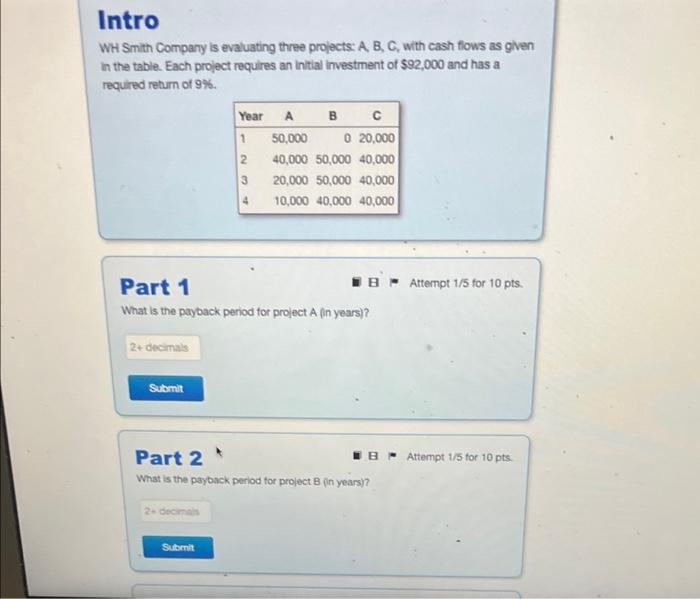

Question: WH Smith Compary is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an intial investment of

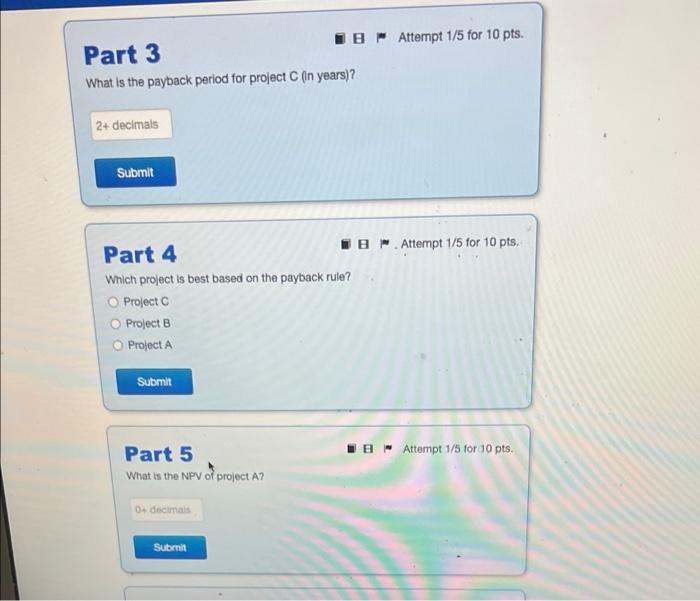

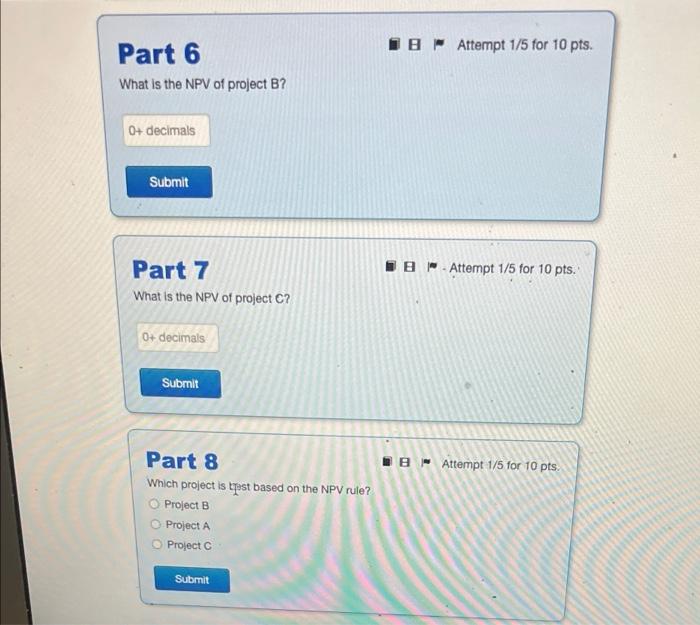

WH Smith Compary is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an intial investment of $92,000 and has a required return of 9%. Part 1 B - Attempt 1/5 for 10 pts. What is the payback period for project A (in years)? Part 2 E - Attempt 1/5 for 10 pts. What is the payback period for project B (in years)? What is the payback period for project C (in years)? Part 4 B . Attempt 1/5 for 10 pts. Which project is best based on the payback rule? Prolect C Project B Project A What is the NPV of project B? Part 7 What is the NPV of project C? Part 8 Which project is trest based on the NPV rule? Project B Project A Project C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts