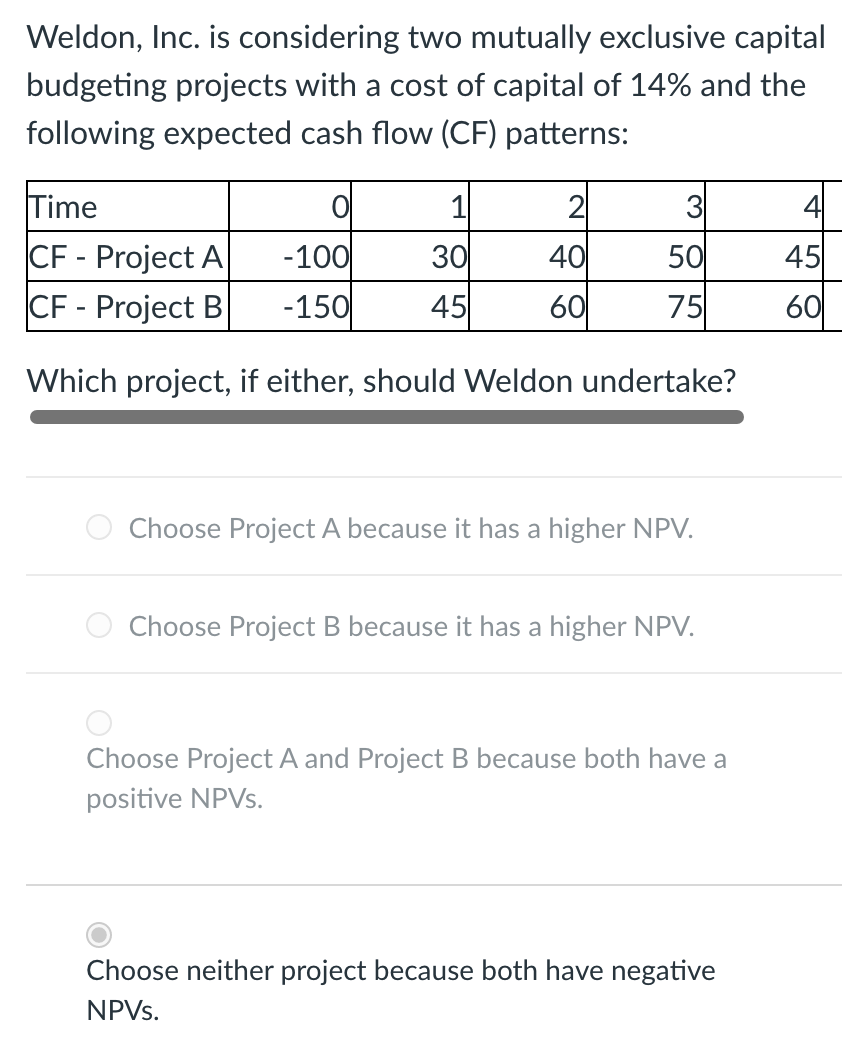

Question: Weldon, Inc. is considering two mutually exclusive capital budgeting projects with a cost of capital of 14% and the following expected cash flow (CF) patterns:

Weldon, Inc. is considering two mutually exclusive capital budgeting projects with a cost of capital of 14% and the following expected cash flow (CF) patterns: 1 21 31 41 Time CF - Project A CF - Project B -1001 30 40 50 45 -150 45 60 75 60 Which project, if either, should Weldon undertake? Choose Project A because it has a higher NPV. Choose Project B because it has a higher NPV. Choose Project A and Project B because both have a positive NPVs. Choose neither project because both have negative NPVs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts