Question: What are your final conclusions regarding how much Nina's should offer and the form of the offer? Case 1 7 Case 4 0 Nina's Fashions,

What are your final conclusions regarding how much Nina's should offer and the form of the offer? Case

Case

Nina's Fashions, Inc.

Mergers

Directed

Nina's Fashions, Inc., operates a chain of retail clothing stores in Michigan, Wisconsin, and Illinois. The company has been in business since and until about years ago, all of its stores were in older, downtown locations. However, in the late s the chain opened its first suburban store which differed significantly from the older stores. The new store was much larger, stocking many more items than the old stores. Many new stores followed, which were primarily located in shopping malls and shopping centers.

The new stores were a resounding success, and over the past ten years, Nina's has been aggressively selling its older locations and opening suburban stores. The downtown areas in many of Nina's locations have been revitalized and are now filled with highrise office buildings and upscale retail outlets, so downtown property values have skyrocketed. Thus, the sale of its old store properties resulted in large cash inflows to Nina's. Since the company's strategic plans call for it to lease the new suburban stores rather than to purchase them, the firm now has a "war chest" of excess cash.

Many alternative uses have been discussed for the excess cash, ranging from repurchases of stock or debt to higher dividend payments. However, management has decided to use the cash to make one or more acquisitions, since they believe an expansion would contribute the most to stockholders' wealth. One of the acquisition candidates is Chic, a chain of eleven stores which operates in northern Illinois. The issues now facing the company are how to approach Chic's management and how much to offer for Chic's stock.

Executives at Nina's are good at running retail clothing stores, but they are not finance experts and have no experience with acquisitions. Bob Sharpe, the treasurer, has an accounting background, but he did attend a threeday workshop on mergers at Harvard University last year specifically to learn something about the subject. Nina's had no acquisition plans at that time; Sharpe just felt that it would be useful to become familiar with the subject.

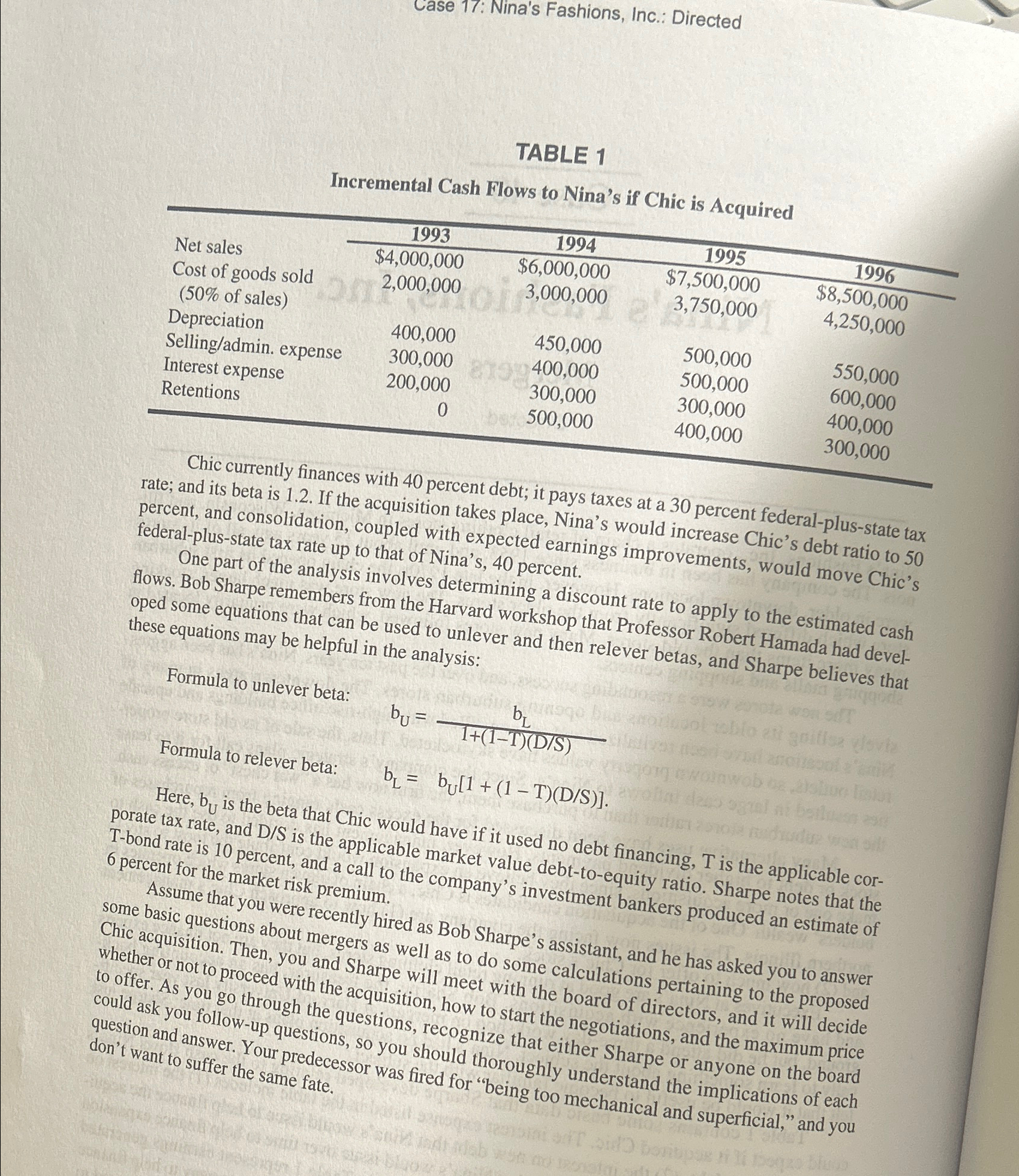

Table contains some basic data that Sharpe developed relating to the cash flows Nina's could expect if it acquired Chic. The interest expense listed in the table includes the interest on Chic's existing debt, the interest on new debt that Nina's would issue to help finance the acquisition, and the interest on new debt that Nina's would issue over time to help finance expansion within the new division. The required retentions shown in Table represent earnings generated within Chic that would be earma growth. Note too that all the earked for reinvestment within the chental flows Chic is expected to produce and to make avail the estimates in Table are the increm specific estimates were only made for through ailable to Nina's if it is acquired. Although in and beyond.

Case : Nina's Fashions, Inc.: Directed

TABLE

Incremental Cash Flows to Nina's if Chic is Acquired

table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock