Question: What are the asnwers? Required information Problem 7-6A Record amortization and prepare the intangible assets section (LO7-5) [The following information applies to the questions displayed

What are the asnwers?

![displayed below.] The following information relates to the intangible assets of University](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1f698afee8_33666f1f69836fd3.jpg)

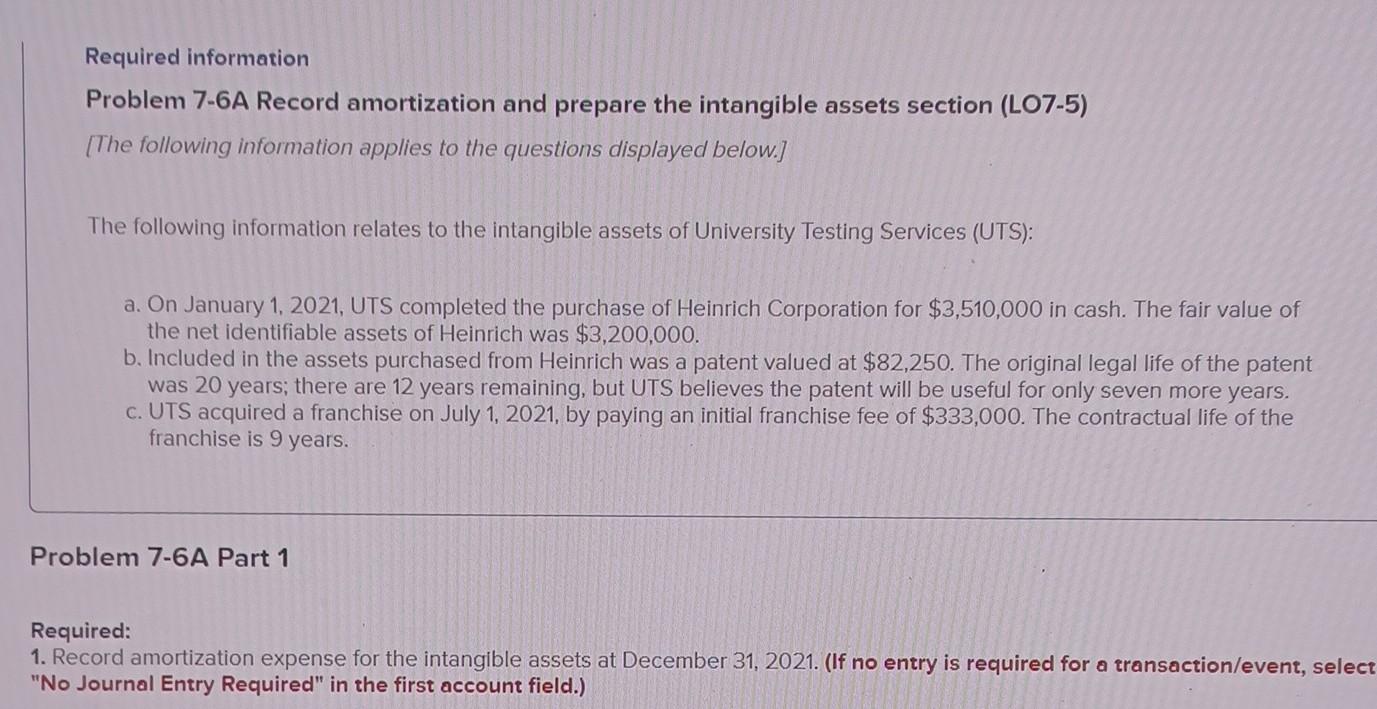

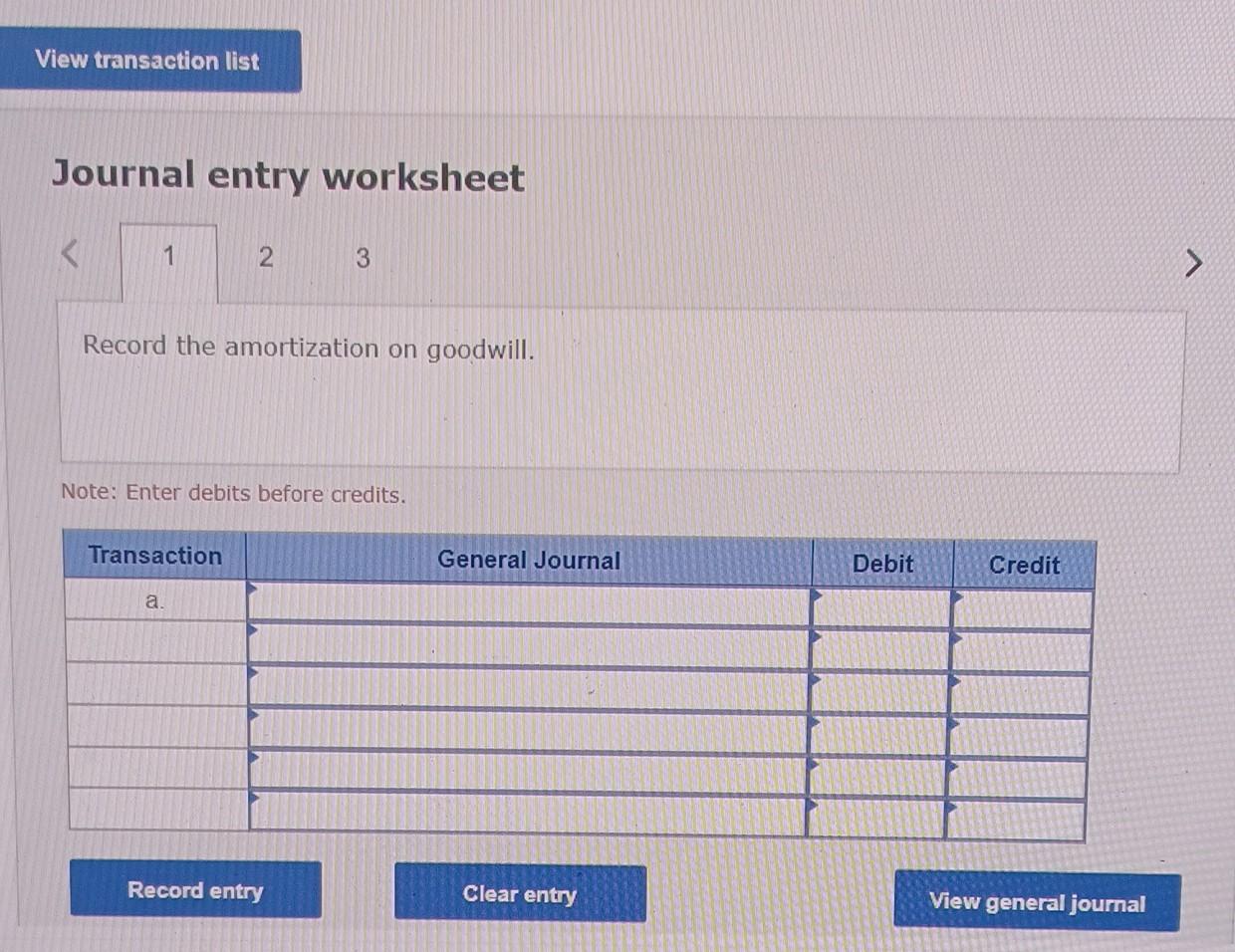

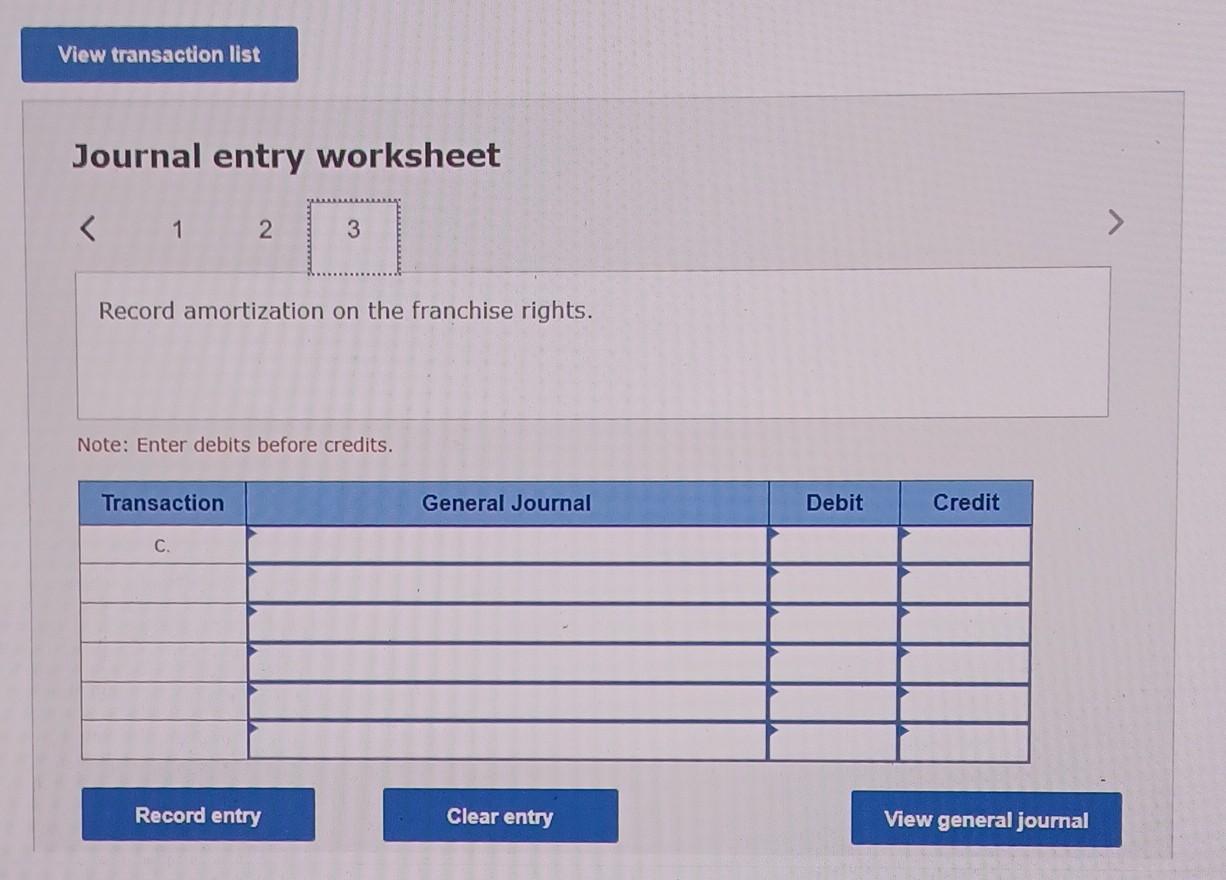

Required information Problem 7-6A Record amortization and prepare the intangible assets section (LO7-5) [The following information applies to the questions displayed below.] The following information relates to the intangible assets of University Testing Services (UTS): a. On January 1, 2021, UTS completed the purchase of Heinrich Corporation for $3,510,000 in cash. The fair value of the net identifiable assets of Heinrich was $3,200,000. b. Included in the assets purchased from Heinrich was a patent valued at $82,250. The original legal life of the patent was 20 years; there are 12 years remaining, but UTS believes the patent will be useful for only seven more years. c. UTS acquired a franchise on July 1, 2021, by paying an initial franchise fee of $333,000. The contractual life of the franchise is 9 years. Problem 7-6A Part 1 Required: 1. Record amortization expense for the intangible assets at December 31, 2021. (If no entry is required for a transaction/event, selec "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the amortization on goodwill. Note: Enter debits before credits. Journal entry worksheet Record amortization on the patent. Note: Enter debits before credits. Journal entry worksheet Record amortization on the franchise rights. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts