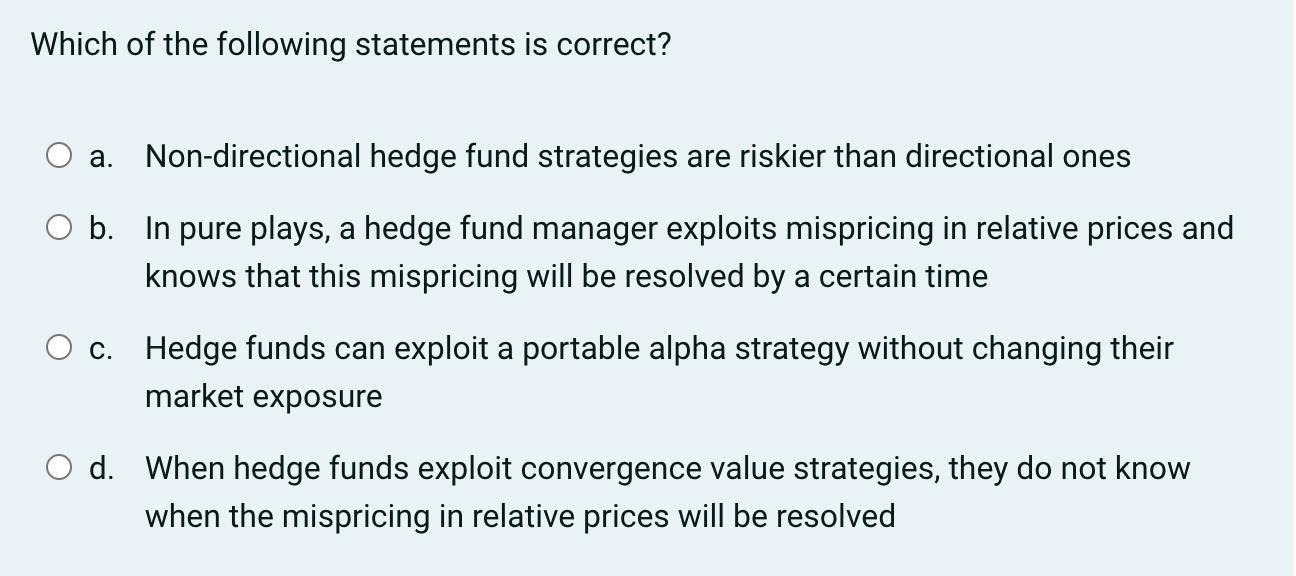

Question: Which of the following statements is correct? a. Non-directional hedge fund strategies are riskier than directional ones O b. In pure plays, a hedge

Which of the following statements is correct? a. Non-directional hedge fund strategies are riskier than directional ones O b. In pure plays, a hedge fund manager exploits mispricing in relative prices and knows that this mispricing will be resolved by a certain time c. Hedge funds can exploit a portable alpha strategy without changing their market exposure O d. When hedge funds exploit convergence value strategies, they do not know when the mispricing in relative prices will be resolved

Step by Step Solution

3.59 Rating (163 Votes )

There are 3 Steps involved in it

option b In pure plays a hedg... View full answer

Get step-by-step solutions from verified subject matter experts