Question: will thumbs up please write out all steps on paper thank you. Expected return and Standard Deviation Suppose there are four possible states in the

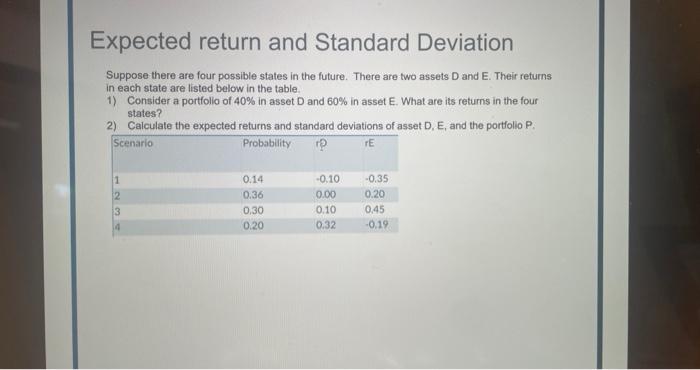

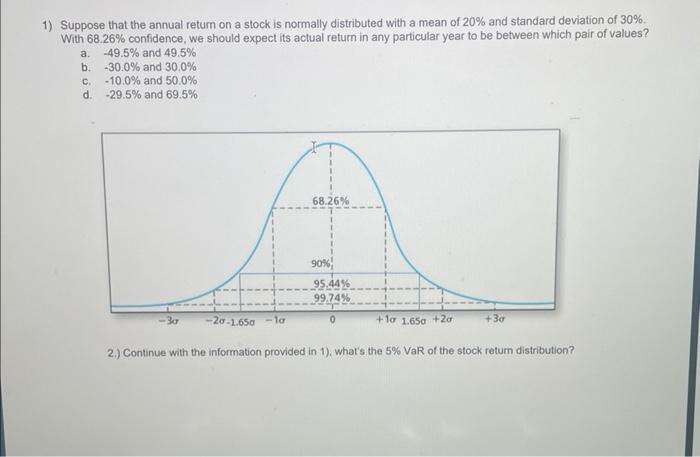

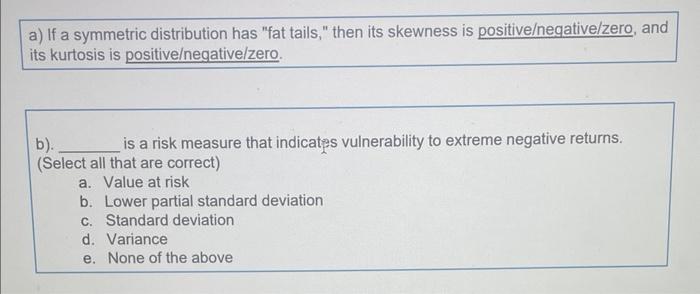

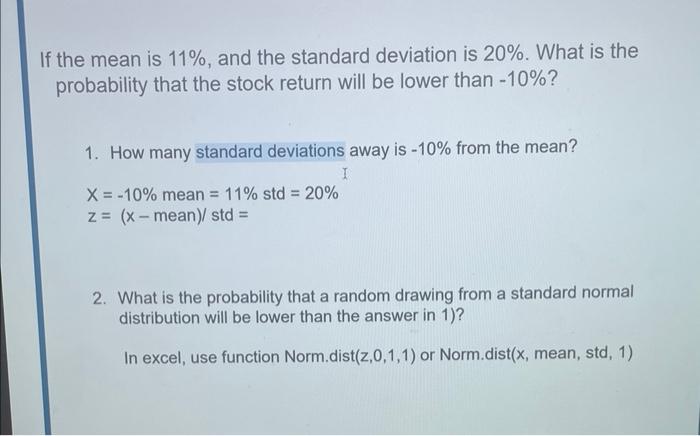

Expected return and Standard Deviation Suppose there are four possible states in the future. There are two assets D and E. Their returns 1n each state are listed below in the table. 1) Consider a portfolio of 40% in asset D and 60% in asset E. What are its returns in the four 2) Calculate the expected returns and standard deviations of asset D,E, and the portfolio P. 1) Suppose that the annual return on a stock is normally distributed with a mean of 20% and standard deviation of 30%. With 68.26% confidence, we should expect its actual return in any particular year to be between which pair of values? a. 49.5% and 49.5% b. 30.0% and 30.0% c. 10.0% and 50.0% d. 29.5% and 69.5% 2.) Continue with the information provided in 1), what's the 5%VaR of the stock retum distribution? a) If a symmetric distribution has "fat tails," then its skewness is positiveegative/zero, and its kurtosis is positiveegative/zero. b). is a risk measure that indicates vulnerability to extreme negative returns. (Select all that are correct) a. Value at risk b. Lower partial standard deviation c. Standard deviation d. Variance e. None of the above If the mean is 11%, and the standard deviation is 20%. What is the probability that the stock return will be lower than 10% ? 1. How many standard deviations away is 10% from the mean? x=10%mean=11%std=20%z=(xmean)/std= 2. What is the probability that a random drawing from a standard normal distribution will be lower than the answer in 1)? In excel, use function Norm.dist (z,0,1,1) or Norm.dist (x, mean, std, 1) Expected return and Standard Deviation Suppose there are four possible states in the future. There are two assets D and E. Their returns 1n each state are listed below in the table. 1) Consider a portfolio of 40% in asset D and 60% in asset E. What are its returns in the four 2) Calculate the expected returns and standard deviations of asset D,E, and the portfolio P. 1) Suppose that the annual return on a stock is normally distributed with a mean of 20% and standard deviation of 30%. With 68.26% confidence, we should expect its actual return in any particular year to be between which pair of values? a. 49.5% and 49.5% b. 30.0% and 30.0% c. 10.0% and 50.0% d. 29.5% and 69.5% 2.) Continue with the information provided in 1), what's the 5%VaR of the stock retum distribution? a) If a symmetric distribution has "fat tails," then its skewness is positiveegative/zero, and its kurtosis is positiveegative/zero. b). is a risk measure that indicates vulnerability to extreme negative returns. (Select all that are correct) a. Value at risk b. Lower partial standard deviation c. Standard deviation d. Variance e. None of the above If the mean is 11%, and the standard deviation is 20%. What is the probability that the stock return will be lower than 10% ? 1. How many standard deviations away is 10% from the mean? x=10%mean=11%std=20%z=(xmean)/std= 2. What is the probability that a random drawing from a standard normal distribution will be lower than the answer in 1)? In excel, use function Norm.dist (z,0,1,1) or Norm.dist (x, mean, std, 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts