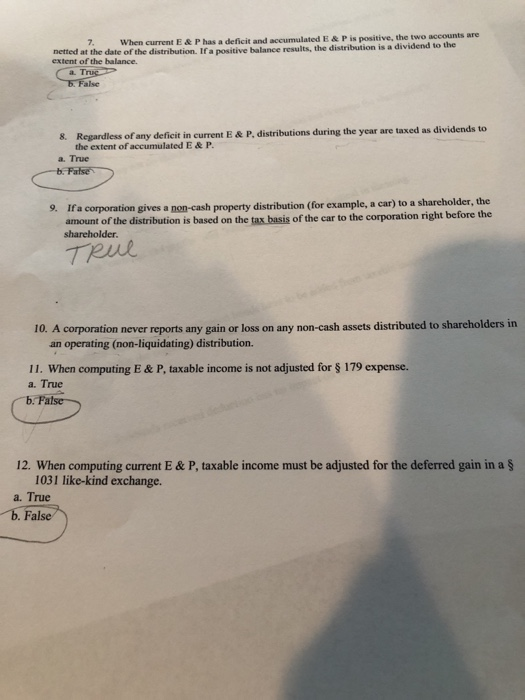

Question: When current E&P has a deficit and accumulated E&P is positive, the two accounts are netted at the date of the distribution. If a positive

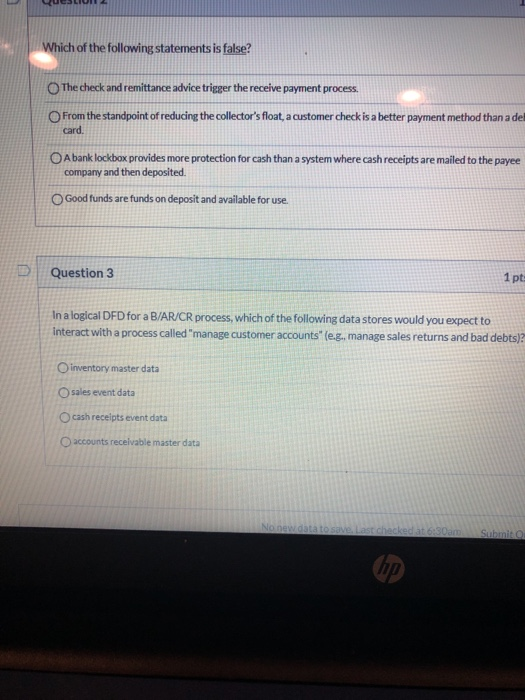

When current E&P has a deficit and accumulated E&P is positive, the two accounts are netted at the date of the distribution. If a positive balance results, the distribution is a dividend to the extent of the balance a Truco Fals 8. Regardless of any deficit in current E&P, distributions during the year are taxed as dividends to the extent of accumulated E&P. a. True b. False 9. If a corporation gives a non-cash property distribution (for example, a car) to a shareholder, the amount of the distribution is based on the tax basis of the car to the corporation right before the shareholder. Trul 10. A corporation never reports any gain or loss on any non-cash assets distributed to shareholders in an operating (non-liquidating) distribution. II. When computing E&P, taxable income is not adjusted for $ 179 expense. a. True b. False 12. When computing current E&P, taxable income must be adjusted for the deferred gain in a si 1031 like-kind exchange. a. True b. False Which of the following statements is false? The check and remittance advice trigger the receive payment process. From the standpoint of reducing the collector's float, a customer check is a better payment method than a de card. A bank lockbox provides more protection for cash than a system where cash receipts are mailed to the payee company and then deposited. Good funds are funds on deposit and available for use Question 3 In a logical DFD for a B/AR/CR process, which of the following data stores would you expect to Interact with a process called "manage customer accounts" (e.g., manage sales returns and bad debts)? Inventory master data Osales event data cash receipts event data accounts receivable master data When current E&P has a deficit and accumulated E&P is positive, the two accounts are netted at the date of the distribution. If a positive balance results, the distribution is a dividend to the extent of the balance a Truco Fals 8. Regardless of any deficit in current E&P, distributions during the year are taxed as dividends to the extent of accumulated E&P. a. True b. False 9. If a corporation gives a non-cash property distribution (for example, a car) to a shareholder, the amount of the distribution is based on the tax basis of the car to the corporation right before the shareholder. Trul 10. A corporation never reports any gain or loss on any non-cash assets distributed to shareholders in an operating (non-liquidating) distribution. II. When computing E&P, taxable income is not adjusted for $ 179 expense. a. True b. False 12. When computing current E&P, taxable income must be adjusted for the deferred gain in a si 1031 like-kind exchange. a. True b. False Which of the following statements is false? The check and remittance advice trigger the receive payment process. From the standpoint of reducing the collector's float, a customer check is a better payment method than a de card. A bank lockbox provides more protection for cash than a system where cash receipts are mailed to the payee company and then deposited. Good funds are funds on deposit and available for use Question 3 In a logical DFD for a B/AR/CR process, which of the following data stores would you expect to Interact with a process called "manage customer accounts" (e.g., manage sales returns and bad debts)? Inventory master data Osales event data cash receipts event data accounts receivable master data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts