Question: Which manager has better Sharpe ratio? (equal or cta or bond) The bond fund is 5 times more volatile than the CTA fund, if we

Which manager has better Sharpe ratio? (equal or cta or bond)

The bond fund is 5 times more volatile than the CTA fund, if we leverage the CTA fund 5x we would multiply the return, volatility, and fees by 5. Now, which manager is better on a risk adjusted basis, on other words has a better Sharpe ratio? (Bond fund or equal or leveraged cta fund)

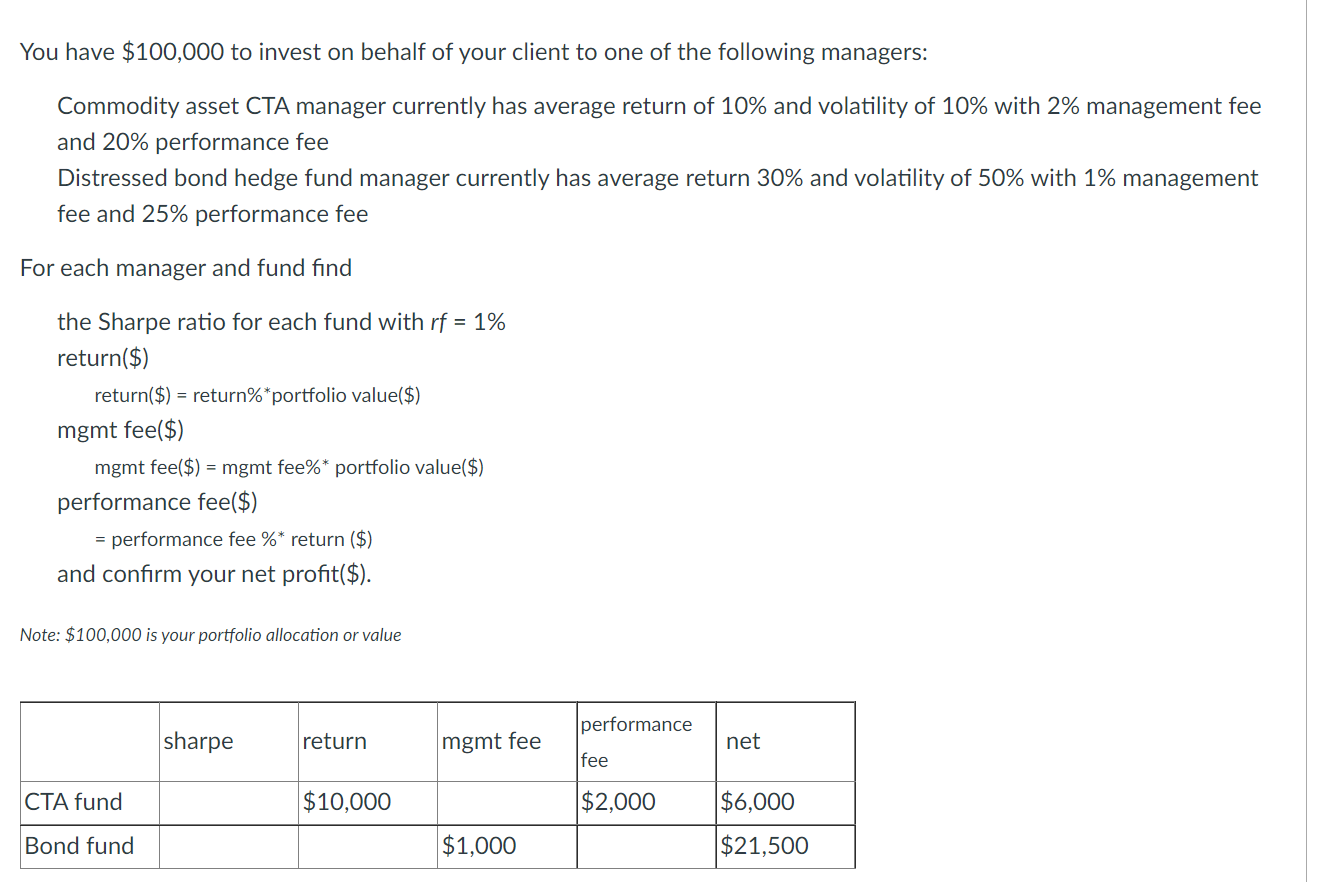

You have $100,000 to invest on behalf of your client to one of the following managers: Commodity asset CTA manager currently has average return of 10% and volatility of 10% with 2% management fee and 20% performance fee Distressed bond hedge fund manager currently has average return 30% and volatility of 50% with 1% management fee and 25% performance fee For each manager and fund find the Sharpe ratio for each fund with rf = 1% return($) return($) = return%*portfolio value($) mgmt fee($) mgmt fee($) = mgmt fee%* portfolio value($) performance fee($) = performance fee %* return ($) and confirm your net profit($). Note: $100,000 is your portfolio allocation or value performance sharpe return Imgmt fee net fee CTA fund $10,000 $2,000 $6,000 Bond fund $1,000 $21,500 You have $100,000 to invest on behalf of your client to one of the following managers: Commodity asset CTA manager currently has average return of 10% and volatility of 10% with 2% management fee and 20% performance fee Distressed bond hedge fund manager currently has average return 30% and volatility of 50% with 1% management fee and 25% performance fee For each manager and fund find the Sharpe ratio for each fund with rf = 1% return($) return($) = return%*portfolio value($) mgmt fee($) mgmt fee($) = mgmt fee%* portfolio value($) performance fee($) = performance fee %* return ($) and confirm your net profit($). Note: $100,000 is your portfolio allocation or value performance sharpe return Imgmt fee net fee CTA fund $10,000 $2,000 $6,000 Bond fund $1,000 $21,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts