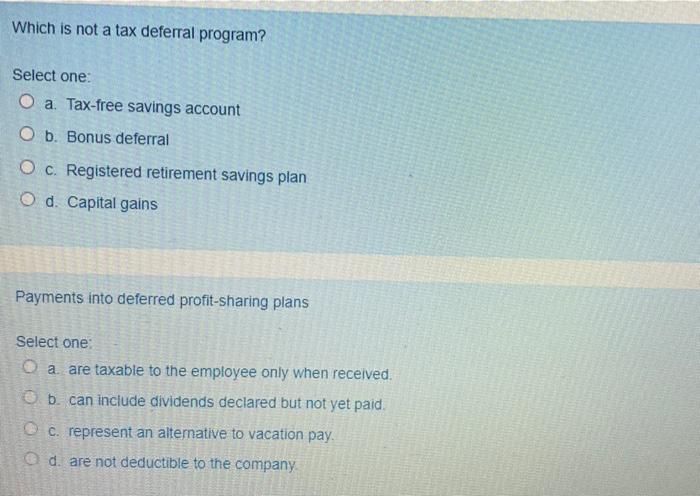

Question: Which is not a tax deferral program? Select one: O a. Tax-free savings account O b. Bonus deferral O c. Registered retirement savings plan O

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock