Question: What financial performance issues do you see at Under Armour based on the data in case Exhibits 1, 2, and 3? EXHIBIT 1 Selected Financial

What financial performance issues do you see at Under Armour based on the data in case Exhibits 1, 2, and 3?

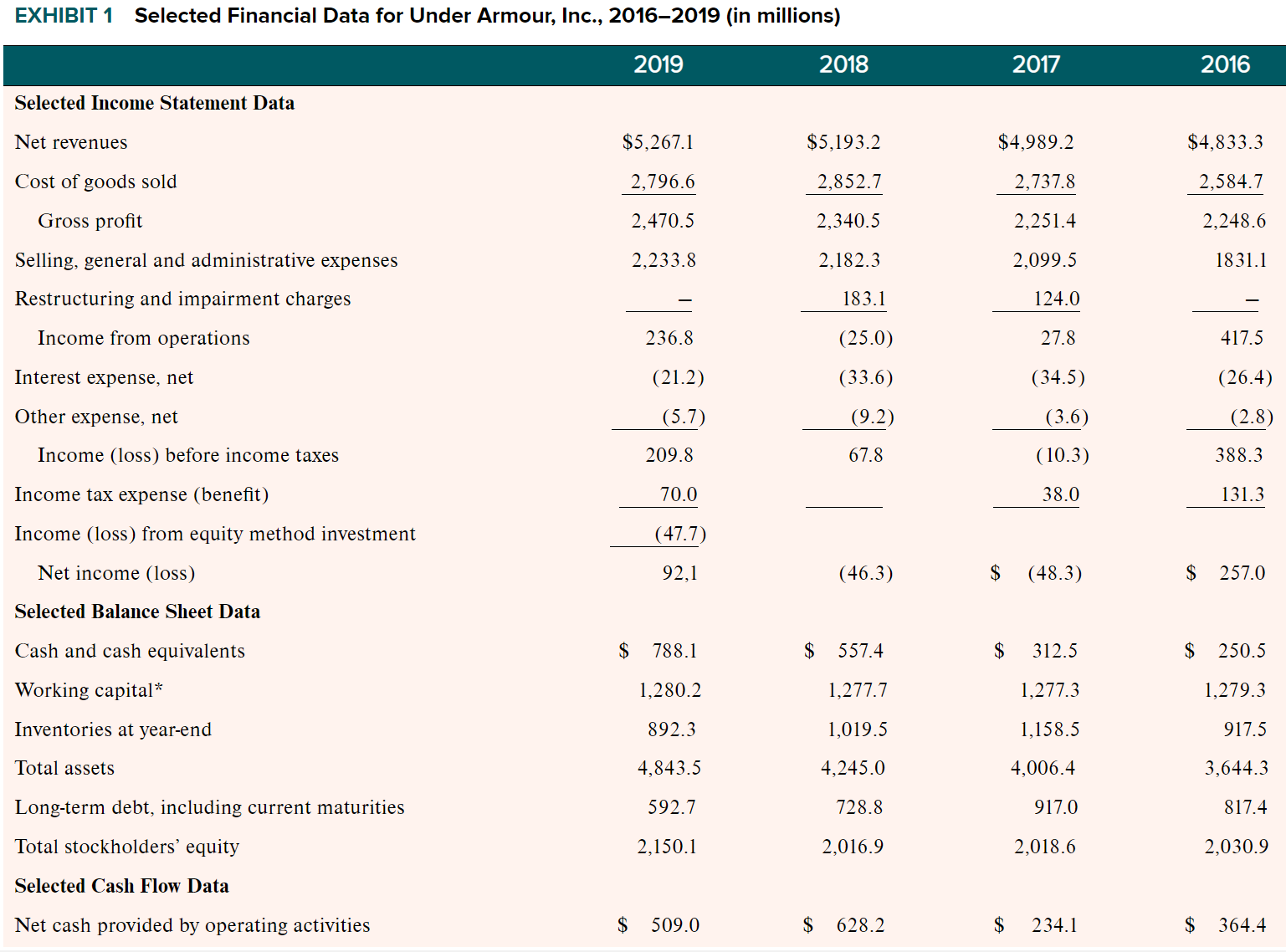

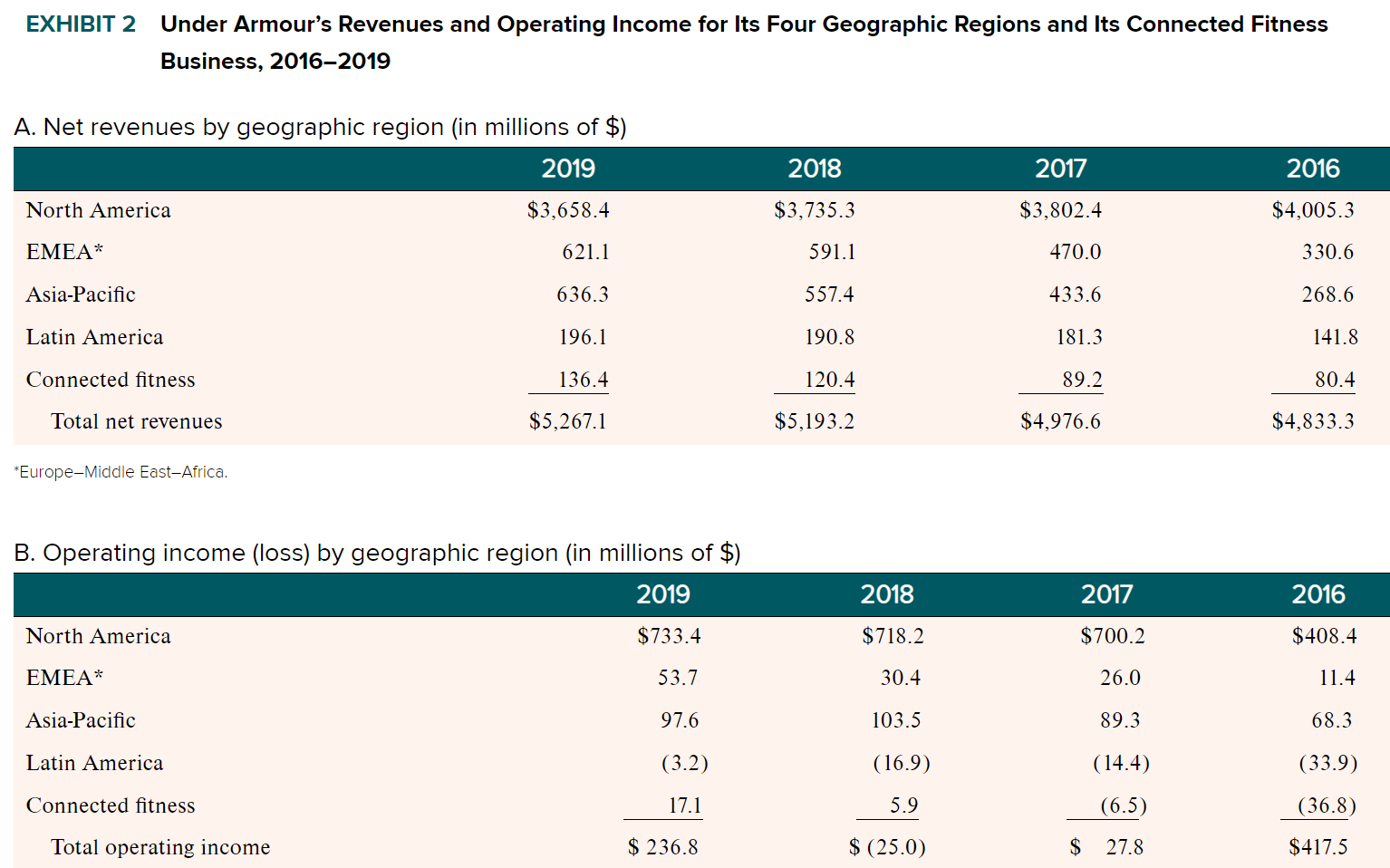

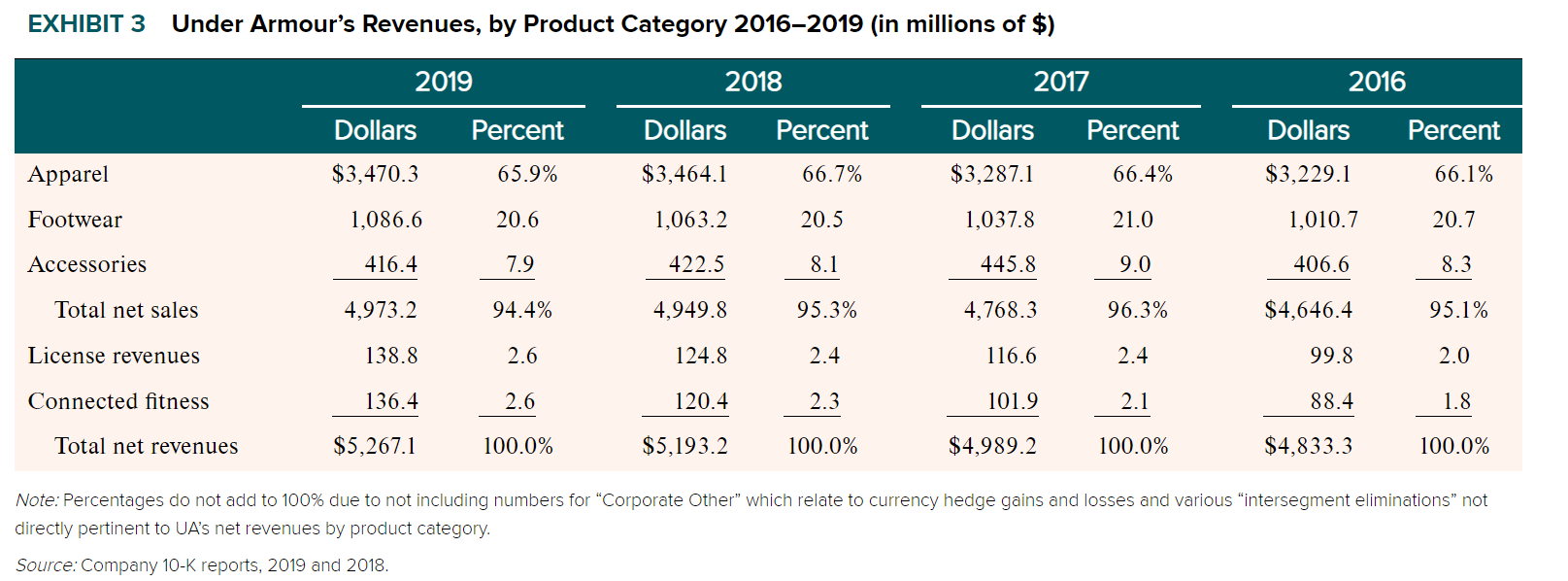

EXHIBIT 1 Selected Financial Data for Under Armour, Inc., 2016-2019 (in millions) 2019 2018 2017 2016 Selected Income Statement Data Net revenues $5,267.1 $5,193.2 $4,989.2 $4,833.3 Cost of goods sold 2,796.6 2,852.7 2,737.8 2,584.7 Gross profit 2,470.5 2,340.5 2,251.4 2,248.6 Selling, general and administrative expenses 2,233.8 2,182.3 2,099.5 1831.1 Restructuring and impairment charges 183.1 124.0 Income from operations 236.8 (25.0) 27.8 417.5 Interest expense, net (21.2) (33.6) (34.5) (26.4) Other expense, net (5.7) (9.2) (3.6) (2.8) Income (loss) before income taxes 209.8 67.8 (10.3) 388.3 Income tax expense (benefit) 70.0 38.0 131.3 Income (loss) from equity method investment (47.7) Net income (loss) 92,1 (46.3) $ (48.3) $ 257.0 Selected Balance Sheet Data Cash and cash equivalents $ 788.1 $ 557.4 $ 312.5 $ 250.5 Working capital* 1,280.2 1,277.7 1,277.3 1,279.3 Inventories at year-end 892.3 1,019.5 1,158.5 917.5 Total assets 4,843.5 4,245.0 4,006.4 3,644.3 Long-term debt, including current maturities 592.7 728.8 917.0 817.4 Total stockholders' equity 2,150.1 2,016.9 2,018.6 2,030.9 Selected Cash Flow Data Net cash provided by operating activities $ 509.0 $ 628.2 $ 234.1 $ 364.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts