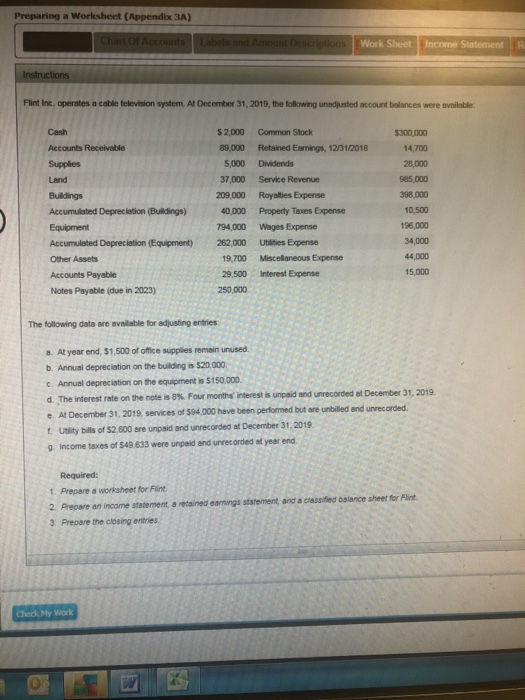

Question: Work Sheet Income Statement R Flint Inc. operates a cable television system At December 31, 2019, the following unadjusted account balances were available S 2,000

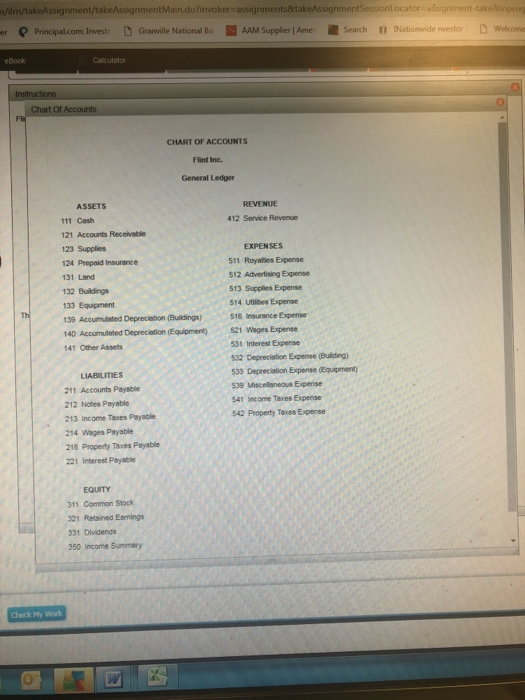

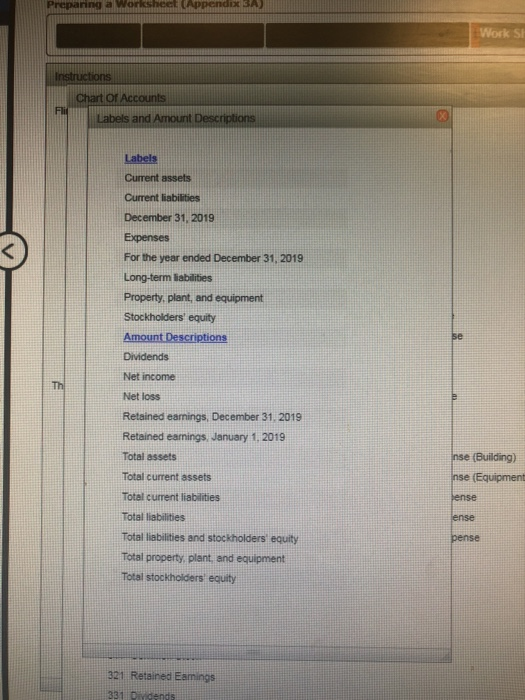

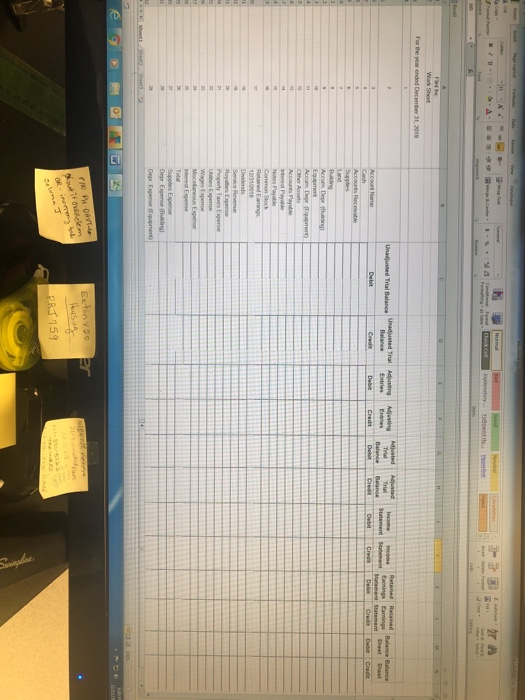

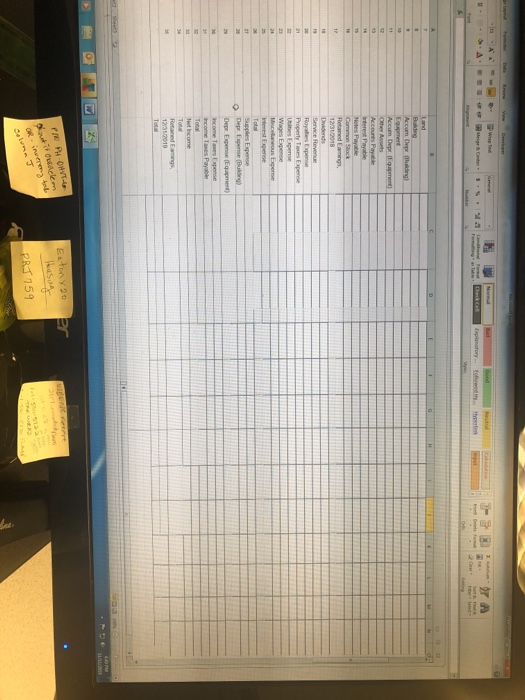

Work Sheet Income Statement R Flint Inc. operates a cable television system At December 31, 2019, the following unadjusted account balances were available S 2,000 Common Stock 89,000 Retained Eamings, 12/31/2018 5,000 Dividends 37,000 Service Revenue Cash $300,000 14,700 28,000 985,000 398,000 10,500 196,000 34,000 44.000 15,000 Accounts Receivable Land Buildings Accumulated Depreciation (Bulings) 209,000 Royalities Expense 40,000 Property Taxes Expense 794,000 Wages Expense Accumulated Depreciation (Equipment) Other Assets Accounts Payable Notes Payable (due in 2023) 262,000 Utilities Expense 19,700 Miscellaneous Expense 29,500 Interest Expense 250,000 The following data are aveilable for adjusting entries . Atyear end. $1,500 of office supplies remain unused. b. Annual deprecistion on the building is $20,000 C Anual depreciation on the equipment is $150,000. d The interest rate on the note is 8% Four months-interest is unpaid and unrecorded at December 3 e At December 31, 2019, services of $94,000 have been performed but are unbilled and unrecorded. t Uslity bills of $2.800 are unpaid and unrecorded at December 31,2019 g Income taxes of $49.633 were unpeid and unrecorded at year end. , 2019 Required: 1. Prepare a worksheet for Flint 2. Prepare an income statement, a retained earnings statement, and a cisssified oslance sheet for Plint 3. Prepare the closing entries Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts