Question: Which statement is TRUE According to the Modern Term Structure Theory? The net effect on the yield curve shape from high demand for long-dated US

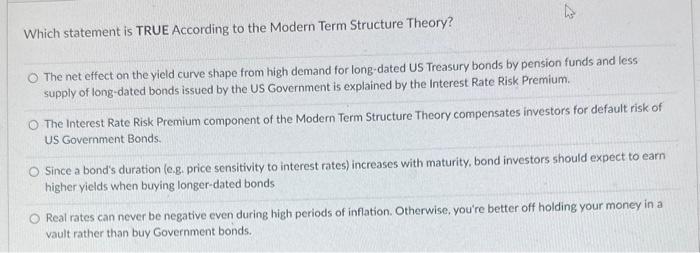

Which statement is TRUE According to the Modern Term Structure Theory? The net effect on the yield curve shape from high demand for long-dated US Treasury bonds by pension funds and less supply of long-dated bonds issued by the US Government is explained by the Interest Rate Risk Premium. The Interest Rate Risk Premium component of the Modern Term Structure Theory compensates investors for default risk of US Government Bonds. Since a bond's duration (e.g, price sensitivity to interest rates) increases with maturity, bond investors should expect to earn higher yields when buying longer-dated bonds Real rates can never be negative even during high periods of inflation. Otherwise, you're better off holding your money in a vault rather than buy Government bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts