Question: will leave a thunbs up for correct help During the month of March, Melisss Company's employees earned wages of $78,000. Withholdings related to these wages

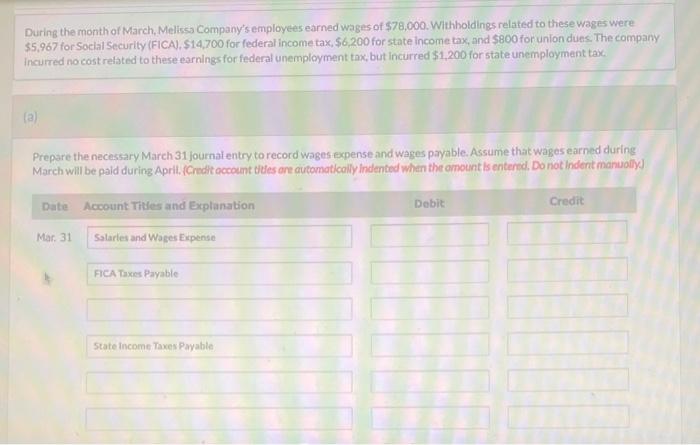

During the month of March, Melisss Company's employees earned wages of $78,000. Withholdings related to these wages were $5,967 for Social Security (FICA), $14,700 for federal incometax, $6,200 for state income tax, and $800 for union dues The company incured no cost related to these earnings for federal unemployment tax, but incurred $1,200 for state unemployment tax. (3) Prepare the necessary March 31 journal entry to record wages expense and wages payable. Assume that wages earned during March will be pald during Aprit. (Credit occount tites are automaticolly indented whan the omount is enternd, Do not indent manuolly]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts