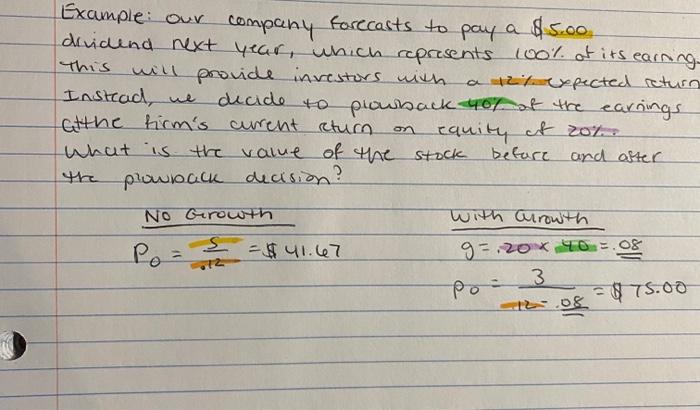

Question: Where does the 3 come from in this example??? Example: our company forecasts to pay a $5.00. dividend next year, which represents 100% of its

Example: our company farecasts to pay a $5.00 dividend next year, which represents 100% of its earning. This will provide investors with a 12% expected return Instead, we decide to plowback 40% of the earnings atthe firm's curent eturn on equity of 20% What is the value of the stock befare and after the plowback decision? No Growth P0=.125=$41.67 with arrowth g=.2040=.08p0=12.083=$75.00 Example: our company farecasts to pay a $5.00 dividend next year, which represents 100% of its earning. This will provide investors with a 12% expected return Instead, we decide to plowback 40% of the earnings atthe firm's curent eturn on equity of 20% What is the value of the stock befare and after the plowback decision? No Growth P0=.125=$41.67 with arrowth g=.2040=.08p0=12.083=$75.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts