Question: WHEN ANSWERING DO NOT COPY THE ANSWER FROM PREVIOUS POSTINGS- RATES ARE NOT THE SAME!!!! Pure Grow Inc., based in Carroll, lowa, sells high-end fertilizers.

WHEN ANSWERING DO NOT COPY THE ANSWER FROM PREVIOUS POSTINGS- RATES ARE NOT THE SAME!!!!

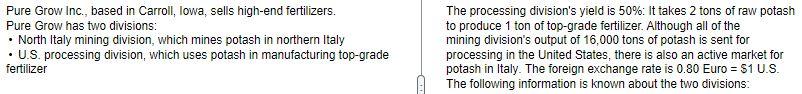

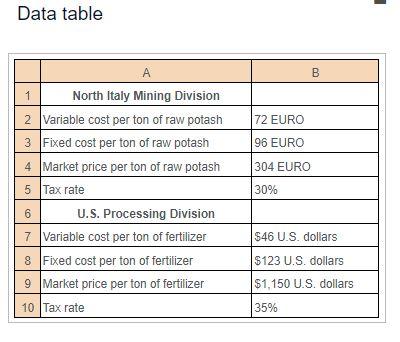

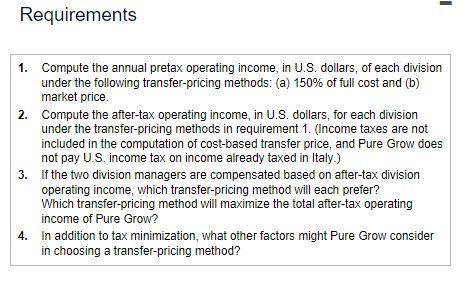

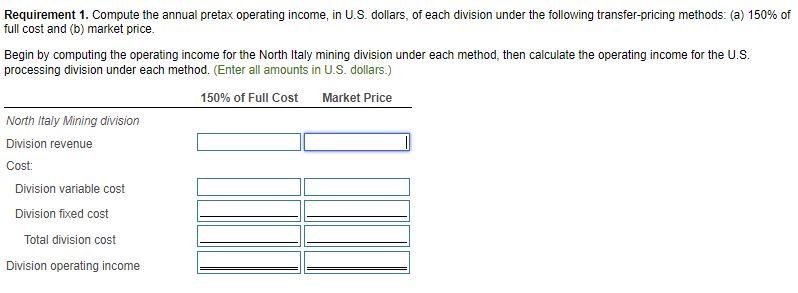

Pure Grow Inc., based in Carroll, lowa, sells high-end fertilizers. The processing division's yield is 50% : It takes 2 tons of raw potash Pure Grow has two divisions: to produce 1 ton of top-grade fertilizer. Although all of the - North Italy mining division, which mines potash in northern Italy mining division's output of 16,000 tons of potash is sent for - U.S. processing division, which uses potash in manufacturing top-grade processing in the United States, there is also an active market for fertilizer potash in Italy. The foreign exchange rate is 0.80 Euro =$1 U.S. Data table Requirements 1. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price. 2. Compute the after-tax operating income, in U.S. dollars, for each division under the transfer-pricing methods in requirement 1 . (Income taxes are not included in the computation of cost-based transfer price, and Pure Grow does not pay U.S. income tax on income already taxed in Italy.) 3. If the two division managers are compensated based on after-tax division operating income, which transfer-pricing method will each prefer? Which transfer-pricing method will maximize the total after-tax operating income of Pure Grow? 4. In addition to tax minimization, what other factors might Pure Grow consider in choosing a transfer-pricing method? Requirement 1. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price. Begin by computing the operating income for the North Italy mining division under each method, then calculate the operating income for the U.S. processing division under each method. (Enter all amounts in U.S. dollars.) Pure Grow Inc., based in Carroll, lowa, sells high-end fertilizers. The processing division's yield is 50% : It takes 2 tons of raw potash Pure Grow has two divisions: to produce 1 ton of top-grade fertilizer. Although all of the - North Italy mining division, which mines potash in northern Italy mining division's output of 16,000 tons of potash is sent for - U.S. processing division, which uses potash in manufacturing top-grade processing in the United States, there is also an active market for fertilizer potash in Italy. The foreign exchange rate is 0.80 Euro =$1 U.S. Data table Requirements 1. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price. 2. Compute the after-tax operating income, in U.S. dollars, for each division under the transfer-pricing methods in requirement 1 . (Income taxes are not included in the computation of cost-based transfer price, and Pure Grow does not pay U.S. income tax on income already taxed in Italy.) 3. If the two division managers are compensated based on after-tax division operating income, which transfer-pricing method will each prefer? Which transfer-pricing method will maximize the total after-tax operating income of Pure Grow? 4. In addition to tax minimization, what other factors might Pure Grow consider in choosing a transfer-pricing method? Requirement 1. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price. Begin by computing the operating income for the North Italy mining division under each method, then calculate the operating income for the U.S. processing division under each method. (Enter all amounts in U.S. dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts