Question: What is the answer? Required information Problem 7-6A Record amortization and prepare the intangible assets section (LO7-5) [The following information applies to the questions displayed

What is the answer?

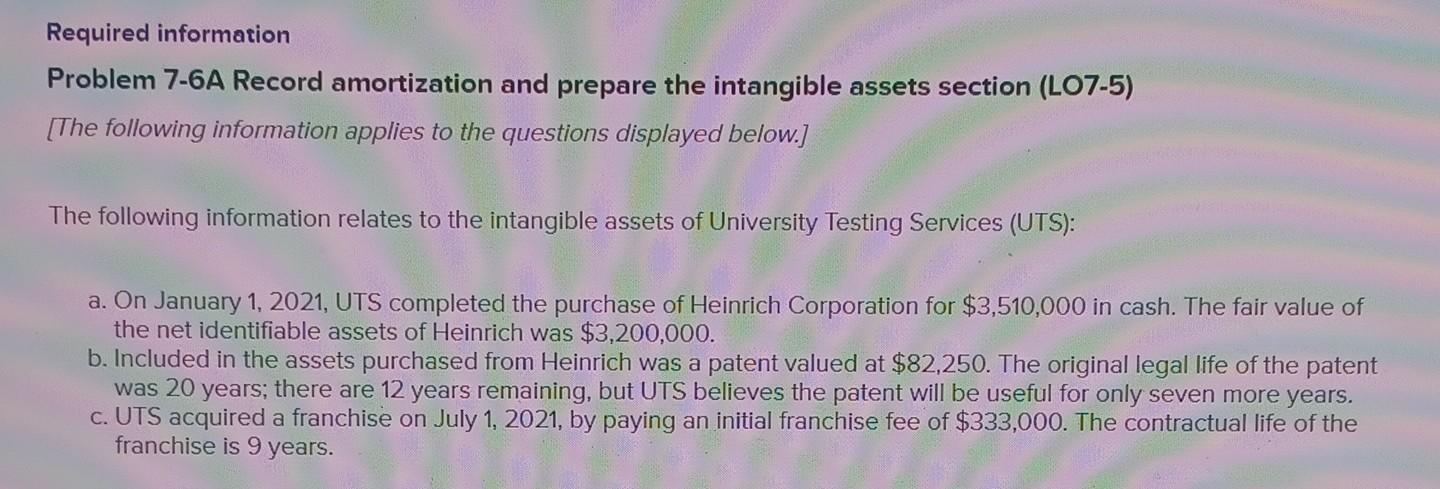

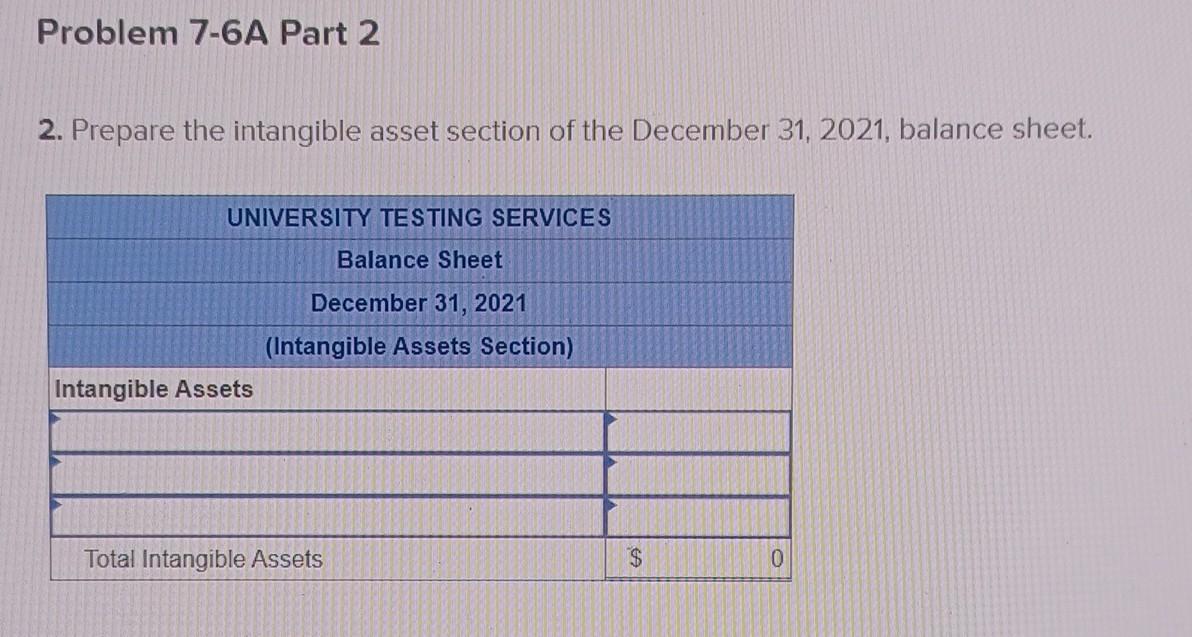

Required information Problem 7-6A Record amortization and prepare the intangible assets section (LO7-5) [The following information applies to the questions displayed below.] The following information relates to the intangible assets of University Testing Services (UTS): a. On January 1, 2021, UTS completed the purchase of Heinrich Corporation for $3,510,000 in cash. The fair value of the net identifiable assets of Heinrich was $3,200,000. b. Included in the assets purchased from Heinrich was a patent valued at $82,250. The original legal life of the patent was 20 years; there are 12 years remaining, but UTS believes the patent will be useful for only seven more years. c. UTS acquired a franchise on July 1,2021 , by paying an initial franchise fee of $333,000. The contractual life of the franchise is 9 years. 2. Prepare the intangible asset section of the December 31,2021 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts