Question: Why would the answer not be $40,725 and how do solve this problem? Corp. is a technology start-up and is in its second year of

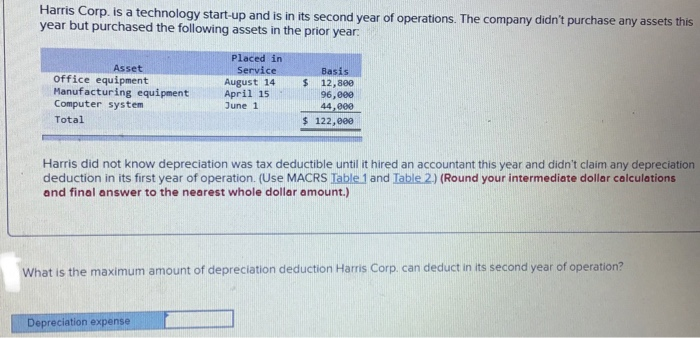

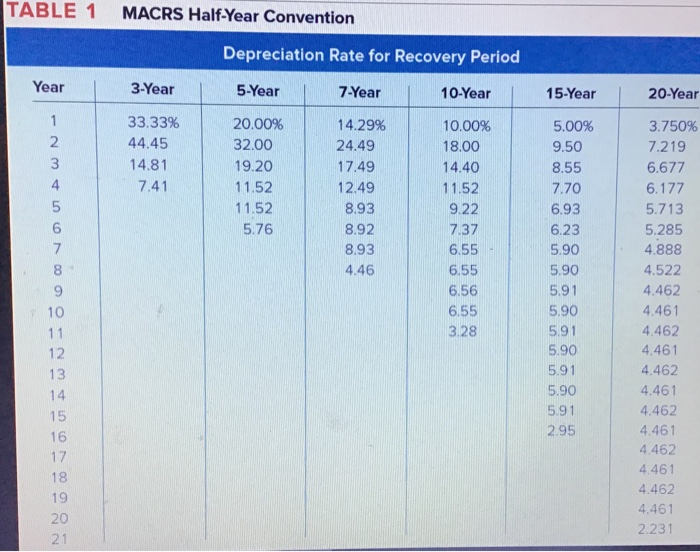

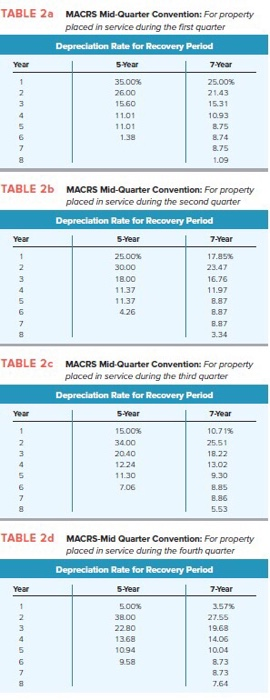

Corp. is a technology start-up and is in its second year of operations. The company didn't purchase any assets this year but purchased the following assets in the prior year Placed in Service Asset Basis 12,800 96,800 44,888 Office equipment rer enos re a1 August 14 Computer system Total June 1 $ 122,eee Harris did not know depreciation was tax deductible until it hired an accountant this year and didn't claim any depreciation deduction in its first year of operation. (Use MACRS Table 1 and Table 2) (Round your intermediate dollar calculations and final answer to the nearest whole dollar amount.) What is the maximum amount of depreciation deduction Harris Corp can deduct in its second year of operation? Depreciation expense TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 10-Year 15-Year 20-Year Year 3-Year 5-Year 7-Year 3.750% 7.219 6.677 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 14.29% 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 5.76 24.49 17.49 12.49 8.93 8.92 8.93 4.46 4 5.713 5.285 4.888 4.522 4462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4. 461 4.462 4.461 2.231 6 9 10 12 15 16 17 18 21 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period s Year 7Year 3500% 6.00 15.60 11.01 11.01 .38 25.00% 1.43 15.31 1093 8.75 8.74 8.75 1.09 TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 7-Year 18.00 11.37 11.37 426 17.85% 23.47 16.76 11.97 887 8.87 B.87 TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 7 Year 1 00% 3400 20.40 1224 1.30 7.06 10.71% 25.51 18.22 13.02 .85 8.86 5.53 TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period 7-Year 157% 38.00 2280 1368 1094 958 27.55 19.68 14.06 1004 873 873 7.64 Corp. is a technology start-up and is in its second year of operations. The company didn't purchase any assets this year but purchased the following assets in the prior year Placed in Service Asset Basis 12,800 96,800 44,888 Office equipment rer enos re a1 August 14 Computer system Total June 1 $ 122,eee Harris did not know depreciation was tax deductible until it hired an accountant this year and didn't claim any depreciation deduction in its first year of operation. (Use MACRS Table 1 and Table 2) (Round your intermediate dollar calculations and final answer to the nearest whole dollar amount.) What is the maximum amount of depreciation deduction Harris Corp can deduct in its second year of operation? Depreciation expense TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 10-Year 15-Year 20-Year Year 3-Year 5-Year 7-Year 3.750% 7.219 6.677 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 14.29% 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 5.76 24.49 17.49 12.49 8.93 8.92 8.93 4.46 4 5.713 5.285 4.888 4.522 4462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4. 461 4.462 4.461 2.231 6 9 10 12 15 16 17 18 21 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period s Year 7Year 3500% 6.00 15.60 11.01 11.01 .38 25.00% 1.43 15.31 1093 8.75 8.74 8.75 1.09 TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 7-Year 18.00 11.37 11.37 426 17.85% 23.47 16.76 11.97 887 8.87 B.87 TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 7 Year 1 00% 3400 20.40 1224 1.30 7.06 10.71% 25.51 18.22 13.02 .85 8.86 5.53 TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period 7-Year 157% 38.00 2280 1368 1094 958 27.55 19.68 14.06 1004 873 873 7.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts