Question: What is the risk-neutral probability that the put option will be in the money at T = 1? (50 points) Suppose that the stock price

What is the risk-neutral probability that the put option will be in the money at T = 1?

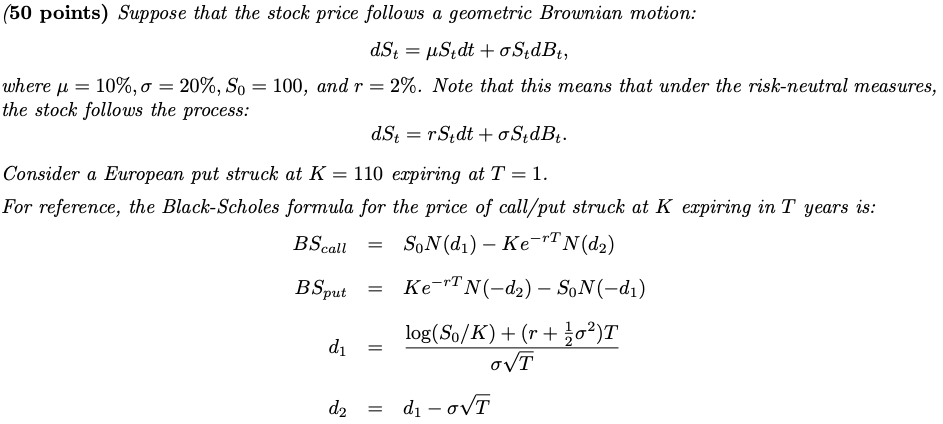

(50 points) Suppose that the stock price follows a geometric Brownian motion: dSt = u Stdt + SidBt, where u = 10%, o = 20%, So = 100, and r = 2%. Note that this means that under the risk-neutral measures, the stock follows the process: dSt = rStdt + oS dBt. = Consider a European put struck at K = 110 expiring at T = 1. For reference, the Black-Scholes formula for the price of call/put struck at K expiring in T years is: BScall SoN(di) - Ke-rT Nd2) Ke-'T N(-d) SoN(-d) log(S./K) + (r + Z02)T di NT B Sput = d2 -di-ovt (50 points) Suppose that the stock price follows a geometric Brownian motion: dSt = u Stdt + SidBt, where u = 10%, o = 20%, So = 100, and r = 2%. Note that this means that under the risk-neutral measures, the stock follows the process: dSt = rStdt + oS dBt. = Consider a European put struck at K = 110 expiring at T = 1. For reference, the Black-Scholes formula for the price of call/put struck at K expiring in T years is: BScall SoN(di) - Ke-rT Nd2) Ke-'T N(-d) SoN(-d) log(S./K) + (r + Z02)T di NT B Sput = d2 -di-ovt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts