Question: What does a temporary difference mean, and how does it differ from a permanent difference? Give an example of a permanent difference and explain why

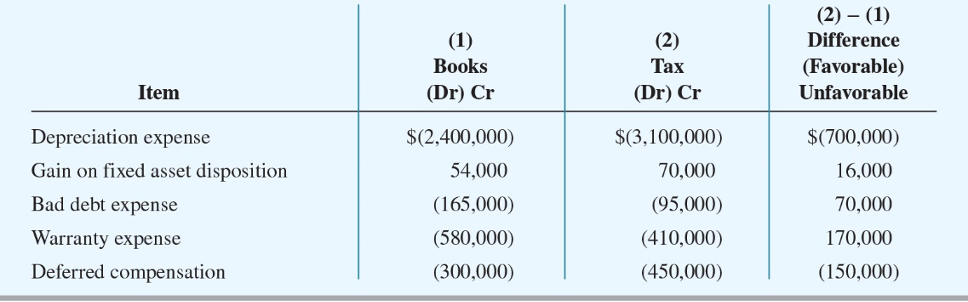

What does a temporary difference mean, and how does it differ from a "permanent" difference? Give an example of a permanent difference and explain why it differs from temporary differences. 2. Each of the differences listed in the table above are temporary differences. In plain English explain why they are temporary differences and why they are currently favorable or unfavorable for the taxpayer.

Plain English description Depreciation Gain Bad debt expense Warranty expense Deferred compensation

(1) Books (2) Tax (2)- (1) Difference (Favorable) Item (Dr) Cr (Dr) Cr Unfavorable Depreciation expense $(2,400,000) $(3,100,000) $(700,000) Gain on fixed asset disposition 54,000 70,000 16,000 Bad debt expense (165,000) (95,000) 70,000 Warranty expense Deferred compensation (580,000) (410,000) 170,000 (300,000) (450,000) (150,000)

Step by Step Solution

There are 3 Steps involved in it

Youve provided a comprehensive overview of Fiat Chrysler Automobiles main competitors including Gene... View full answer

Get step-by-step solutions from verified subject matter experts