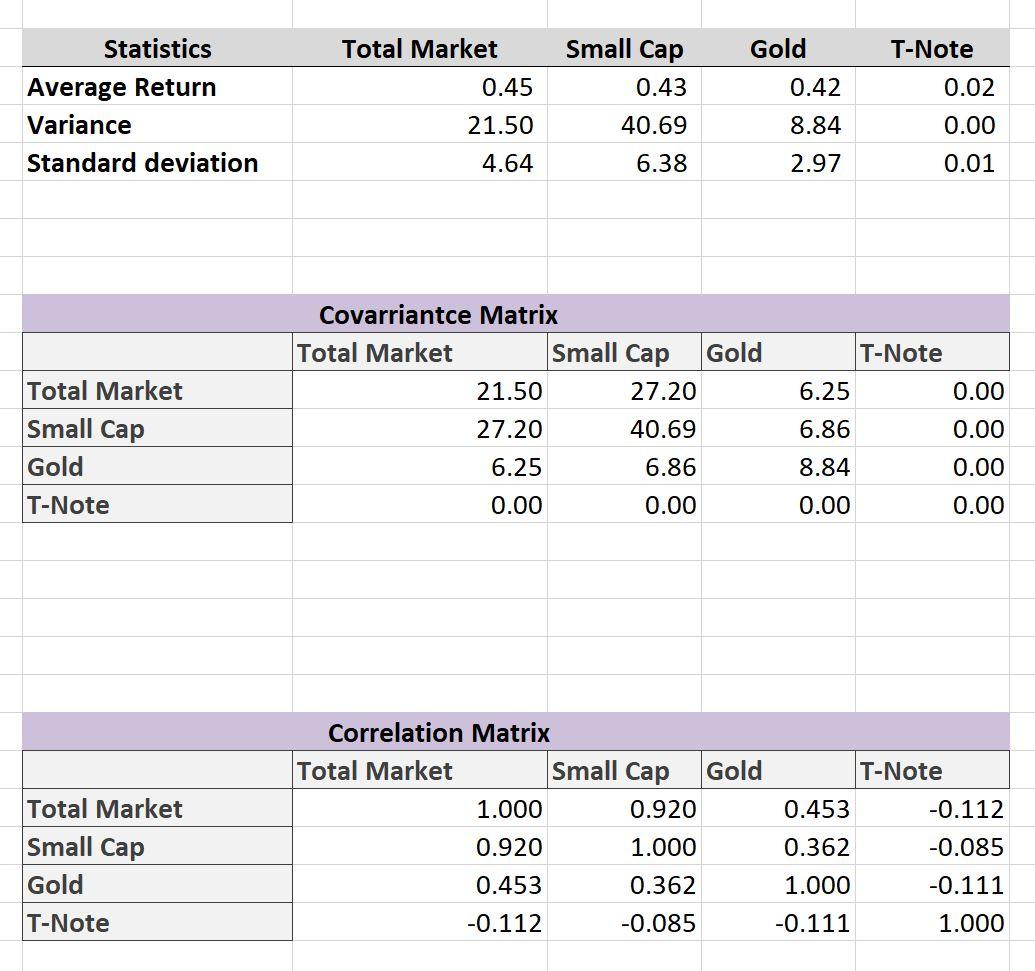

Question: What is the expected weekly return on a portfolio comprised of 55% of the Market and 45% of the Gold Index? What is the standard

What is the expected weekly return on a portfolio comprised of 55% of the Market and 45% of the Gold Index?

What is the standard deviation of this portfolio?

T-Note Total Market 0.45 Small Cap 0.43 40.69 Gold 0.42 Statistics Average Return Variance Standard deviation 0.02 21.50 8.84 0.00 4.64 6.38 2.97 0.01 Covarriantce Matrix Total Market Small Cap Gold 21.50 27.20 27.20 40.69 6.25 6.86 T-Note 6.25 0.00 Total Market Small Cap Gold 6.86 0.00 8.84 0.00 T-Note 0.00 0.00 0.00 0.00 T-Note 0.453 -0.112 Correlation Matrix Total Market Small Cap Gold 1.000 0.920 0.920 1.000 0.453 0.362 -0.112 -0.085 0.362 Total Market Small Cap Gold T-Note -0.085 1.000 -0.111 -0.111 1.000 T-Note Total Market 0.45 Small Cap 0.43 40.69 Gold 0.42 Statistics Average Return Variance Standard deviation 0.02 21.50 8.84 0.00 4.64 6.38 2.97 0.01 Covarriantce Matrix Total Market Small Cap Gold 21.50 27.20 27.20 40.69 6.25 6.86 T-Note 6.25 0.00 Total Market Small Cap Gold 6.86 0.00 8.84 0.00 T-Note 0.00 0.00 0.00 0.00 T-Note 0.453 -0.112 Correlation Matrix Total Market Small Cap Gold 1.000 0.920 0.920 1.000 0.453 0.362 -0.112 -0.085 0.362 Total Market Small Cap Gold T-Note -0.085 1.000 -0.111 -0.111 1.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts