Question: wing discussion question for this module. Consider the situation where you are in love with the perfect house. You have two options: A 30-year mortgage

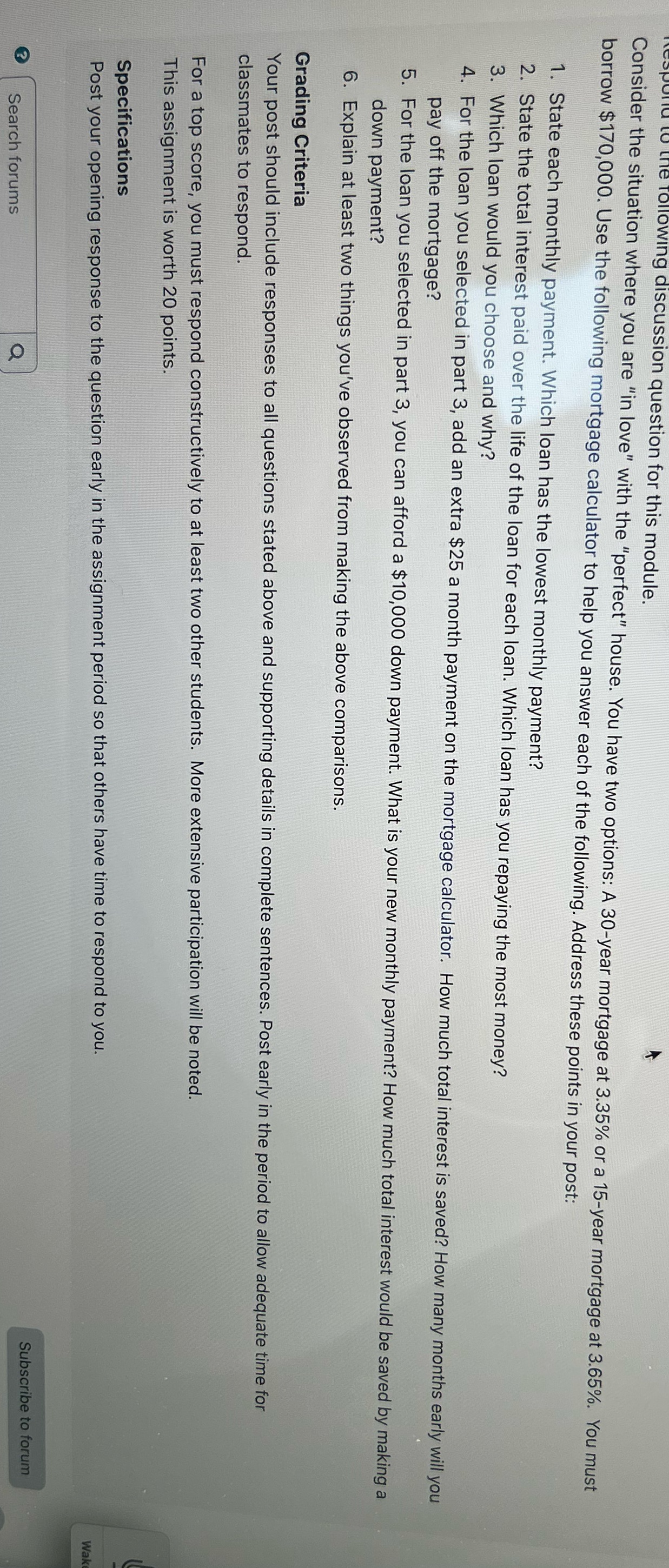

wing discussion question for this module. Consider the situation where you are "in love" with the "perfect" house. You have two options: A 30-year mortgage at 3.35% or a 15-year mortgage at 3.65%. You must borrow $170,000. Use the following mortgage calculator to help you answer each of the following. Address these points in your post: 1. State each monthly payment. Which loan has the lowest monthly payment? 2. State the total interest paid over the life of the loan for each loan. Which loan has you repaying the most money? 3. Which loan would you choose and why? 4. For the loan you selected in part 3, add an extra $25 a month payment on the mortgage calculator. How much total interest is saved? How many months early will you pay off the mortgage? 5. For the loan you selected in part 3, you can afford a $10,000 down payment. What is your new monthly payment? How much total interest would be saved by making a down payment? 6. Explain at least two things you've observed from making the above comparisons. Grading Criteria Your post should include responses to all questions stated above and supporting details in complete sentences. Post early in the period to allow adequate time for classmates to respond. For a top score, you must respond constructively to at least two other students. More extensive participation will be noted. This assignment is worth 20 points. Specifications Post your opening response to the question early in the assignment period so that others have time to respond to you. Wak Subscribe to forum Search forums

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts