Question: With notations found below (a) construct a synthetic put. (b) construct a synthetic share. Put-Call Parity for Options on Currencies Let S be the price

With notations found below

(a) construct a synthetic put. (b) construct a synthetic share.

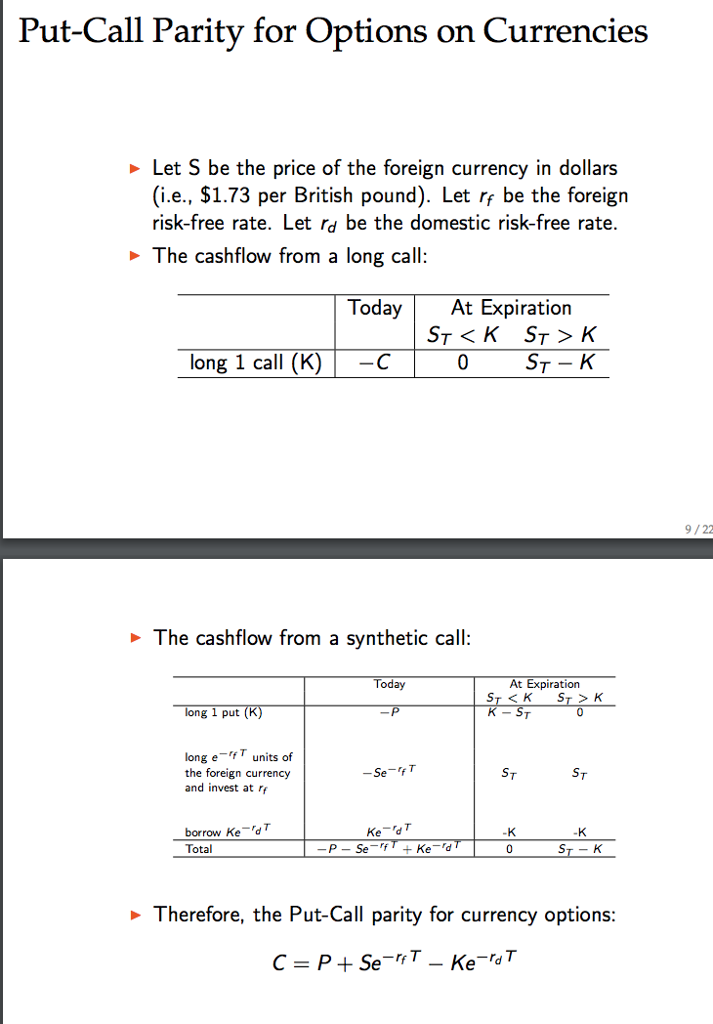

Put-Call Parity for Options on Currencies Let S be the price of the foreign currency in dollars (i.e., $1.73 per British pound). Let rf be the foreign risk-free rate. Let rd be the domestic risk-free rate >- The cashflow from a long call: Today At Expiration long 1 call (K) ST - K 9/22 The cashflow from a synthetic call Today At Expiration ng l put long eT units of the foreign currency and invest at r -SeT borrow Ke-dT Total 0 Therefore, the Put-Call parity for currency options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts