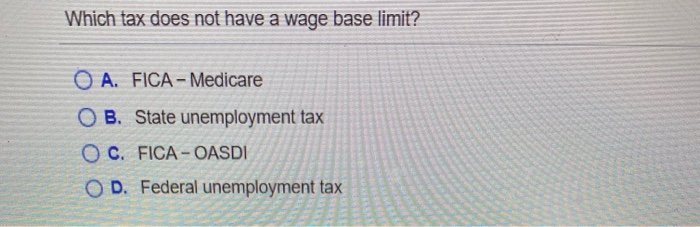

Question: Which tax does not have a wage base limit? O A. FICA - Medicare O B. State unemployment tax O C. FICA - OASDI OD.

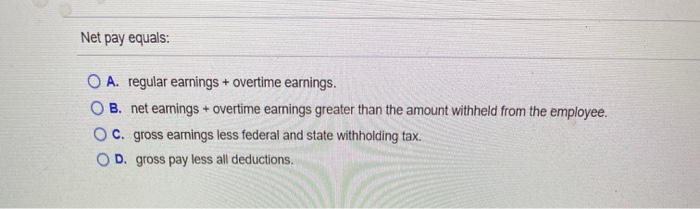

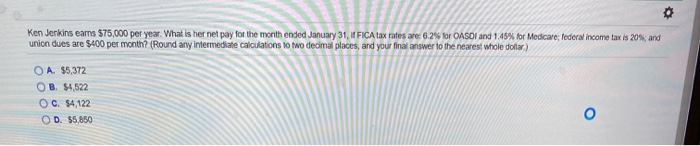

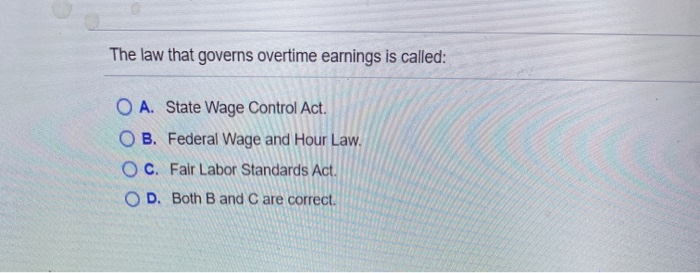

Which tax does not have a wage base limit? O A. FICA - Medicare O B. State unemployment tax O C. FICA - OASDI OD. Federal unemployment tax Net pay equals: O A. regular earnings + overtime earnings. OB. net earnings + overtime earnings greater than the amount withheld from the employee Oc. gross earnings less federal and state withholding tax. OD. gross pay less all deductions. Ken Jerkins earns $75,000 per year. What is her net pay for the month ended January 31, FICA tax rates are: 62% for OASDI and 1.45% for Medicare;federal income tax is 20%; and union des are $100 per month? (Round any intermediate calculations to two decimal places, and your finanswer to the nearest whole dow) O A $5,372 OB. $4,522 OC. 54,122 OD. 55.850 The law that governs overtime earnings is called: 02. Fesen Hosen rater on O A. State Wage Control Act. O B. Federal Wage and Hour Law. OC. Fair Labor Standards Act. O D. Both B and C are correct. A pay period is defined as: dia O A. weekly. O B. biweekly. O c. monthly OD. All of the above are correct. When an employee's earnings are greater than FICA base limit during the calendar year, no more FICA-OASDi tax is deducted from earnings O O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts