Question: Word File Edit View Insert Format Tools Table Window Help w tax question * 100% 67 Wed 10:18 PM Q Q Search in Document +

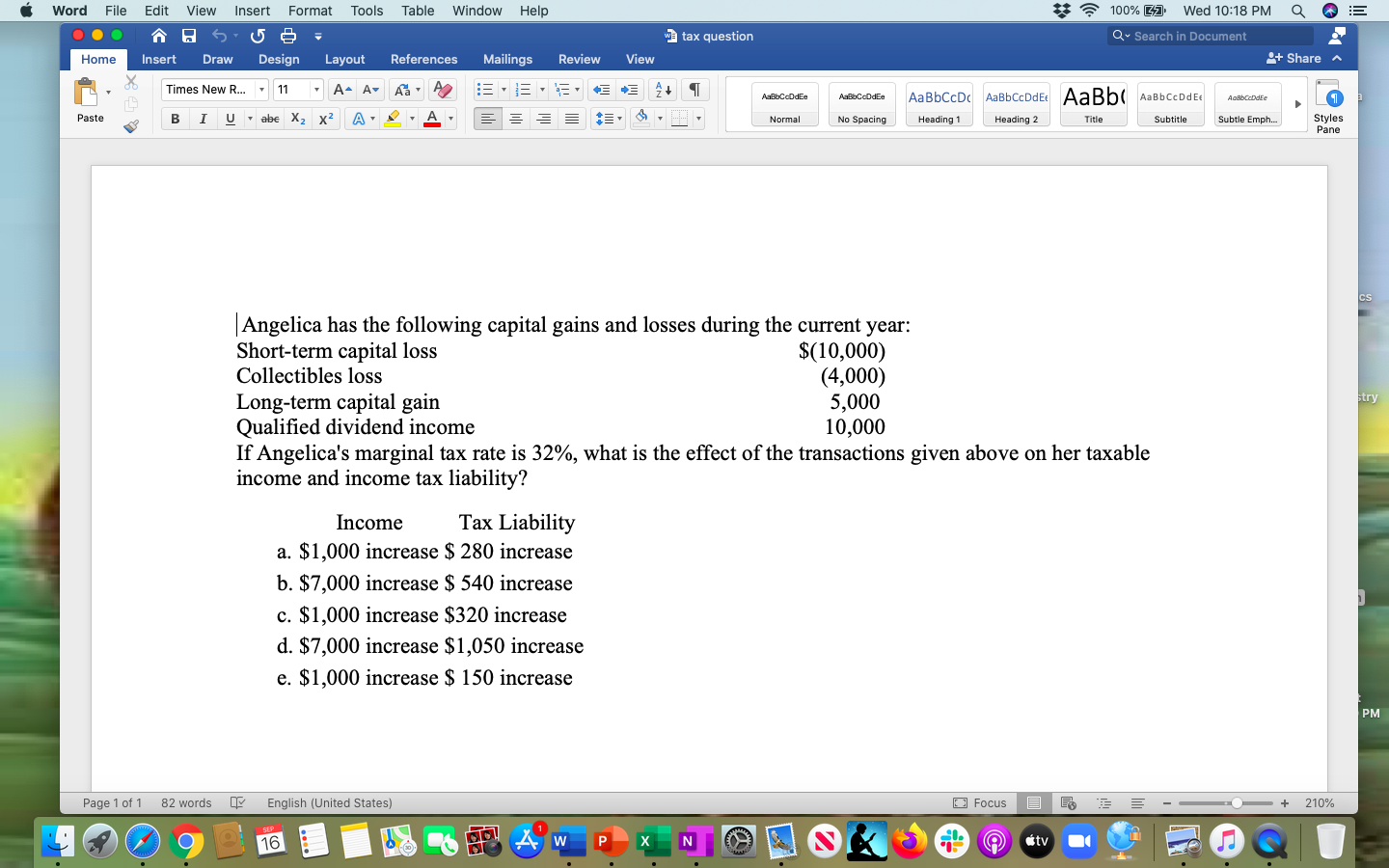

Word File Edit View Insert Format Tools Table Window Help w tax question * 100% 67 Wed 10:18 PM Q Q Search in Document + Share Home Insert Draw Design Layout References Mailings Review View Times New R... 11 - A- A- Aa A 1 AabbaDdEe Aabbcode AaBbCcDc AaBbCcDdEt AaBb AaBb CcDdEx Aalbode Paste I U abe Xx? Normal No Spacing Heading 1 Heading 2 Subtitle Subtle Emph... Styles Pane CS |Angelica has the following capital gains and losses during the current year: Short-term capital loss $(10,000) Collectibles loss (4,000) Long-term capital gain 5,000 Qualified dividend income 10,000 If Angelica's marginal tax rate is 32%, what is the effect of the transactions given above on her taxable income and income tax liability? Income Tax Liability a. $1,000 increase $ 280 increase b. $7,000 increase $ 540 increase c. $1,000 increase $320 increase d. $7,000 increase $1,050 increase e. $1,000 increase $ 150 increase PM Page 1 of 1 82 words English (United States) O Focus 210% TO A W P N tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts