Question: Why are nonqualified deferred compensation plans particularly well - suited for use in executive compensation arrangements? Nonqualified deferred compensation plans are particularly well - suited

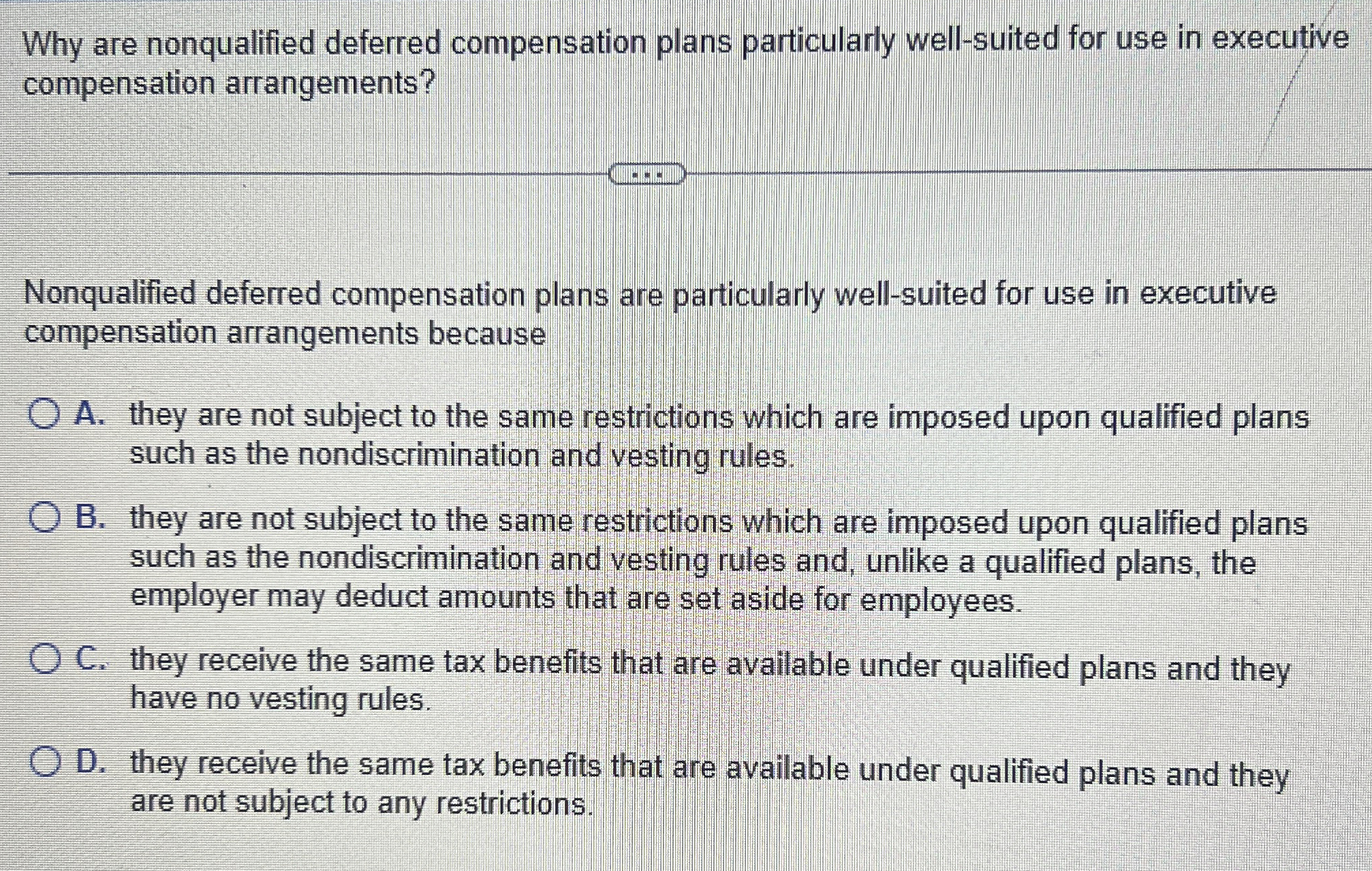

Why are nonqualified deferred compensation plans particularly wellsuited for use in executive compensation arrangements?

Nonqualified deferred compensation plans are particularly wellsuited for use in executive compensation arrangements because

A they are not subject to the same restrictions which are imposed upon qualified plans such as the nondiscrimination and vesting rules.

B they are not subject to the same restrictions which are imposed upon qualified plans such as the nondiscrimination and vesting rules and, unlike a qualified plans, the employer may deduct amounts that are set aside for employees.

C they receive the same tax benefits that are available under qualified plans and they have no vesting rules.

D they receive the same tax benefits that are available under qualified plans and they are not subject to any restrictions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock