Question: Week 2 Week 3 Week 4 Testi Week 6 Week 7 QUESTION 1 Week 8 Week 9 - Spring Break Week 10 Week 11 Test

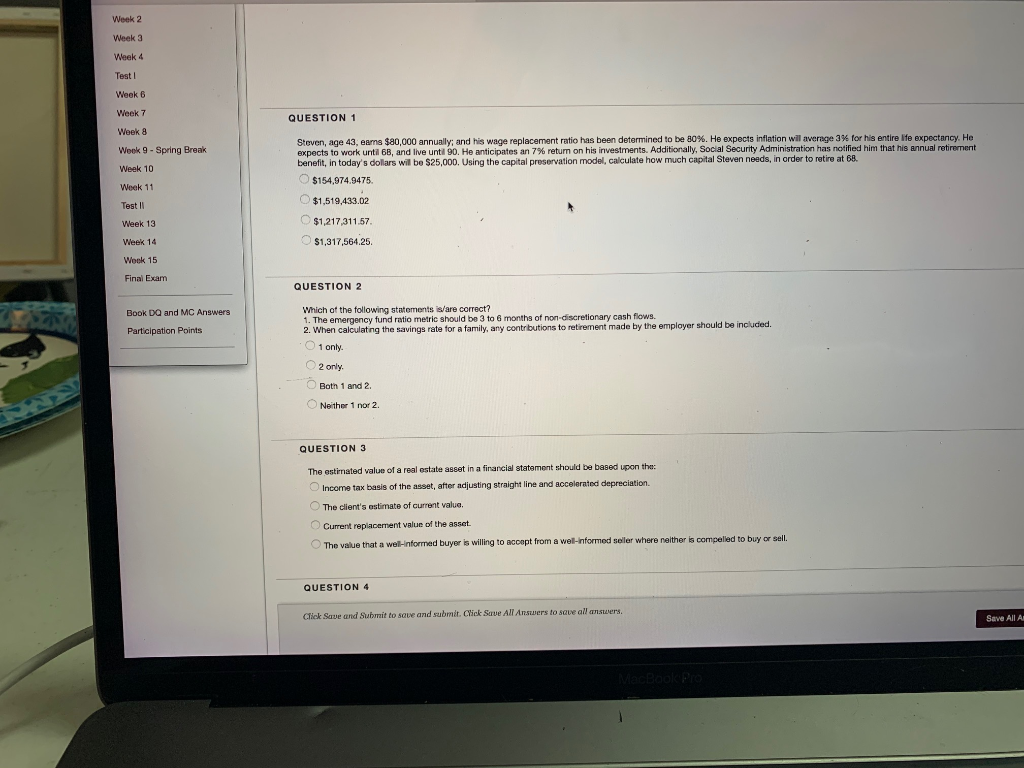

Week 2 Week 3 Week 4 Testi Week 6 Week 7 QUESTION 1 Week 8 Week 9 - Spring Break Week 10 Week 11 Test 11 Steven, age 43, earns $20,000 annually, and his wage replacement ratio has been determined to be 80%. He expects Inflation wil average 3% for his entire ife expectancy. He expects to work unti 68, and live unti 90. He anticipates an 7% return on his investments. Additionally, Social Security Administration has notified him that his annual retirement benefit, in today's dollars will be $25,000. Using the capital preservation model, calculate how much capital Steven noods, in order to retire at 68. $154,974.9475 $1,519,433.02 $1,217,311.57 $1,317,564.25 Week 13 Week 14 Wook 15 Final Exam QUESTION 2 Book DQ and MC Answers Participation Points Which of the following statements is/are correct? 1. The emergency fund ratio metrie should be 3 to 6 months of non-discretionary cash flows. 2. When calculating the savings rate for a family, any contributions to retirement made by the employer should be included. 1 only 2 only Both 1 and 2 Neither 1 nor 2 QUESTION 3 The estimated value of a real estate asset in a financial statement should be based upon the Income tax basis of the asset, after adjusting straight line and Bocelerated depreciation The client's estimate of current value Current replacement value of the asset. The value that a well-informed buyer is willing to accept from a well-Informed seller where neither is compelled to buy or sell QUESTION 4 Click Save and Submit to save and submit. Click Save All Answers to save all answers Save All Week 2 Week 3 Week 4 Testi Week 6 Week 7 QUESTION 1 Week 8 Week 9 - Spring Break Week 10 Week 11 Test 11 Steven, age 43, earns $20,000 annually, and his wage replacement ratio has been determined to be 80%. He expects Inflation wil average 3% for his entire ife expectancy. He expects to work unti 68, and live unti 90. He anticipates an 7% return on his investments. Additionally, Social Security Administration has notified him that his annual retirement benefit, in today's dollars will be $25,000. Using the capital preservation model, calculate how much capital Steven noods, in order to retire at 68. $154,974.9475 $1,519,433.02 $1,217,311.57 $1,317,564.25 Week 13 Week 14 Wook 15 Final Exam QUESTION 2 Book DQ and MC Answers Participation Points Which of the following statements is/are correct? 1. The emergency fund ratio metrie should be 3 to 6 months of non-discretionary cash flows. 2. When calculating the savings rate for a family, any contributions to retirement made by the employer should be included. 1 only 2 only Both 1 and 2 Neither 1 nor 2 QUESTION 3 The estimated value of a real estate asset in a financial statement should be based upon the Income tax basis of the asset, after adjusting straight line and Bocelerated depreciation The client's estimate of current value Current replacement value of the asset. The value that a well-informed buyer is willing to accept from a well-Informed seller where neither is compelled to buy or sell QUESTION 4 Click Save and Submit to save and submit. Click Save All Answers to save all answers Save All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts