Question: we use the libby accounting textbook version 10e Refer to the financial statements of American Eagle Outfitters in Appendix B, Express in Appendix C, and

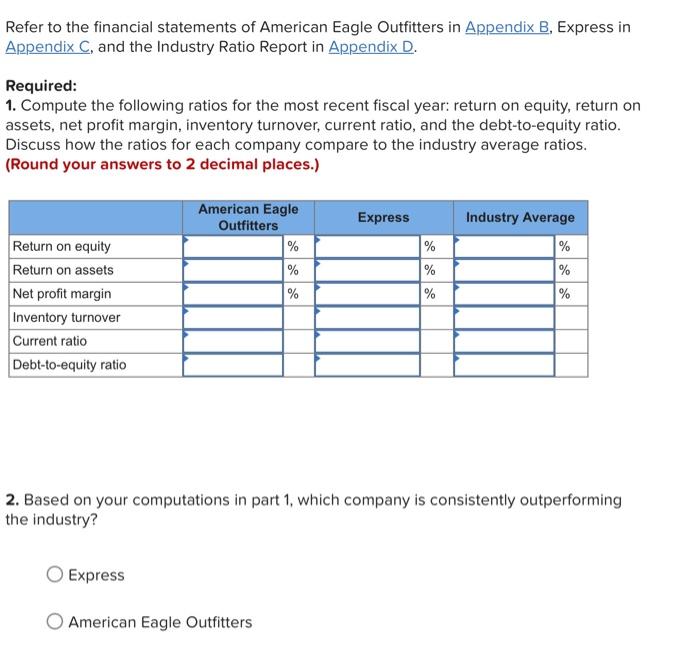

Refer to the financial statements of American Eagle Outfitters in Appendix B, Express in Appendix C, and the Industry Ratio Report in Appendix D. Required: 1. Compute the following ratios for the most recent fiscal year: return on equity, return on assets, net profit margin, inventory turnover, current ratio, and the debt-to-equity ratio. Discuss how the ratios for each company compare to the industry average ratios. (Round your answers to 2 decimal places.) Express American Eagle Outfitters % % % % % % Industry Average % % % Return on equity Return on assets Net profit margin Inventory turnover Current ratio Debt-to-equity ratio 2. Based on your computations in part 1, which company is consistently outperforming the industry? O Express American Eagle Outfitters Refer to the financial statements of American Eagle Outfitters in Appendix B, Express in Appendix C, and the Industry Ratio Report in Appendix D. Required: 1. Compute the following ratios for the most recent fiscal year: return on equity, return on assets, net profit margin, inventory turnover, current ratio, and the debt-to-equity ratio. Discuss how the ratios for each company compare to the industry average ratios. (Round your answers to 2 decimal places.) Express American Eagle Outfitters % % % % % % Industry Average % % % Return on equity Return on assets Net profit margin Inventory turnover Current ratio Debt-to-equity ratio 2. Based on your computations in part 1, which company is consistently outperforming the industry? O Express American Eagle Outfitters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts