Question: What would be the best method a financial planner could offer this couple that would allow them to make a minimum of $120,000 per annum

What would be the best method a financial planner could offer this couple that would allow them to make a minimum of $120,000 per annum combined until retirement and a further $100,000 per annum after retirement based on the information above. The couple has stated they are happy to sell there investment property if need be also would not mind cashing in their shares however do not want to move from their principal home.

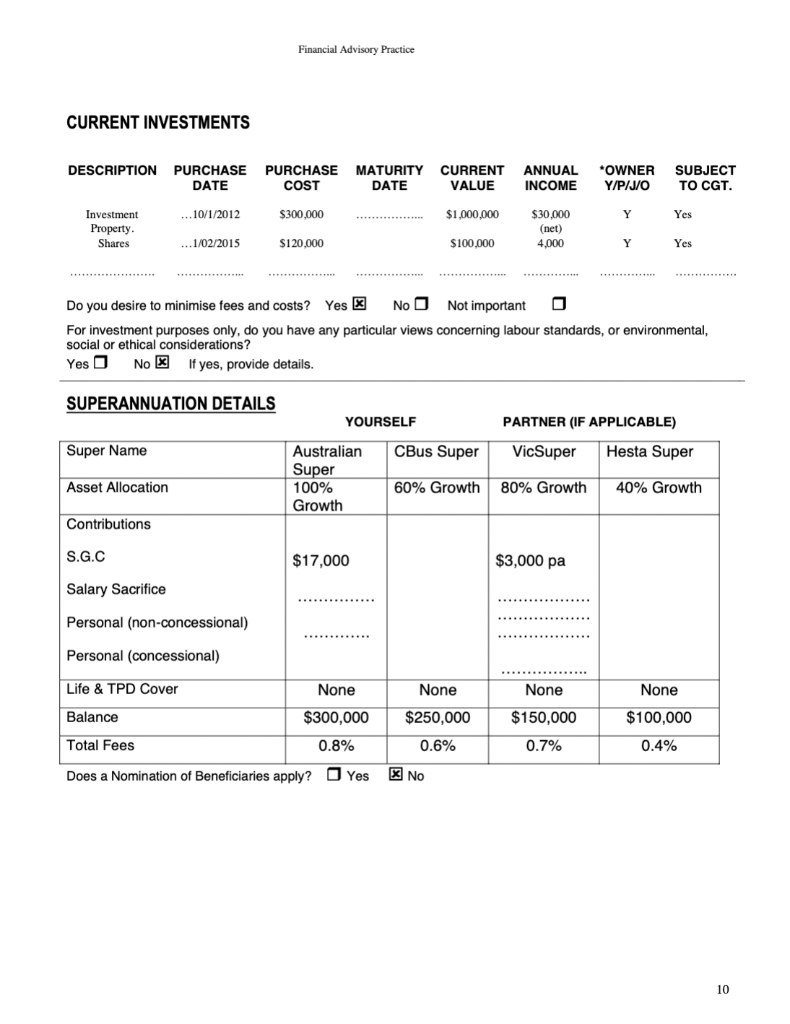

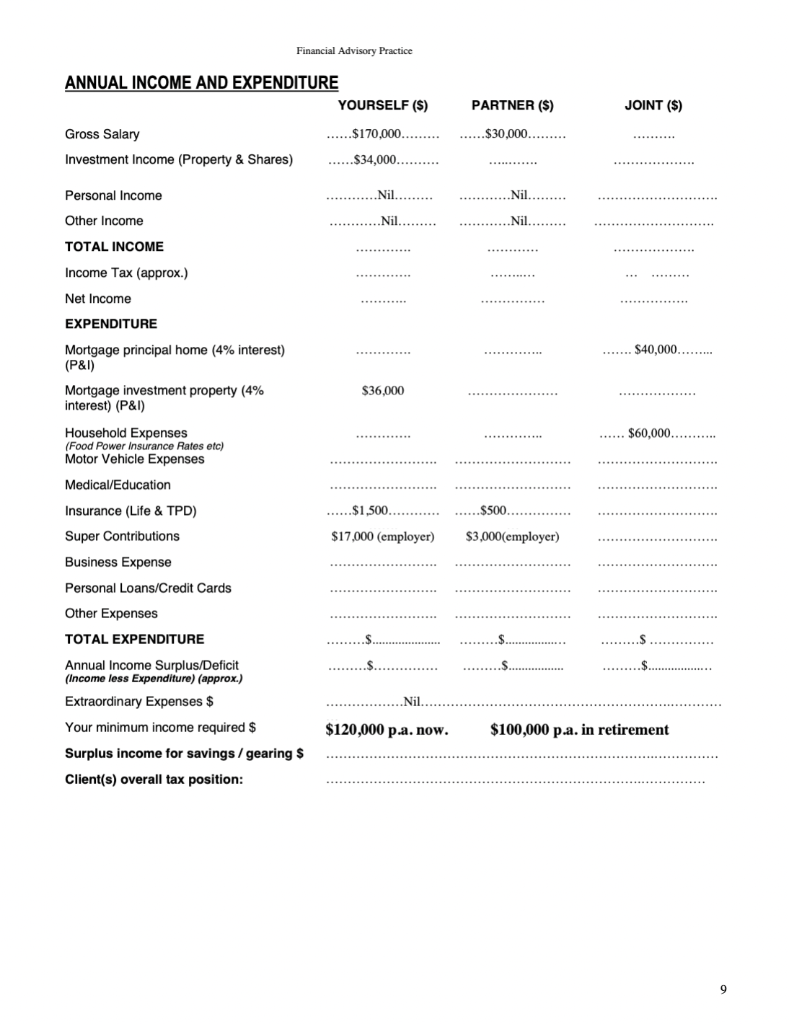

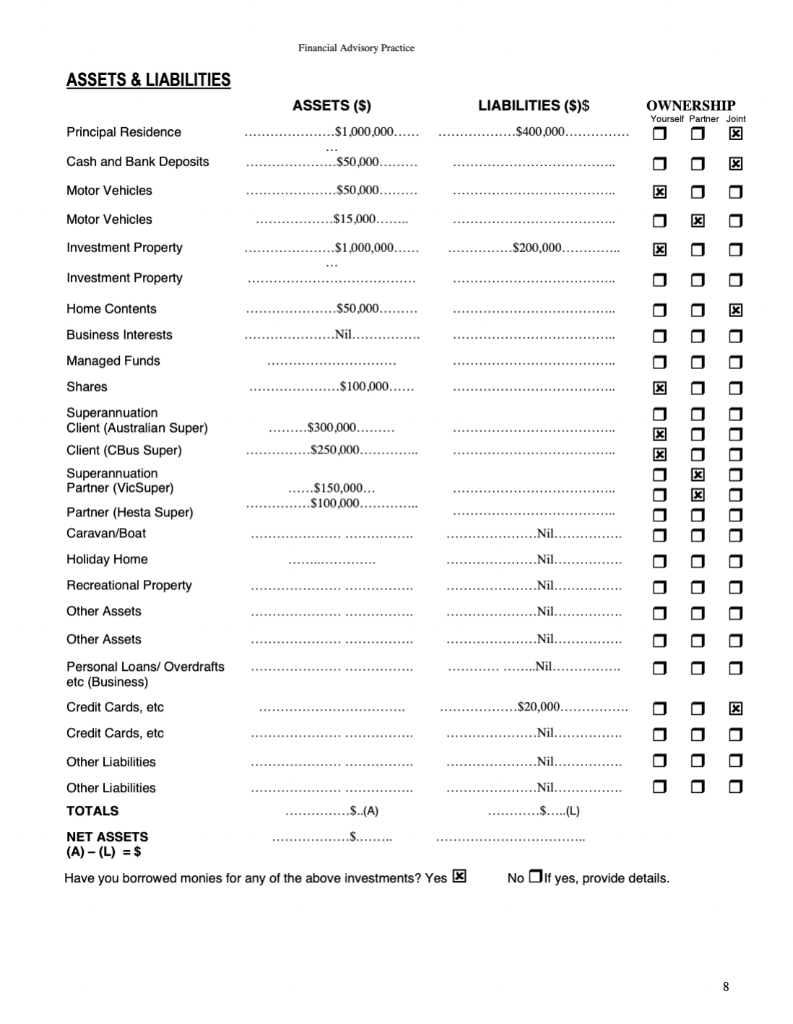

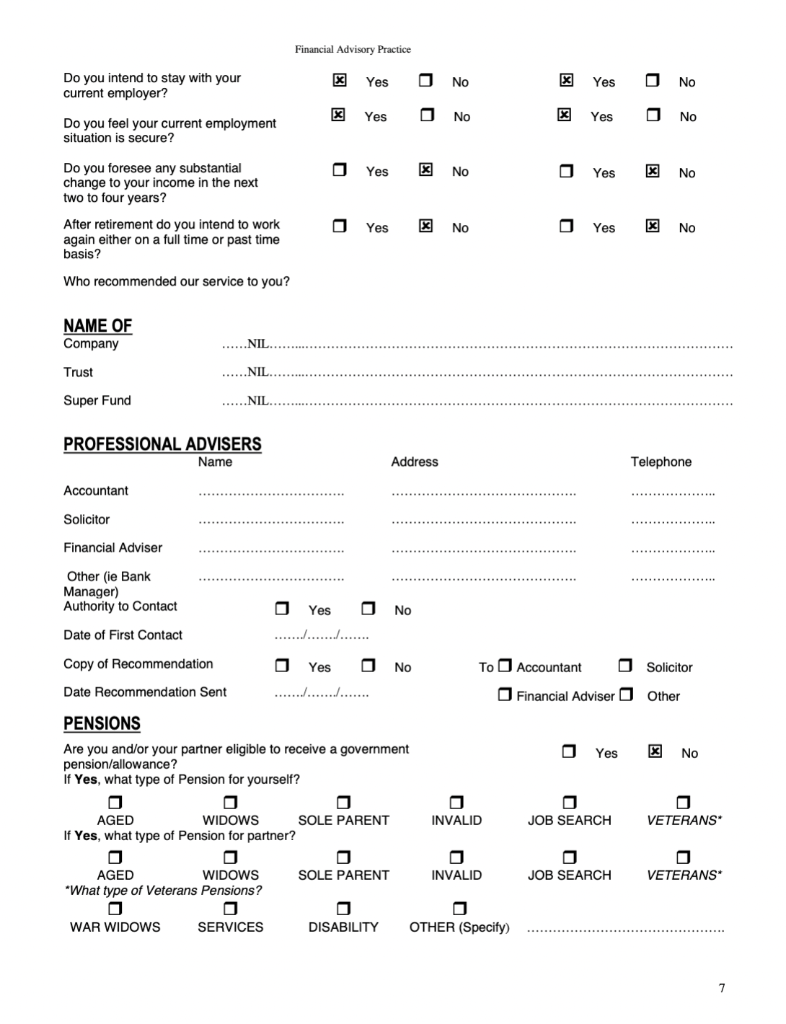

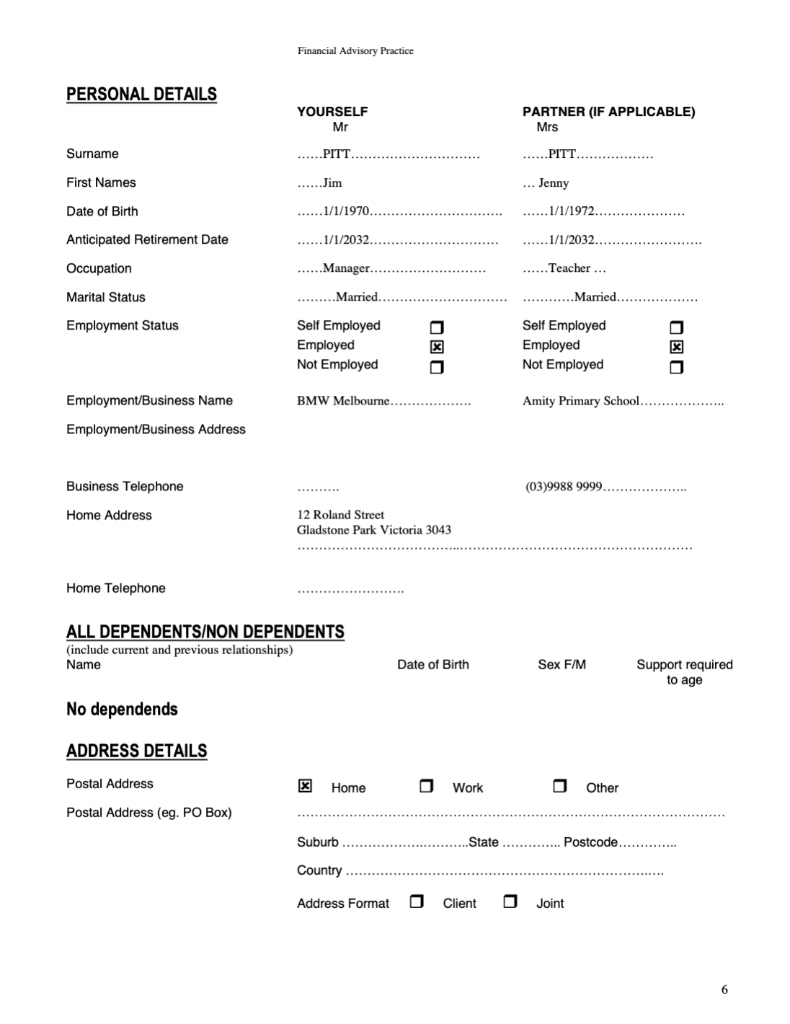

Financial Advisory Practice CURRENT INVESTMENTS ANNUAL *OWNER DESCRIPTION PURCHASE PURCHASE MATURITY DATE CURRENT VALUE SUBJECT TO CGT. COST DATE INCOME Y/P/J/O Investment ...10/1/2012 $300,000 $1,000,000 Y Yes $30,000 (net) Property. Shares ...1/02/2015 $120,000 $100,000 4,000 Y Yes Do you desire to minimise fees and costs? Yes x No Not important 0 For investment purposes only, do you have any particular views concerning labour standards, or environmental, social or ethical considerations? Yes No If yes, provide details. SUPERANNUATION DETAILS YOURSELF PARTNER (IF APPLICABLE) Super Name VicSuper Asset Allocation 80% Growth Contributions S.G.C $3,000 pa Salary Sacrifice Personal (non-concessional) Personal (concessional) Life & TPD Cover None None Balance $300,000 $150,000 Total Fees 0.8% 0.7% Does a Nomination of Beneficiaries apply? Yes Australian Super 100% Growth $17,000 CBus Super 60% Growth None $250,000 0.6% No Hesta Super 40% Growth None $100,000 0.4% 10 Financial Advisory Practice ANNUAL INCOME AND EXPENDITURE Gross Salary Investment Income (Property & Shares) Personal Income Other Income TOTAL INCOME Income Tax (approx.) Net Income EXPENDITURE Mortgage principal home (4% interest) (P&I) Mortgage investment property (4% interest) (P&I) Household Expenses (Food Power Insurance Rates etc) Motor Vehicle Expenses Medical/Education Insurance (Life & TPD) Super Contributions Business Expense Personal Loans/Credit Cards Other Expenses TOTAL EXPENDITURE Annual Income Surplus/Deficit (Income less Expenditure) (approx.) Extraordinary Expenses $ Your minimum income required $ Surplus income for savings / gearing $ Client(s) overall tax position: YOURSELF (S) ......$170,000......... $34,000. Nil. Nil. $36,000 ......$1,500. $17,000 (employer) $120,000 p.a. now. PARTNER ($) ......$30,000......... Nil. Nil ..$500. $3,000(employer) JOINT (S) ....... $40,000......... $60,000. $100,000 p.a. in retirement Financial Advisory Practice ASSETS ($) ..$1,000,000...... ..$50,000......... ..$50,000......... $15,000........ .$1,000,000...... .$50,000......... Nil. ..$100,000...... ASSETS & LIABILITIES Principal Residence Cash and Bank Deposits Motor Vehicles Motor Vehicles Investment Property Investment Property Home Contents Business Interests Managed Funds Shares Superannuation Client (Australian Super) Client (CBus Super) Superannuation Partner (VicSuper) Partner (Hesta Super) Caravan/Boat Holiday Home Recreational Property Other Assets Other Assets Personal Loans/ Overdrafts etc (Business) Credit Cards, etc Credit Cards, etc Other Liabilities Other Liabilities TOTALS .$..(A) NET ASSETS (A)-(L) = $ Have you borrowed monies for any of the above investments? Yes x .........$300,000......... $250,000... ......$150,000... $100,000.. ********* LIABILITIES ($)$ ..$400,000............ $200,000... OWNERSHIP Yourself Partner Joint 0000 000000000x0 000 0 0 00 .Nil .Nil. Nil. Nil.. .Nil. Nil. $20,000..... Nil. Nil Nil. .$.....(L) No If yes, provide details. 0000000000000000000 0000000000000000000000 0000 8 Financial Advisory Practice x Yes No Yes No Yes XNo Yes No Do you intend to stay with your current employer? Do you feel your current employment situation is secure? Do you foresee any substantial change to your income in the next two to four years? After retirement do you intend to work again either on a full time or past time basis? Who recommended our service to you? NAME OF Company ......NIL Trust ..NIL.. Super Fund NIL. PROFESSIONAL ADVISERS Name Address Accountant Solicitor Financial Adviser Other (ie Bank Manager) Authority to Contact Yes No Date of First Contact ...................... Copy of Recommendation Yes No Date Recommendation Sent ...................... PENSIONS Are you and/or your partner eligible to receive a government pension/allowance? If Yes, what type of Pension for yourself? 0 WIDOWS AGED SOLE PARENT If Yes, what type of Pension for partner? SOLE PARENT AGED WIDOWS "What type of Veterans Pensions? DISABILITY WAR WIDOWS SERVICES 0 0 To Accountant INVALID INVALID 0 OTHER (Specify) Yes No Yes No O Yes No Yes No Telephone Financial Adviser O Yes 00 0 JOB SEARCH 0 JOB SEARCH *********** Solicitor Other No VETERANS* VETERANS* 7 Financial Advisory Practice YOURSELF Mr ...PITT. PERSONAL DETAILS Surname First Names Date of Birth Anticipated Retirement Date Occupation Marital Status Employment Status Employment/Business Name Employment/Business Address Business Telephone Home Address Home Telephone ALL DEPENDENTS/NON DEPENDENTS (include current and previous relationships) Name No dependends ADDRESS DETAILS Postal Address Home Postal Address (eg. PO Box) ......Jim 1/1/1970. ......1/1/2032. ......Manager. .........Married. Self Employed Employed Not Employed BMW Melbourne......... 12 Roland Street Gladstone Park Victoria 3043 Date of Birth Work Suburb Country Address Format Client ..State PARTNER (IF APPLICABLE) Mrs .PITT. ... Jenny ......1/1/1972. ......1/1/2032.. ......Teacher ... Self Employed Employed Not Employed Amity Primary School........ (03)9988 9999.. Sex F/M ...Married..... Other Postcode....... Joint Support required to age ******* 6 Financial Advisory Practice CURRENT INVESTMENTS ANNUAL *OWNER DESCRIPTION PURCHASE PURCHASE MATURITY DATE CURRENT VALUE SUBJECT TO CGT. COST DATE INCOME Y/P/J/O Investment ...10/1/2012 $300,000 $1,000,000 Y Yes $30,000 (net) Property. Shares ...1/02/2015 $120,000 $100,000 4,000 Y Yes Do you desire to minimise fees and costs? Yes x No Not important 0 For investment purposes only, do you have any particular views concerning labour standards, or environmental, social or ethical considerations? Yes No If yes, provide details. SUPERANNUATION DETAILS YOURSELF PARTNER (IF APPLICABLE) Super Name VicSuper Asset Allocation 80% Growth Contributions S.G.C $3,000 pa Salary Sacrifice Personal (non-concessional) Personal (concessional) Life & TPD Cover None None Balance $300,000 $150,000 Total Fees 0.8% 0.7% Does a Nomination of Beneficiaries apply? Yes Australian Super 100% Growth $17,000 CBus Super 60% Growth None $250,000 0.6% No Hesta Super 40% Growth None $100,000 0.4% 10 Financial Advisory Practice ANNUAL INCOME AND EXPENDITURE Gross Salary Investment Income (Property & Shares) Personal Income Other Income TOTAL INCOME Income Tax (approx.) Net Income EXPENDITURE Mortgage principal home (4% interest) (P&I) Mortgage investment property (4% interest) (P&I) Household Expenses (Food Power Insurance Rates etc) Motor Vehicle Expenses Medical/Education Insurance (Life & TPD) Super Contributions Business Expense Personal Loans/Credit Cards Other Expenses TOTAL EXPENDITURE Annual Income Surplus/Deficit (Income less Expenditure) (approx.) Extraordinary Expenses $ Your minimum income required $ Surplus income for savings / gearing $ Client(s) overall tax position: YOURSELF (S) ......$170,000......... $34,000. Nil. Nil. $36,000 ......$1,500. $17,000 (employer) $120,000 p.a. now. PARTNER ($) ......$30,000......... Nil. Nil ..$500. $3,000(employer) JOINT (S) ....... $40,000......... $60,000. $100,000 p.a. in retirement Financial Advisory Practice ASSETS ($) ..$1,000,000...... ..$50,000......... ..$50,000......... $15,000........ .$1,000,000...... .$50,000......... Nil. ..$100,000...... ASSETS & LIABILITIES Principal Residence Cash and Bank Deposits Motor Vehicles Motor Vehicles Investment Property Investment Property Home Contents Business Interests Managed Funds Shares Superannuation Client (Australian Super) Client (CBus Super) Superannuation Partner (VicSuper) Partner (Hesta Super) Caravan/Boat Holiday Home Recreational Property Other Assets Other Assets Personal Loans/ Overdrafts etc (Business) Credit Cards, etc Credit Cards, etc Other Liabilities Other Liabilities TOTALS .$..(A) NET ASSETS (A)-(L) = $ Have you borrowed monies for any of the above investments? Yes x .........$300,000......... $250,000... ......$150,000... $100,000.. ********* LIABILITIES ($)$ ..$400,000............ $200,000... OWNERSHIP Yourself Partner Joint 0000 000000000x0 000 0 0 00 .Nil .Nil. Nil. Nil.. .Nil. Nil. $20,000..... Nil. Nil Nil. .$.....(L) No If yes, provide details. 0000000000000000000 0000000000000000000000 0000 8 Financial Advisory Practice x Yes No Yes No Yes XNo Yes No Do you intend to stay with your current employer? Do you feel your current employment situation is secure? Do you foresee any substantial change to your income in the next two to four years? After retirement do you intend to work again either on a full time or past time basis? Who recommended our service to you? NAME OF Company ......NIL Trust ..NIL.. Super Fund NIL. PROFESSIONAL ADVISERS Name Address Accountant Solicitor Financial Adviser Other (ie Bank Manager) Authority to Contact Yes No Date of First Contact ...................... Copy of Recommendation Yes No Date Recommendation Sent ...................... PENSIONS Are you and/or your partner eligible to receive a government pension/allowance? If Yes, what type of Pension for yourself? 0 WIDOWS AGED SOLE PARENT If Yes, what type of Pension for partner? SOLE PARENT AGED WIDOWS "What type of Veterans Pensions? DISABILITY WAR WIDOWS SERVICES 0 0 To Accountant INVALID INVALID 0 OTHER (Specify) Yes No Yes No O Yes No Yes No Telephone Financial Adviser O Yes 00 0 JOB SEARCH 0 JOB SEARCH *********** Solicitor Other No VETERANS* VETERANS* 7 Financial Advisory Practice YOURSELF Mr ...PITT. PERSONAL DETAILS Surname First Names Date of Birth Anticipated Retirement Date Occupation Marital Status Employment Status Employment/Business Name Employment/Business Address Business Telephone Home Address Home Telephone ALL DEPENDENTS/NON DEPENDENTS (include current and previous relationships) Name No dependends ADDRESS DETAILS Postal Address Home Postal Address (eg. PO Box) ......Jim 1/1/1970. ......1/1/2032. ......Manager. .........Married. Self Employed Employed Not Employed BMW Melbourne......... 12 Roland Street Gladstone Park Victoria 3043 Date of Birth Work Suburb Country Address Format Client ..State PARTNER (IF APPLICABLE) Mrs .PITT. ... Jenny ......1/1/1972. ......1/1/2032.. ......Teacher ... Self Employed Employed Not Employed Amity Primary School........ (03)9988 9999.. Sex F/M ...Married..... Other Postcode....... Joint Support required to age ******* 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts