Question: * Will rate for a step by step solution. Thank you!* 1 pt) You wish to loan some funds starting 1 year from now, in

* Will rate for a step by step solution. Thank you!*

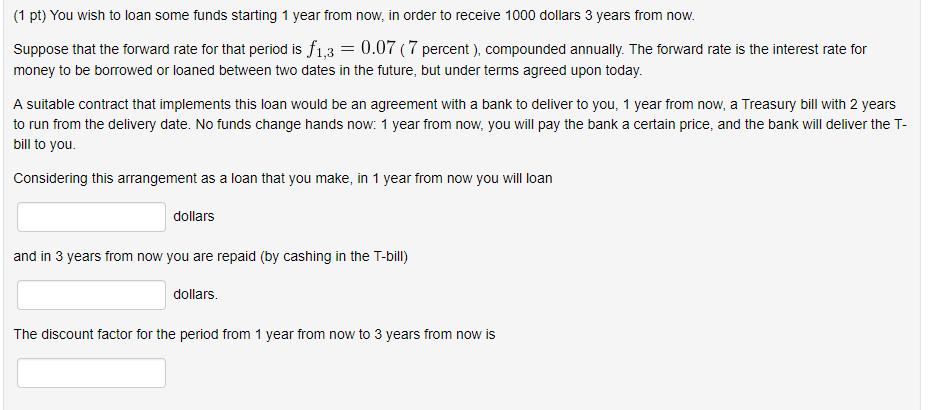

1 pt) You wish to loan some funds starting 1 year from now, in order to receive 1000 dollars 3 years from now. Suppose that the forward rate for that period is f1,3-0.07 (7 percent), compounded annually. The forward rate is the interest rate for money to be borrowed or loaned between two dates in the future, but under terms agreed upon today. A suitable contract that implements this loan would be an agreement with a bank to deliver to you, 1 year from now, a Treasury bill with 2 years to run from the delivery date. No funds change hands now: 1 year from now, you will pay the bank a certain price, and the bank will deliver the T- bill to you. Considering this arrangement as a loan that you make, in 1 year from now you will loan dollars and in 3 years from now you are repaid (by cashing in the T-bill) The discount factor for the period from 1 year from now to 3 years from now is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts