Question: What information is needed? Provided all information... Also, based on this I have already mentioned a solution for part c , kindly verify and let

What information is needed? Provided all information...

Also, based on this I have already mentioned a solution for part c , kindly verify and let me know

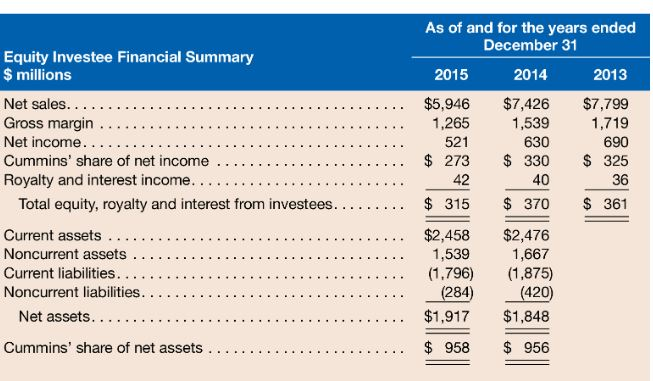

a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins balance sheet as a result of the equity method of accounting for those investments?

b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain

c. How does the equity method impact a company's ROE and its RNOA components (net operating asset turnover and net operating profit margin)?

for part c-->

Note: My opinion is :

I guess the ROE is unaffected and for the RNOA components, ( Net Operating Asset Turnover-NOAT) ---> Sales/Average Net operating Assets

Since Investees sales are excluded from the NOAT numerator, and net operating assets in excess of the investment balance are excluded from the denominator. This means the impact on NOAT is indeterminate and the Net Operating Proft Margin value is overstated

Please verify and let me know if understanding is correct

Equity Investee Financial Summary $ millions As of and for the years ended December 31 2015 2014 2013 $5,946 1,265 521 $ 273 - 42 $ 315 .. $7,426 1,539 630 $ 330 40 $ 370 $7,799 1,719 690 $ 325 36 361 Net sales...... Gross margin ... Net income............. Cummins' share of net income ...... Royalty and interest income. Total equity, royalty and interest from investees. Current assets .. Noncurrent assets .... Current liabilities. .... Noncurrent liabilities........ Net assets.......... Cummins' share of net assets $2,458 1,539 (1.796) (284) $1,917 $2,476 1,667 (1,875) (420) $1,848 $ 958 $ 956 Equity Investee Financial Summary $ millions As of and for the years ended December 31 2015 2014 2013 $5,946 1,265 521 $ 273 - 42 $ 315 .. $7,426 1,539 630 $ 330 40 $ 370 $7,799 1,719 690 $ 325 36 361 Net sales...... Gross margin ... Net income............. Cummins' share of net income ...... Royalty and interest income. Total equity, royalty and interest from investees. Current assets .. Noncurrent assets .... Current liabilities. .... Noncurrent liabilities........ Net assets.......... Cummins' share of net assets $2,458 1,539 (1.796) (284) $1,917 $2,476 1,667 (1,875) (420) $1,848 $ 958 $ 956

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts