Question: With the assumptions below, create a Proforma and 10 year Discounted Cash Flow model based on the following assumption and answer the questions below. Assume

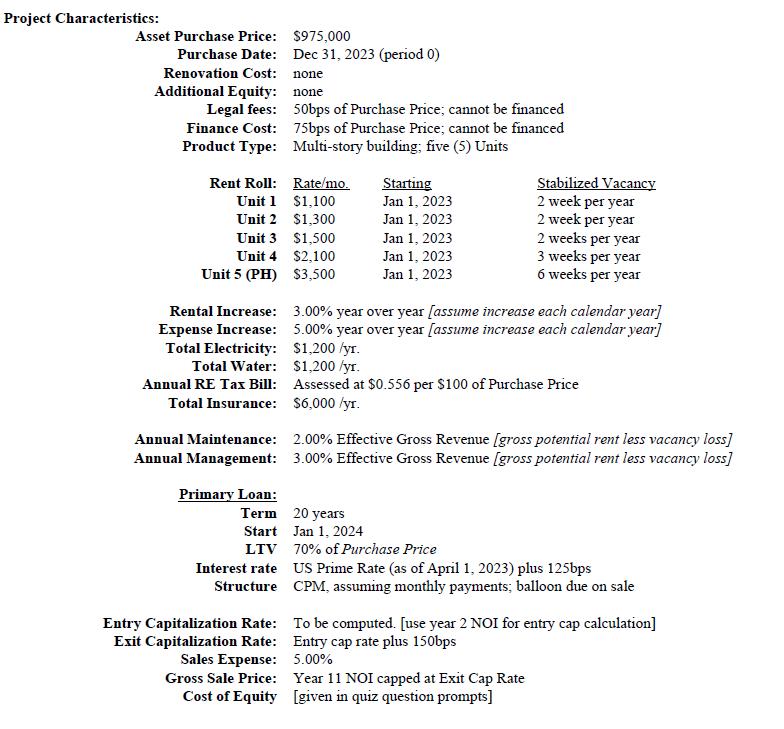

With the assumptions below, create a Proforma and 10 year Discounted Cash Flow model based on the following assumption and answer the questions below.

Assume to cost of capital for the equity portion of the capital stack is 25% and the corporate tax rate is 21%. What is the weighted average cost of capital (WACC)? 2. What is the approximate Debt Service Coverage Ratio at the end of year 7? 3. What are the approximate percentages of present value allocated between leveraged cash flow from operations and leveraged cash flow from sale, respectively? (i.e., PV Ops and PV Sale). Assume a discount rate of 20% 4. In what year is the total amount of the initial equity investment returned using the levered free cash flow (i.e., in what year is the cumulative levered free cash flow first positive)? 5. At a 20% levered discount rate, should the project be accepted? 6. What is the approximate total undiscounted sum of cash flow from operations? 7. What is the approximate primary loan payoff value in year 10? 8. What is the approximate gross sale value in year 10? 9. What is the maximum leveraged discount rate you can use in order to accept this deal based on the Net Present Value criterion? 10. Assuming all other inputs remain as modeled in the write up instructions, rank the following options shown below from highest to lowest increase to NPV? a. Decreasing the NPV discount rate from 20% to 15% b. Increasing the Year over Year rent escalation from 3% to 5% c. Extending the primary loan from 20 years to 30 years d. Increasing the bank LTV from 70% to 90% e. Decreasing the spread on the exit cap from +150bps to zero bps

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Creating a Proforma and 10year Discounted Cash Flow DCF model based on the provided assumptions is a complex financial analysis that requires detailed calculations and assumptions for various variable... View full answer

Get step-by-step solutions from verified subject matter experts