Question: With notations found below (a) construct a synthetic put. (b) construct a synthetic share. Put-Call Parity for Options on Currencies Let S be the price

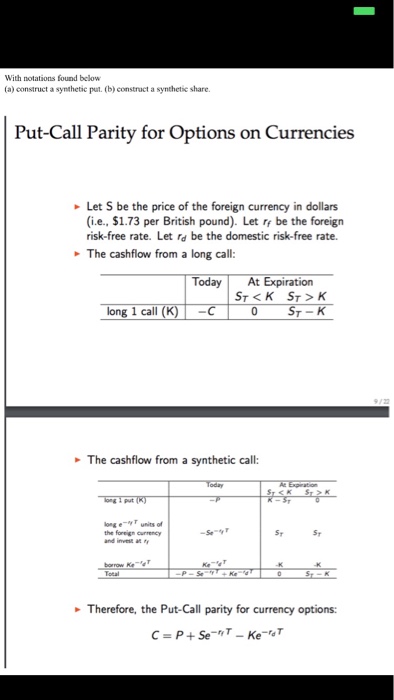

With notations found below (a) construct a synthetic put. (b) construct a synthetic share. Put-Call Parity for Options on Currencies Let S be the price of the foreign currency in dollars (i.e., $1.73 per British pound). Let rr be the foreign risk-free rate. Let rd be the domestic risk-free rate. The cashflow from a long call: Today At Expiration long 1 cal (K)C0ST- The cashflow from a synthetic call: ong e-VT units of the foreign currency and inves a Therefore, the Put-Call parity for currency options: With notations found below (a) construct a synthetic put. (b) construct a synthetic share. Put-Call Parity for Options on Currencies Let S be the price of the foreign currency in dollars (i.e., $1.73 per British pound). Let rr be the foreign risk-free rate. Let rd be the domestic risk-free rate. The cashflow from a long call: Today At Expiration long 1 cal (K)C0ST- The cashflow from a synthetic call: ong e-VT units of the foreign currency and inves a Therefore, the Put-Call parity for currency options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts