Question: WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of

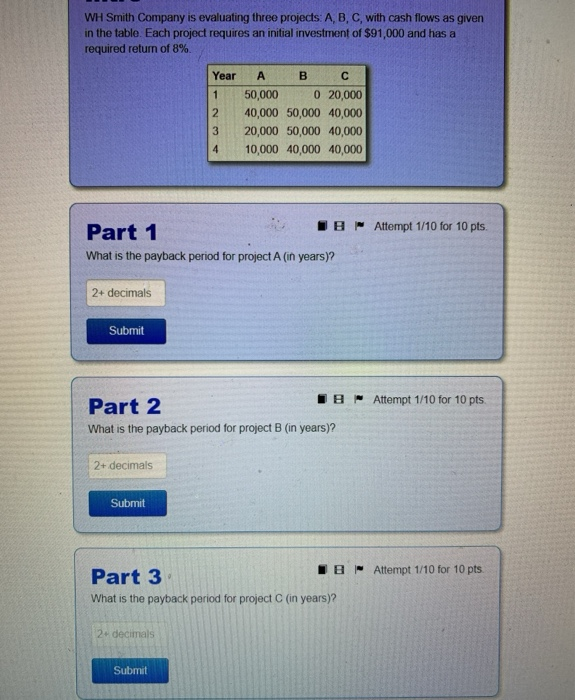

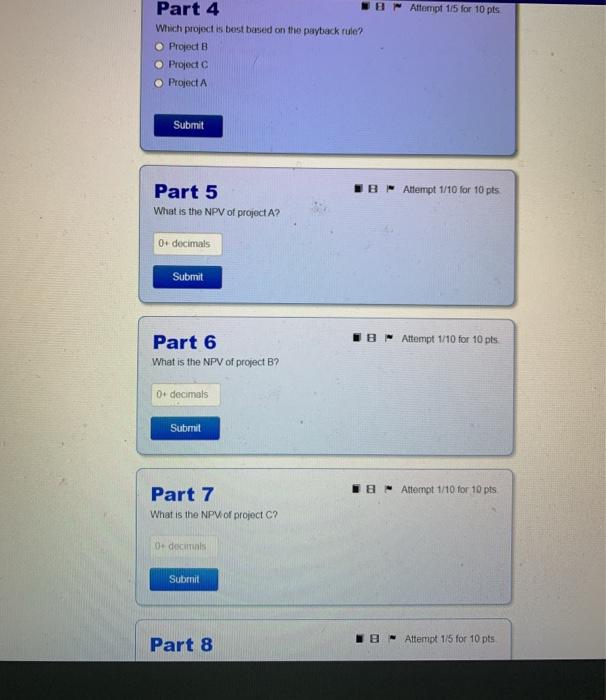

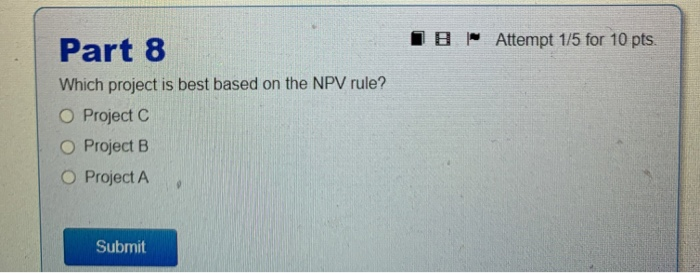

WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of $91,000 and has a required return of 8% Year 1 2 A B 50,000 0 20,000 40,000 50,000 40,000 20,000 50,000 40,000 10,000 40,000 40,000 3 4 Part 1 IB Attempt 1/10 for 10 pts. What is the payback period for project A (in years)? 2+ decimals Submit Part 2 IB Attempt 1/10 for 10 pts What is the payback period for project B (in years)? 2+ decimals Submit Part 3 IB Attempt 1/10 for 10 pts What is the payback period for project C (in years)? 2-decimals Submit Attempt 1/5 for 10 pts Part 4 Which project is best based on the payback rule? Project B Project C Project Submit BAttempt 1/10 for 10 pts Part 5 What is the NPV of project A? 0+ decimals Submit IB Attempt 1/10 for 10 pts Part 6 What is the NPV of project B? 0+ decimals Submit TB Attempt 1/10 for 10 pts Part 7 What is the NPV of project C? 0+ decimals Submit Part 8 VB Attempt 15 for 10 pts IB Attempt 1/5 for 10 pts. Part 8 Which project is best based on the NPV rule? O Project Project B O Project A Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts