Question: What are the Excel Formulas for this problem? Johnny Cake Ltd. has 8 million shares of stock outstanding selling at $22 per share and an

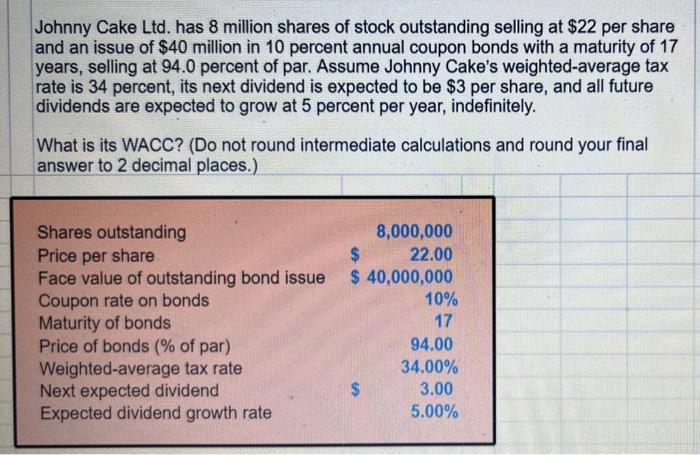

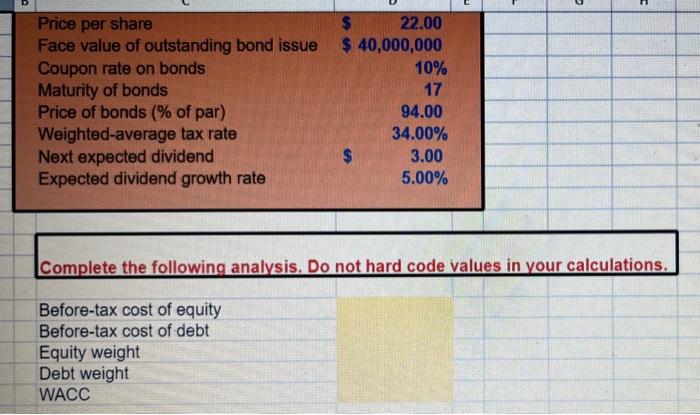

Johnny Cake Ltd. has 8 million shares of stock outstanding selling at $22 per share and an issue of $40 million in 10 percent annual coupon bonds with a maturity of 17 years, selling at 94.0 percent of par. Assume Johnny Cake's weighted-average tax rate is 34 percent, its next dividend is expected to be $3 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely. What is its WACC? (Do not round intermediate calculations and round your final answer to 2 decimal places.) \begin{tabular}{lcc} Price per share & $ & 22.00 \\ Face value of outstanding bond issue & $40,000,000 \\ Coupon rate on bonds & 10% \\ Maturity of bonds & 17 \\ Price of bonds (\% of par) & 94.00 \\ Weighted-average tax rate & 34.00% \\ Next expected dividend & 3.00 \\ Expected dividend growth rate & 5.00% \\ \hline \end{tabular} Complete the following analysis. Do not hard code values in your calculations. Before-tax cost of equity Before-tax cost of debt Equity weight Debt weight WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts