 0.02081 0.1 6 TLT 0.000774721 0.01367 0.1 7 GLD 0.000967329 0.01162 0.1 8 Total weight 0.6 9 Portfolio return 0.000189307 10 Portfolio stdev 0.008334219 11 Sharpe 0.020776932 12 13 14 15 16 17 18 19 20 Meeting Safed ht SI Select for Town and the 21 22 23 What shall we do with "Set Objective Set K9 to Me Set M8 to Vale of 1 Set 10 to Min Set 11 to Max

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts